Hi, I'm in the same boat, and want to fix now for 2.55%. Should i request confirmation of no break free or just email them the amendment form directly asking for the new rate?To refine this further, anyone who has fixed with AIB since their April 2019 rate changes, can currently break with zero break fee. This is regardless of the term they have fixed for, all the way from 2 years to 10 years.

Happy to look at any specific scenarios not covered above to explain why.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Calling AIB customers who fixed before the latest fixed rate cuts

- Thread starter misstealeaf

- Start date

Brendan Burgess

Founder

- Messages

- 55,193

You should ring first and get the quotation..

Brendan

Brendan

Hello All

Just wanted to share my story. I started a fixed mortgage of 5 years with AIB at 2.85% in May 2019. After recent rate changes i contacted this site to see if it would be advisable to request a break from mortgage and refix at 2.45% Green 5 Year fixed rate as my house is A2 .

With help from @RedOnion and @Brendan Burgess we worked out that breakage fee would be 0 as AIB 4 year fixed rate had not changed unlike 5 year which had decreased from 2.85% to 2.55%.

I requested a Breakage fee from AIB and they informed me that a letter would be sent out within 5 days. I rang back 3 days later as i still have not got letter but they confirmed that letter was created and that my break fee was 0 EURO. I have now sent my mortgage amendment to change my 5 year fixed mortgage at 2.85% to 5 Year fixed at 2.45% so a great saving.

Thanks a million to all on this site for the excellent advise.

JC

Just wanted to share my story. I started a fixed mortgage of 5 years with AIB at 2.85% in May 2019. After recent rate changes i contacted this site to see if it would be advisable to request a break from mortgage and refix at 2.45% Green 5 Year fixed rate as my house is A2 .

With help from @RedOnion and @Brendan Burgess we worked out that breakage fee would be 0 as AIB 4 year fixed rate had not changed unlike 5 year which had decreased from 2.85% to 2.55%.

I requested a Breakage fee from AIB and they informed me that a letter would be sent out within 5 days. I rang back 3 days later as i still have not got letter but they confirmed that letter was created and that my break fee was 0 EURO. I have now sent my mortgage amendment to change my 5 year fixed mortgage at 2.85% to 5 Year fixed at 2.45% so a great saving.

Thanks a million to all on this site for the excellent advise.

JC

Brendan Burgess

Founder

- Messages

- 55,193

Charlie Weston covers it here

One poster on the site said she has a five-year fixed rate of 2.85pc. The bank, which is led by Colin Hunt, has since cut this rate to 2.55pc.

The poster asked AIB what it would cost to break out of a five-year rate. She was told that there would be a zero break fee.

www.independent.ie

www.independent.ie

"I requested a break fee from AIB last Monday when the cuts were announced. We had fixed on a five-year rate of 2.85pc last June. Got the letter today, break fee of €0.00," the woman wrote.

The difference in repayments on the two rates for a €300,000 mortgage works out at more than €560 a year.

Mr Burgess said: "Some people are saying they fixed two months ago and they are stuck on the higher rate as AIB has since reduced its three and five-year rates.

One poster on the site said she has a five-year fixed rate of 2.85pc. The bank, which is led by Colin Hunt, has since cut this rate to 2.55pc.

The poster asked AIB what it would cost to break out of a five-year rate. She was told that there would be a zero break fee.

AIB drops fee for mortgage customers breaking out of fixed rate

AIB is allowing some customers to break out of fixed mortgages and lock into lower ones at no cost, in a move that is likely to benefit thousands of people.

"I requested a break fee from AIB last Monday when the cuts were announced. We had fixed on a five-year rate of 2.85pc last June. Got the letter today, break fee of €0.00," the woman wrote.

The difference in repayments on the two rates for a €300,000 mortgage works out at more than €560 a year.

Mr Burgess said: "Some people are saying they fixed two months ago and they are stuck on the higher rate as AIB has since reduced its three and five-year rates.

Well done @Brendan Burgess

Delighted to see this issue highlighted.

If they hadn't argued with customers like @_ripped_off in the past, when they were wrong, I wouldn't have even looked at this issue now.

Delighted to see this issue highlighted.

If they hadn't argued with customers like @_ripped_off in the past, when they were wrong, I wouldn't have even looked at this issue now.

Last edited:

_ripped_off

Registered User

- Messages

- 82

I was delighted to see all the people here saying they are going to request their break fees from AIB and glad I persisted with them last year to give me a break fee in line with EU Mortgage credit directive terms.

Would not and couldn’t have done it without the help from everyone on ask about money.

It’s also taught myself and my husband to keep a much closer eye on our mortgage and the competitors rates and the interbank rates for that matter!

Would not and couldn’t have done it without the help from everyone on ask about money.

It’s also taught myself and my husband to keep a much closer eye on our mortgage and the competitors rates and the interbank rates for that matter!

Brendan Burgess

Founder

- Messages

- 55,193

We'll done @Brendan Burgess

I am only acting as your spokesman and getting all the credit for it!

Hi all, as promised earlier id let ye know how i got on, no breakage fee as ye prediceted Red onion and Brendan so thanks a mill for youre help. Im now going to fix for 3 years as i was almost a year into a 4 year fixed rate. Wont be sending it until tomorrow so if anyone feels a 5 year fix would be the better option ill always listen to good advice.

Personally, (I've no inside knowledge of any bank), I can't see anything changing in the short term. AIB group (AIB and EBS) have done enough to cement in their market share. I still think we're going to see the current rates being made available for longer periods rather than a material drop in rates. Earlier this week PTSB dropped their 7 year rates to very close to what their 3 year rates are for some LTV bands. We'll see more of this.Im on the variable of 2.95% and tempted by the fixed of 2.55%. Any thoughts on whether the fixed rates could drop further based on recent market volatility ?

I think if you're not switching lender, the 2.55% is a good rate.

If you go for the 3 year rate, as things currently stand they cannot charge you a break fee. They would need to reduce their 2 year rate below 2.55% before they could, as explained earlier in the thread.

Healthinsurance

Registered User

- Messages

- 12

I got my confirmation letter today about the new rate. We had rang AIB on Tuesday to confirm they had received our form and he suggested ringing today to make sure it went through on time for our next payment. So of course we doubled up by ringing on the same day the letter came! Better safe than sorry though,specially when it comes to banks!

Thanks again to everyone for additional info given on this thread.

Thanks again to everyone for additional info given on this thread.

Duke of Marmalade

Registered User

- Messages

- 4,704

I pointed someone in this position to this thread and they too have successfully got a break fee of €0.0 and re-entered at 2.55%. Thanks are due to Redonion et. al.Charlie Weston covers it here

One poster on the site said she has a five-year fixed rate of 2.85pc. The bank, which is led by Colin Hunt, has since cut this rate to 2.55pc.

The poster asked AIB what it would cost to break out of a five-year rate. She was told that there would be a zero break fee.

AIB drops fee for mortgage customers breaking out of fixed rate

AIB is allowing some customers to break out of fixed mortgages and lock into lower ones at no cost, in a move that is likely to benefit thousands of people.www.independent.ie

"I requested a break fee from AIB last Monday when the cuts were announced. We had fixed on a five-year rate of 2.85pc last June. Got the letter today, break fee of €0.00," the woman wrote.

The difference in repayments on the two rates for a €300,000 mortgage works out at more than €560 a year.

Mr Burgess said: "Some people are saying they fixed two months ago and they are stuck on the higher rate as AIB has since reduced its three and five-year rates.

Note that the savings are actually higher than those illustrated in the Charlie Weston article. CW is showing the savings on the monthly repayment but this includes paying more off the outstanding balance each month - that's the way annuity mortgages work. The combined savings are not far off 0.3% p.a. of €300,000 which is €900 p.a. compared to the €560 p.a. savings in monthly repayments.

Yes, the actual savings are always higher than the change in repayment amount, but it's what people focus on. I've challenged that approach in the media before, but the vast majority of people don't understand how annuity repayments work, so I now accept that repayment is the easiest thing to explain to people to get them to take action.Note that the savings are actually higher than those illustrated in the Charlie Weston article. CW is showing the savings on the monthly repayment

