@joe sod that is a bit of a mind-bender but if understand correctly the critical factor here is time?

Bear with me a little see if I can figure this out.

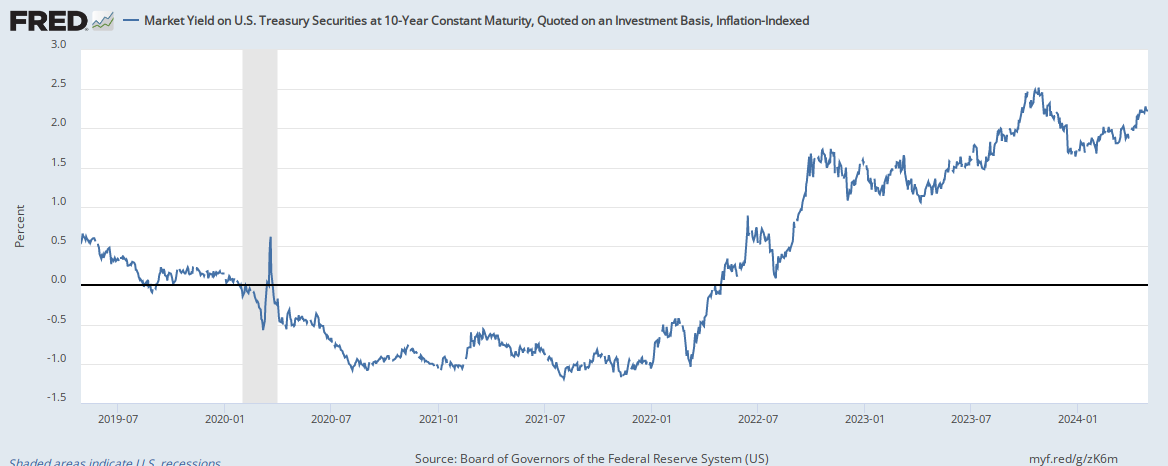

Ordinarily my €100 will have less purchasing power in 5yrs time than it does today. To protect against that I need a positive interest rate to maintain its purchasing power, say 3%, or €103 in 5yrs time.

But if I'm being offered a negative interest rate, say - 0.10% it means my €100 will have purchasing power of €99.90c in 5yrs time.

And investors think this is value? Meaning they think there is a real risk €100 will actually be worth less than €99.90 so that is why they are buying bonds with negative yields?

Is this not a deflationary trap?

That is all because of negative interest rates.

Bear with me a little see if I can figure this out.

Ordinarily my €100 will have less purchasing power in 5yrs time than it does today. To protect against that I need a positive interest rate to maintain its purchasing power, say 3%, or €103 in 5yrs time.

But if I'm being offered a negative interest rate, say - 0.10% it means my €100 will have purchasing power of €99.90c in 5yrs time.

And investors think this is value? Meaning they think there is a real risk €100 will actually be worth less than €99.90 so that is why they are buying bonds with negative yields?

Is this not a deflationary trap?