This extract was shamefully cut and paste by the cult to further their credo.

I also watched the complete interview - and your claim isn't valid. The suggestion is that the excerpts have been devised to misrepresent. That's not the case - and what you go on with doesn't demonstrate otherwise.

The cult’s high priests must obsess at creating this propaganda.

And as you already know, your comment is wayward. There is no CEO for bitcoin. There is no Lagarde or Bailey or Powell. Those are your high priests. Bitcoin monetary policy is transparent and can't be tampered with. This is Trumpism from you (deflecting precisely the criticism that falls at the door of the conventional system).

In the full interview the interviewer reveals his total naivete.

That's also clear from the excerpts and it doesn't in any way detract from the evident takeaways from the interview. Everyone knows Jon Stewart isn't involved in monetary policy but he may have one or two years experience interviewing people perhaps.

He asks why don’t the Fed print dollars and buy back the US debt from China and Europe and then tear it up. Indeed that can be done. What Jon misses is that instead of owing the bonds the US would then owe the dollars.

You're deliberately misconstruing the direction of his query. You did the very same thing a year ago when I asked why can't they just print off whatever we owe the state in taxes this year and accept that as payment? Stewart's line of thought was to question the unbridled printing of money.

So called “printing” of dollars is the US government borrowing. The owners of the dollars have a faith that they will be repaid.

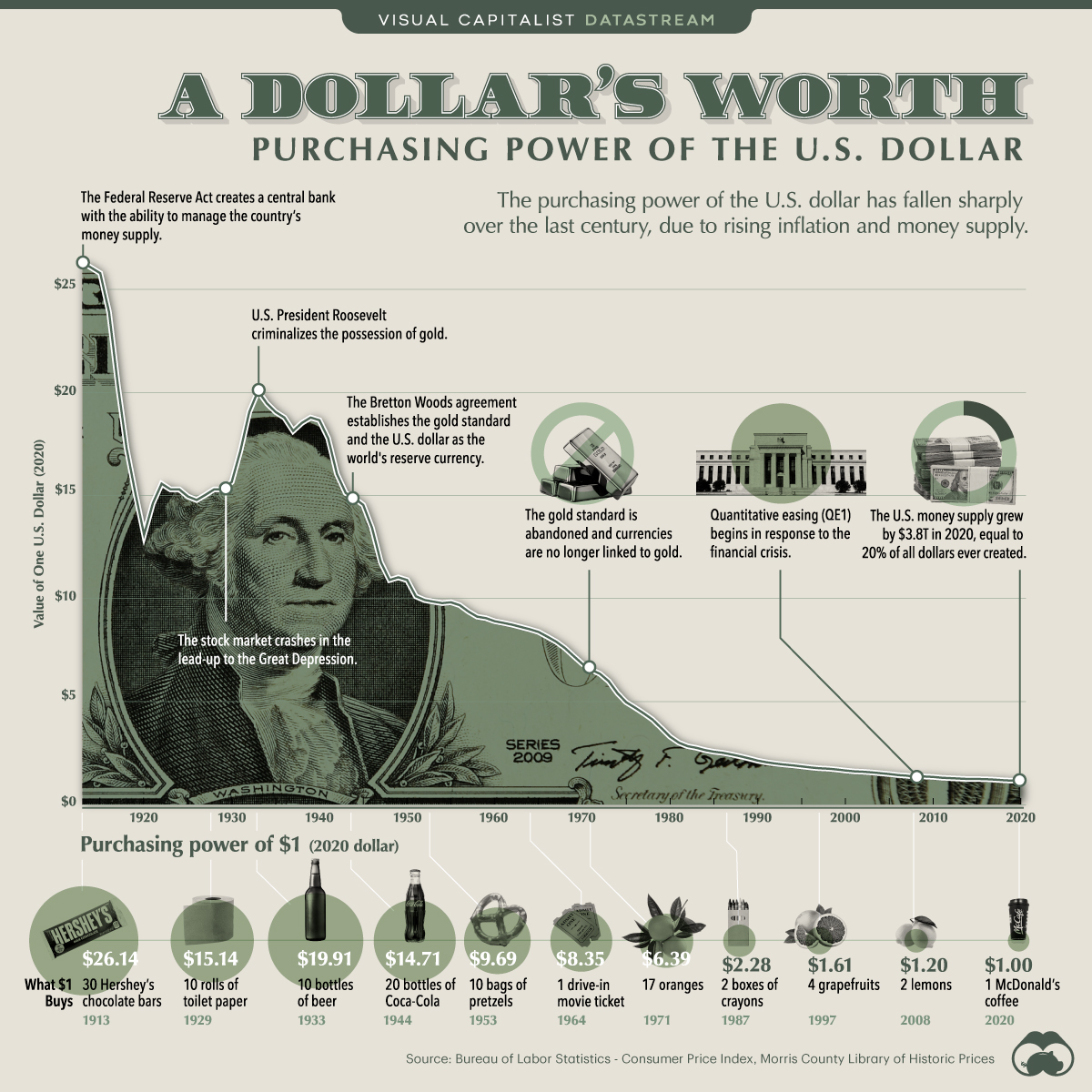

Complete BS Duke. In real terms if the $1000 dollars I've been carrying around in my pocket for the past 12 months is worth 10% less, who's going to write me a cheque for the $100 of buying power that has disappeared?

The owners of the dollars have a faith that they will be repaid.

Unless you can direct me to the person in the US government who's going to write me that $100 cheque, then I have no such faith. I'm not religious like you Duke - I don't have faith.

And in that interview we got it from the horses mouth. It's a FAITH - BASED system! The former Kansas Fed President acknowledged that and you yourself acknowledged that around 18 months ago when you said that you'd have to have faith in the ECB and the decisions it took.

The owners of bitcoin have faith that there will be folk in the future prepared to pay them for their valueless digital entries (with dollars, they hope) just as they have done.

Whether there are folks prepared to pay X for bitcoin in the future relates to adoption. It's got nothing to do with faith. Bitcoin's monetary policy is rules based - and everyone knows the rules - not just the elites. With fiat, you don't know from one minute to the next what interest rate will be set - or the motivation behind those decisions and who it may benefit most.

Just before the GFC Bernanke said everything was hunky dory - when he had info that couldn't have left him in any doubt about what was in play. Some months back, the Fed were continually claiming that either there was no inflation or that it was 'transitory'. We had people here saying that the evidence presented re. inflation was just hearsay. AFTER the fact, the Fed admits it's not transitory.

Any reasonable commentator will admit that the Fed was under incredible pressure from the Trump administration. The very same is true now with the Biden administration. Decisions taken that are helpful to politicians in the short term are most likely not in the best interests of ordinary people in the long term. But that's what the conventional system facilitates. By contrast, bitcoin monetary policy can't be tampered with. From that perspective, people don't have to pray and hope that decisions are made with their interests in mind rather than special interest groups or political interests.

That's before we get into a whole host of central banks that are mismanaged to the nth degree - because the currency supply and monetary system can be tampered with.