NoRegretsCoyote

Registered User

- Messages

- 5,766

I don't know! It's been a long time since I looked at the numbers thoroughly. My overall point is that a country is not a tennis club and books don't have to balance every year.Are you saying that our finances are sensibly managed? That running up the borrowing over the last number of years is not a problem? That we have spent the Corporation Tax windfalls and low cost of servicing the debt well?

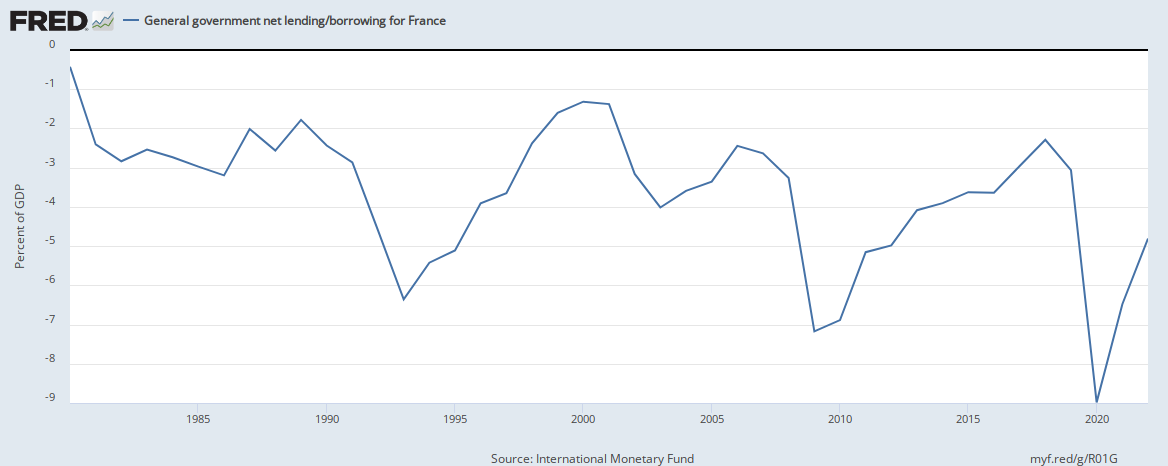

Too much government borrowing can lead to bad things (we all remember the troika years) but permanent deficits are fine for a country in a way that they are not for a corporation. France has not run a budget surplus in 40 years and it is not insolvent!

Yes. But what is the magnitude here? Losing €2bn of the current €14bn take over a few years is manageable. I haven't seen any indication that IP-intensive tech firms have any plans to reduce Irish activity, in fact the opposite.And there is no risk of the state getting into difficulties when any or all of the following happens:

1) A fall off in Corporation Tax Revenue

But this process will be extremely slow to feed through the stock of outstanding debt. A sharp rise in rates would see borrowing go from 1.2% of GNI* to 2.5* of GNI* over five years? That's a lot of time to plan.2) A rise in interest rates causing an increase in the cost of servicing debt

I think there is an exposure there for sure. Ireland's labour market is unusually flexible and in a recession a lot of workers get laid off. You could easily see unemployment double and benefits increase by €5bn in 18 months. I thought the idea floated a few years ago of a Rainy Day Fund was good, but it has never been implemented.3) A recession which will hit general tax revenues and increase our social welfare bill

I agree. A lot of "one-off" things like Covid, Mica, refugees, etc have been covered by the expanding corporation tax take in recent years. That's not a good policy and the IFAC has pointed it out on a few occasions now.4) The cost of Mica, refugees etc