Duke of Marmalade

Registered User

- Messages

- 4,714

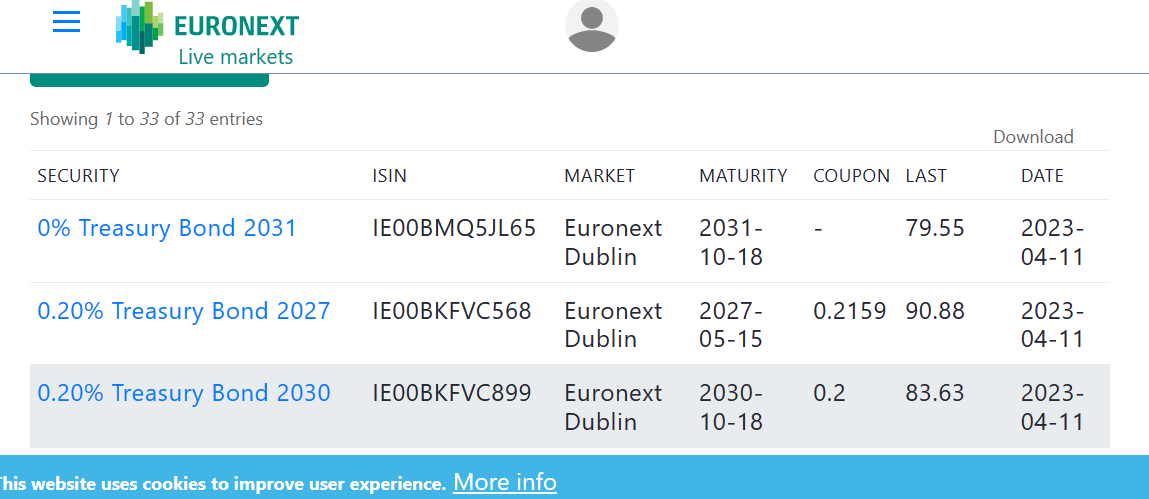

I think I have found a better Govie. The 0.20% Treasury Bond 2027 is priced at 90.88. It matures on May 15th 2027 so it is a 4 year bond, a preferrable term, and precisely comparable with the 4 year National Solidarity Bond. The NSB pays 2% or 0.50% AER. The TB pays 2.08% AER for a €100k investment and 2.34% AER for a €500k investment (using Goodbody charges and assuming subject to 40% tax and 8% USC on the coupons.

A downside is that if interest rates go up you can encash the NSB and reinvest, whereas the 4 year yield on the TB is locked in (no point in encashing and reinvesting). If 3 year Savings Certs where increased from 1% to c. 8% in say 1 year's time then encashing the NSB and reinvesting in the SC would give the same return as the TB.

A downside is that if interest rates go up you can encash the NSB and reinvest, whereas the 4 year yield on the TB is locked in (no point in encashing and reinvesting). If 3 year Savings Certs where increased from 1% to c. 8% in say 1 year's time then encashing the NSB and reinvesting in the SC would give the same return as the TB.

Last edited: