I know that's a joke but he genuinely has a very international fan base, you should see ballyshannon on June Bank Holiday, it is choc a bloc with camper vans from all over Europe. I can't think of any other irish artist or festival that generates that interest , he may not have the U2 record sales but I doubt u2 would generate that interest, I know they did back in 80s and 90s but not now. Gallagher fan base is fiercely loyalThe biggest problem is that most of his fans are from Cork and Cork people are too mean to pay into a museum.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

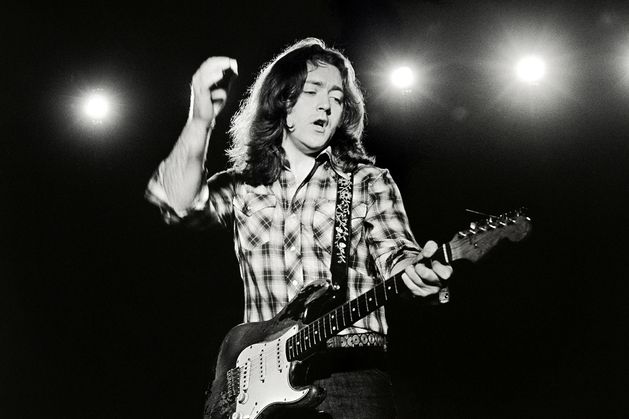

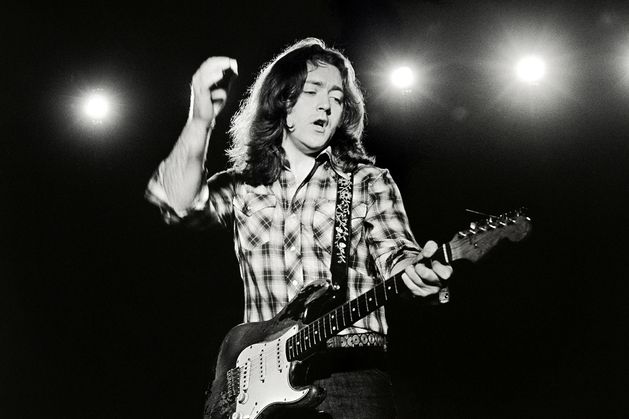

€1 million For Rory Gallagher's Guitar . . . Or For Donal Gallagher's Lifestyle ?

- Thread starter trajan

- Start date

thedaddyman

Registered User

- Messages

- 1,338

Daniel O'Donnell springs to mind, age group of his fans probably in line with Gallaghers fan baseI know that's a joke but he genuinely has a very international fan base, you should see ballyshannon on June Bank Holiday, it is choc a bloc with camper vans from all over Europe. I can't think of any other irish artist or festival that generates that interest , he may not have the U2 record sales but I doubt u2 would generate that interest, I know they did back in 80s and 90s but not now. Gallagher fan base is fiercely loyal

Note to self……..you should see ballyshannon on June Bank Holiday, it is choc a bloc with camper vans from all over Europe.

What, you don't like the smell of damp clothes and middle-aged virginity?Note to self……..

The thing about Rory's management is that everything is so bog-standard.

No business addresses in lock-up garages in South London. No offshore trusts (so far anyhow) in Bermuda.

Just plain old Ltd companies with hip names like Strange Music (Donal's naming ?) or Capo Records (Rory's effort ?) put together by accountants/lawyers on the fringes of the London music scene. Then plain old annual accounts with a profits very modest indeed. Often just abridged balance sheets. Expenses always seem to eat into the turnover however big or small it be.

The one novelty is the changing of names of the main holding company. It goes from Strange Music to RG2016 to being taken over by UMC - then starts again as a Gallagher 'family vehicle' Strange Music. Donal's attachment to his company name is almost touching.

No probate record is listed in UK or Ireland for one William Rory Gallagher. This suggests that the main assets of the great man may have been company owned and personal effects would not amount to much. It seems that the guitar, mandolin, sax, harmonica and amps collection was either unloved and unvalued in 1995 or someone neglected to contemplate parting with them.

How times can change . . .

No business addresses in lock-up garages in South London. No offshore trusts (so far anyhow) in Bermuda.

