@Steven Barrett. I too enjoyed the story of Lyndon Johnson trying to make his opponent deny he had sex with a pig. It's a sad lookout, though, if you consider that a request for insurance companies to ascertain customer outcomes is in the same category as Johnson's opponent having sex with a pig. Do you not agree that both providers and advisers should be doing studies of this type on an ongoing basis? There is a constant barrage of figures showing comparative returns for this, that and the other fund, but nothing - zilch - about actual customer outcomes. We need to change the focus, to measuring actual outcomes for customers, then seeing how we can improve them.

Why should any insurance company go to the expense and work of collating and publishing data to rebut a preposterous claim unless your friend published it with data to back it up?

Let me put it differently. Why shouldn't insurance companies complete studies to ascertain how their customers have done, and compare the results with the amounts paid to brokers. For example, it would be good to know if high rewards to intermediaries translate into high rewards for customers, or the opposite. After all, we are all told to cherish our customers.

Oh come now @Duke of Marmalade - I'm sure you know very well that the average DC pension fund in Ireland is far less than €1 million. Sounds to me like you're inflating the realistic figures to make a point.

We are now in the era of DC pensions. DB pensions are dying or dead. In future, anyone on a half decent salary will have a DC pension fund of over €1 million. That's what the industry should be preparing for. Instead, it tries to justify ridiculously high charges and commissions.

The vast majority of ARF money is in Multi-Asset / Mixed Asset Funds and I would say that if they are invested in those funds for the last 10 years they probably have an annualised return (net of all charges) of circa 7% and 12% (roughly).

There is no evidence whatsoever to support a claim that intermediaries are biased towards cash/bonds.

@GSheehy, Where do you get those figures? They are absolute rubbish.

The only figures I can get my hands on are from a 2015 paper by a Working Group of the Society of Actuaries. I quote the following paragraph from the paper:

"Data supplied to us by some life assurance QFMs indicate that in respect of some €2.6bn of AMRF and ARF funds, the two most popular asset allocations were:

• Cash or cash like funds (capital protected) : 44%

• Managed type , where the asset allocation is determined by the fund manager : 44%

• Single asset type fund : 12%

This analysis varied little by ARF size."

The figures are dated, but I have no reason to believe that the proportions in various asset types since then have changed that much. For that reason, I would be very interested in learning the source of your claim that "the vast majority" is in Multi-Asset/ Mixed Asset Funds.

There is no evidence whatsoever to support a claim that intermediaries are biased towards cash/bonds.

In the light of the above, are you still saying that, or have you changed your tune?

Okay so first you were quoting nonsensical claims from "a friend who knows the pensions business". Now you're making other claims about what "experience shows", again without a shred of evidence to back up such claims. Is this experience coming from the same friend? I'm happy to debate but I've no interest in debating points that seem to be works of fiction.

Is the above (in bold) sufficient evidence that "experience shows" where ARF customers are advised to put their money? Show me why my claims are works of fiction. I wish others could produce some hard facts to support their self-serving arguments.

But to go back to the very first post on this thread, we have both the Central Bank and the Pensions Authority to regulate this business. I don't see it as the responsibility of the product companies to police the regulations. By all means change and improve the regulations and then issue the new rules to the product providers to follow.

Do you not agree that companies should try to look after their customers? Why should they wait until the CBI or the Pensions Regulator pushes them into doing it? Sadly, too many insurance companies see the broker, not the final consumer, as their "customer". They keep trying to find new ways of paying more to brokers, not caring that the 'real' customer is the one who suffers as a result.

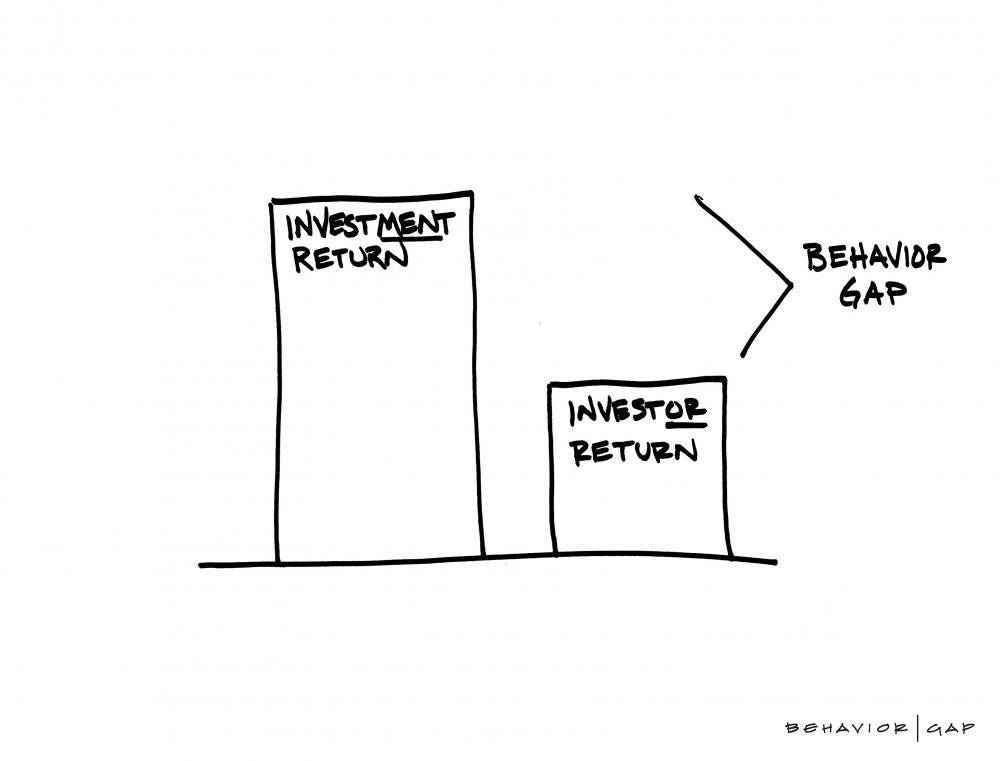

Then on the other side of the coin, is the advisor who thinks he's Warren Buffett and feels that he needs to change around clients portfolios every year to justify his ongoing fee. How much are they costing their clients by switching funds all the time and going for the new best fund?

It's great to see an adviser talking sense. Well done!