Brendan Burgess

Founder

- Messages

- 55,193

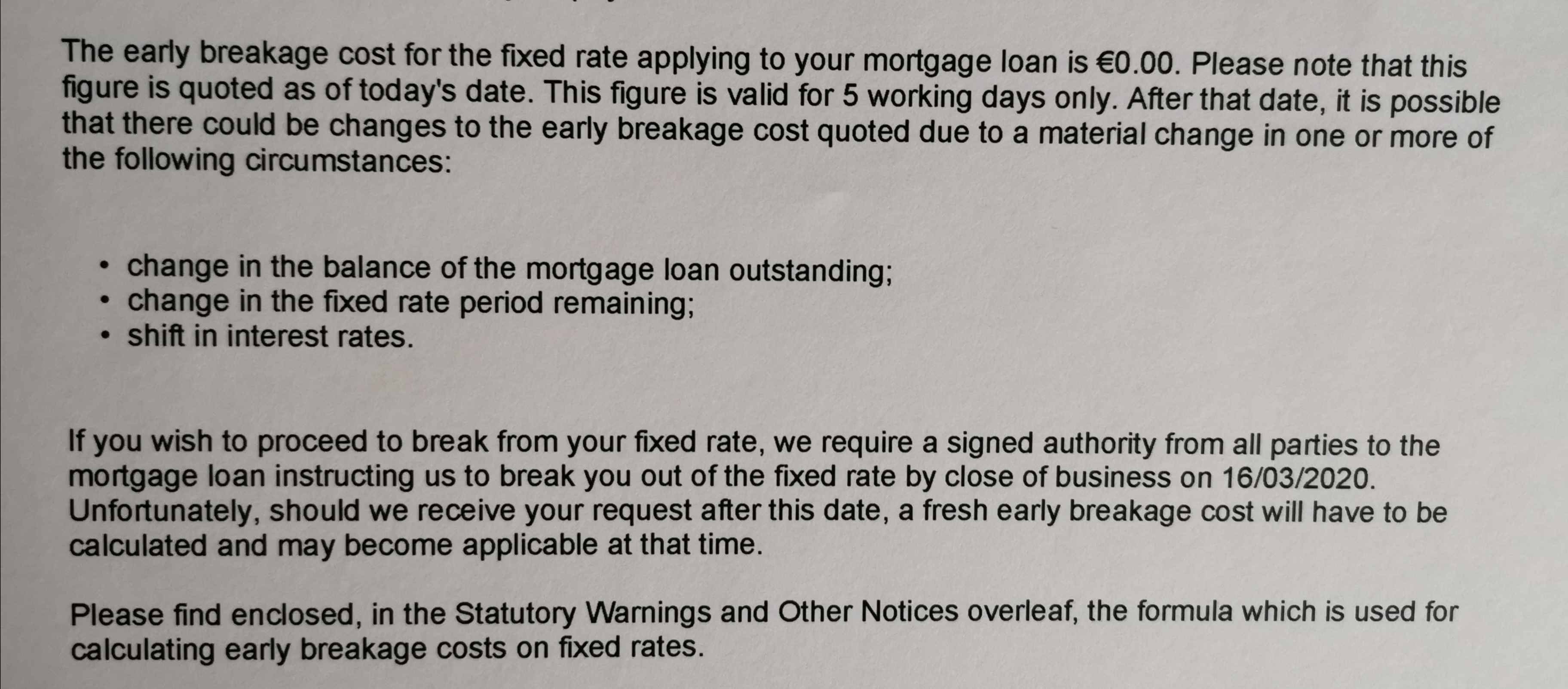

When the bank quotes a break fee of zero (or any other figure) how long does the quote last for?

Do you have to make the decision that day?

Brendan

Do you have to make the decision that day?

Brendan

@Brendan Burgess think it's tight enough. Maybe 7 days. I cannot remember fully but can post again when I get home later as I will have it on my last correspondence from them in March.

Coldwarrior

Registered User

- Messages

- 396

With Ulster Bank they give you a week if I remember correctly, the only problem is that week has expired before you receive the letter in the post notifying you of it. That's happened to me twice, though luckily I wasn't going to break either way.When the bank quotes a break fee of zero (or any other figure) how long does the quote last for?

Do you have to make the decision that day?

Brendan

@Brendan Burgess extract from my letter attached. I'd agree with @Coldwarrior in that it was massively tight to complete and return within the time allowed given letter was late arriving.

Brendan Burgess

Founder

- Messages

- 55,193

Get it in as quickly as possible, but don't worry too much about missing the 5 day deadline.

For most of the AIB cases, the break fee should remain at zero.

Brendan

For most of the AIB cases, the break fee should remain at zero.

Brendan

Thank you. That letter was back in March. I did however ask for new figures yesterday on account of possible redress cheque but may be break fee this time as went from 2.85% to 2.55%. Now 55 months left.Get it in as quickly as possible, but don't worry too much about missing the 5 day deadline.

For most of the AIB cases, the break fee should remain at zero.

Brendan