Just plain old Ltd companies with hip names like Strange Music (Donal's naming ?) or Capo Records (Rory's effort ?) put together by accountants/lawyers on the fringes of the London music scene. Then plain old annual accounts with a profits very modest indeed. Often just abridged balance sheets. Expenses always seem to eat into the turnover however big or small it be.

The one novelty is the changing of names of the main holding company. It goes from Strange Music to RG2016 to being taken over by UMC - then starts again as a Gallagher 'family vehicle' Strange Music. Donal's attachment to his company name is almost touching.

No probate record is listed in UK or Ireland for one William Rory Gallagher. This suggests that the main assets of the great man may have been company owned and personal effects would not amount to much. It seems that the guitar, mandolin, sax, harmonica and amps collection was either unloved and unvalued in 1995 or someone neglected to contemplate parting with them.

How times can change . . .

Last edited:

I made that point aswell, the guitar is only valuable now it wasn't back then, not monetary anyway. I think alot of it is to do with YouTube if that didn't exist Gallagher would be largely forgotten about but because there is so much quality footage on YouTube the guitar is now synonymous with his powerful live performances. Gallagher uniquely for 1970s and 80s had alot of his live performances recorded in very high quality, can thank german , Dutch and British TV companies for that. The bigger acts of the day didn't have so much material broadcast on TV as they were more commercial so we're more interested in selling records and live videos than giving free performances to TV. That is now standing to Gallagher as his legacy grows not diminishesIt seems that the guitar, mandolin, sax, harmonica and amps collection was either unloved and unvalued in 1995 or someone neglected to contemplate parting with them.

How times can change . . .

He doesn't have massive viewing figures on YouTube though, so I think it's more a niche underground following. No doubt the guitar has value to some, but the suggested price would put it amongst the most expensive of all time.I think alot of it is to do with YouTube if that didn't exist Gallagher would be largely forgotten about but because there is so much quality footage on YouTube the guitar is now synonymous with his powerful live performances.

Maybe this lad might buy it...

US rock guitarist Joe Bonamassa is to lead a special tribute to Irish blues legend Rory Gallagher which will include a replica setlist to the Cork star's famous 1974 Irish tour.

Promoter Peter Aiken described the two night performance next year as "a labour of love" for all involved - and a recognition of the incredible legacy of Rory Gallagher who died aged just 47 years in 1995.

Joe Bonamassa flew to Cork today for a special press conference to announce the two gigs at the Live At The Marquee series next July.

The New York-born musician, who opened for B.B. King when he was just 12 years old, has been a lifelong fan of Rory Gallagher and is one of just two musicians given permission by the Gallagher family to play Rory's iconic 1961 Fender Stratocaster...

The tribute shows will take place on July 1 and 2 and will see Joe Bonamassa lead a band including Jeremy Stacey, Lachlan Doley and Aongus Ralston.

www.independent.ie

www.independent.ie

US rock guitarist Joe Bonamassa is to lead a special tribute to Irish blues legend Rory Gallagher which will include a replica setlist to the Cork star's famous 1974 Irish tour.

Promoter Peter Aiken described the two night performance next year as "a labour of love" for all involved - and a recognition of the incredible legacy of Rory Gallagher who died aged just 47 years in 1995.

Joe Bonamassa flew to Cork today for a special press conference to announce the two gigs at the Live At The Marquee series next July.

The New York-born musician, who opened for B.B. King when he was just 12 years old, has been a lifelong fan of Rory Gallagher and is one of just two musicians given permission by the Gallagher family to play Rory's iconic 1961 Fender Stratocaster...

The tribute shows will take place on July 1 and 2 and will see Joe Bonamassa lead a band including Jeremy Stacey, Lachlan Doley and Aongus Ralston.

US star Joe Bonamassa to lead tribute gigs for Irish rock icon Rory Gallagher with setlist from 1974 shows

US rock guitarist Joe Bonamassa is to lead a special tribute to Irish blues legend Rory Gallagher which will include a replica setlist to the Cork star's famous 1974 Irish tour.

Maybe this lad might buy it...

Interesting intervention by John Bona.

But then bidding for this type of thing would be handled by anonymous intermediaries and JB's presence in Cork could have no significance to the upcoming auction on 17 October. JB's net worth is listed at $20 m. Taking 2/3 of this to be property and half the rest as palimony reserve, I wonder if this would give him the leeway to bid to $1 . . .

The catalogue shows 94 lots for sale in the auction proper. There is also an online auction of 90 items from cheaper guitars/other instruments to small electronic sound effect boxes at lower prices. Maybe the online auction might go some way towards paying the final Bonham's bill - which I expect will be substantial given the time needed to photo, blurb and catalogue ~ 200 items by staff knowing sfa about them.

On the lower limit of the guide prices, the 94 main auction lots tot up to ~ £1.707 million or £1 million for the strat and around £700k for all the rest of the stuff. I am surprised to see the 1968 Coral among the lots as my info was that was among a batch sold off a few years ago.

It is sad to see his old sax under the hammer.

Le cúnamh Dé the small items at least will find appreciative homes at realistic prices.

Last edited:

If it sells I wonder what the CGT liability is for Donal?

On the face of it the CGT liability would be 20% of the net proceeds (after deducting Bonhams' fees) less the acquisition cost, in this case likely to be zero since as personal effects they would have been initially inherited by Rory G's mother and thereafter inherited by Donal G.

I am not sure where the collection's maintenance and storage charges fit into the CGT assessment but I am sure that Donal G's London accountant will be making a strong case for its inclusion amongst the reliefs to his liability.

On the other hand, maybe the post 1972 items of the collection - which does not include the Strat - were acquired by the Strange Music entity that ran RG's business affairs. That's definitely one for tax lawyers.

Maybe the UK tax specialists alighting on this forum might venture a view on this.

From Bonhams' AUCTION INFORMATION

Buyers' Obligations

ALL BIDDERS MUST AGREE THAT THEY HAVE READ AND UNDERSTOOD BONHAMS' CONDITIONS OF SALE AND AGREE TO BE BOUND BY THEM, AND AGREE TO PAY THE BUYER'S PREMIUM AND ANY OTHER CHARGES MENTIONED IN THE NOTICE TO BIDDERS. THIS AFFECTS THE BIDDERS LEGAL RIGHTS.If you have any complaints or questions about the Conditions of Sale, please contact your nearest client services team.

Buyers' Premium and Charges

For all Sales categories, buyer's premium excluding Cars, Motorbikes, Wine, Whisky and Coin & Medal sales, will be as follows:Buyer's Premium Rates

28% on the first £40,000 of the hammer price;

27% of the hammer price of amounts in excess of £40,000 up to and including £800,000;

21% of the hammer price of amounts in excess of £800,000 up to and including £4,500,000;

and 14.5% of the hammer price of any amounts in excess of £4,500,000.

A 3rd party bidding platform fee of 4% of the Hammer Price for Buyers using the following bidding platforms will be added to the invoices of successful Buyers for auctions starting on or after 6th July 2024 – Invaluable; Live Auctioneers; The Saleroom; Lot-tissimo.

VAT at the current rate of 20% will be added to the Buyer's Premium and charges excluding Artists Resale Right.

Does anyone know the rationale for this buyer's premium thing ?

Is it only on collectibles and antiques ? I ask as I've never heard of such charges being levied on people buying say land or houses.

When I was in primary school some of the old math questions used to attribute the auctioneer's commission to the buyer. But I recall a teacher saying that this was changed to make the seller pay it as they were the ones benefitting from the auction service.

And then the bar-stars add on VAT as well

I think we might be in the wrong line of work if margins by collectables auction houses are so thick.

Funny none of these recent schoolboy entrepreneurs thought of starting an online auction house with more humanely applied charges

Maybe I should ask BB if this constitutes an entrant for AAM's proposed new business ideas sub-forum . . .

Last edited:

thedaddyman

Registered User

- Messages

- 1,338

Not sure where barristers are coming into things but bear in mind most auctioneers will charge both a buyers and sellers premium or a fixed fee for the sellers, or a combination of both.

So in effect, if you buy something for €100 at an auction, changes are you'll be charged €120 and the seller paid €80.

For soemthing like a €1m object, I expect the seller is being charged a fixed fee or a much lower %

So in effect, if you buy something for €100 at an auction, changes are you'll be charged €120 and the seller paid €80.

For soemthing like a €1m object, I expect the seller is being charged a fixed fee or a much lower %

Don’t forget VAT @ 23%So in effect, if you buy something for €100 at an auction, changes are you'll be charged €120 and the seller paid €80.

Not sure where barristers are coming into things but . . .

@thedaddyman: My spelling must be off this morning.

This buyer's premium only applies in the fine art/collectables sector auction rooms, I am assured.

I went to the trouble of asking a Bonhams employee for a rationale for this 28% for items up to £40k. I mean, I see how the collectables auction rooms have to have a range of experts employed and many more on retainer. I see how during the period in which these items lie within the auction rooms' premises that they must be handled with great care - and insured for damage. I acknowledge that in gathering together large sales of collectables of a given category they are providing a service to the buyer as well as the sellers. But 28% . . . that's a lot of care.

She had no rationale for me on this only to say that it was largely the same at other auction rooms in London and there was little variation in the precise figure. Even online auction rooms had such premia and at a comparable rate.

The only crumb of comfort she offered me on this vis-à-vis the Rory G auctions is that overseas buyers were exempt from the UK VAT on the buyer's premium. For a £40,000 item this VAT exemption is ~ £2,240.

But I suppose that Uncle Paddy at the customs & excise will insist on applying Irish VAT . . .

It may have something to do with a droit de suite payment that requires artists to be paid a premium on any future resale of their works. It came in as a result of an EU Directive in 2006.@thedaddyman: My spelling must be off this morning.

This buyer's premium only applies in the fine art/collectables sector auction rooms, I am assured.

I went to the trouble of asking a Bonhams employee for a rationale for this 28% for items up to £40k. I mean, I see how the collectables auction rooms have to have a range of experts employed and many more on retainer. I see how during the period in which these items lie within the auction rooms' premises that they must be handled with great care - and insured for damage. I acknowledge that in gathering together large sales of collectables of a given category they are providing a service to the buyer as well as the sellers. But 28% . . . that's a lot of care.

She had no rationale for me on this only to say that it was largely the same at other auction rooms in London and there was little variation in the precise figure. Even online auction rooms had such premia and at a comparable rate.

The only crumb of comfort she offered me on this vis-à-vis the Rory G auctions is that overseas buyers were exempt from the UK VAT on the buyer's premium. For a £40,000 item this VAT exemption is ~ £2,240.

But I suppose that Uncle Paddy at the customs & excise will insist on applying Irish VAT . . .

It may have something to do with a droit de suite payment that requires artists to be paid a premium on any future resale of their works. It came in as a result of an EU Directive in 2006.

Fair enough with artistic works.

But collectables like Rory G instruments (and spare guitar sound-effect electronic items, rusty and old, totally untested for 30 years) hardly fit into this category

Why are you so invested in this topic. I'm a big Rory Gallagher fan but the topic of his guitar is not that important in my opinion. If someone is willing to pay half a million for it, let them off. Probably the publicity generated by Joe bonamassa appearance in Cork last week might bump up the value a bit pre auction.Fair enough with artistic works.

But collectables like Rory G instruments (and spare guitar sound-effect electronic items, rusty and old, totally untested for 30 years) hardly fit into this category

The whole Rory Gallagher phenomenon is interesting though the way his reputation keeps growing even 30 years after his death, usually it goes the other way

@joe sod

Read the foregoing posts to understand how old video footage of concerts from Belgium, France, Germany, etc contribute to the younger generation's awareness of Gallagher and their appreciation of his musicianship.

YouTube has a channel by Wing of Pegasus analysing his techniques - try this one:

www.youtube.com

www.youtube.com

Now what was that you were saying - why am I so invested in this topic ?

Read the foregoing posts to understand how old video footage of concerts from Belgium, France, Germany, etc contribute to the younger generation's awareness of Gallagher and their appreciation of his musicianship.

YouTube has a channel by Wing of Pegasus analysing his techniques - try this one:

British guitarist and Donal Logue analyse Rory Gallagher live in 1979!

Tonight I'm teaming up with Donal Logue to take a look back at Rory Gallagher live in 1979! Original video - https://www.youtube.com/watch?v=go9J9REtfdAFor m...

Now what was that you were saying - why am I so invested in this topic ?