Thanks for the correction. This means that from a tax perspective it is actually better to invest in Gold ETC given that I can enjoy the 1270 euros exemptionGold whether physical or traded on an exchange is not subject to exit tax or deemed disposal. It is very likely your ETF is actually an ETC (commodity) and subject to CGT.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Where to put money as interest rates fall? Long Term ETF, etc.

- Thread starter Racrus

- Start date

Could you elaborate why you wouldn't advise someone to invest in Gold? Since the beginning of the year its returns are next to none beating even the SP500. Also from a tax perspective, it is much better.Exchange traded gold products are actually debt instruments that fall under the normal income tax/CGT regime.

I wouldn’t advise anybody to “invest” a material proportion of their net wealth in a shiny rock.

I once read Warren Buffett advising against gold but the markets and central banks in particular seems to diverge on that particular subject.

Last edited:

The tax situation on Gold ETCs is better than ETFs. That doesn't mean Gold ETCs are better investments than ETFs.This means that from a tax perspective it is actually better to invest in Gold ETC given that I can enjoy the 1270 euros exemption

Last edited:

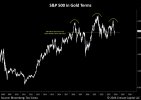

Because over the long-term the return on gold has been very unimpressive.Could you elaborate why you wouldn't advise someone to invest in Gold?

The return over any 9-month period is irrelevant to a long-term investor.

I’ve no issue with somebody holding >5% of their net assets in gold/precious metals.

Personally, I couldn’t be bothered.

Because over the long-term the return on gold has been very unimpressive.

The return over any 9-month period is irrelevant to a long-term investor.

Stocks vs. Gold and Silver - Updated Chart | Longtermtrends

Which was the best investment in the past 30, 50, 80, or 100 years? This chart compares the performance of the S&P 500, the Dow Jones, Gold, and Silver. Including dividends leads to a very different picture.

Just to correct this, Exit Tax is offset against CAT in the case of death so the net effect is the same as stocks in most cases.ETF gains are not exempt from tax on death, compared to stocks which are exempt from CGT, so less money to your estate in case of ETFs.

Thanks for the replies, some interesting feedback cropping up. I think I'll continue with my ETF plan for my non pension money.

How much is an annual average health insurance policy for someone in their 40's? Sort of a how long is a piece of string question I suppose. I never really thought of getting health insurance before and anytime I did think of it I just sort of thought of it as another expense you may not need and if you do the insurance company will probably try wriggle out of it. I think many people that have it, started it via their work which if that had of been an option to me I probably would have availed of it. Just something I never put too much heed into. But maybe I should!

When you start talking of Income protection then as well, it just starts to seem a bit crazy paying all these policies that you may not need. It starts to sound a bit like all the streaming subscriptions some folk have and are constantly cancelling and resigning up, etc.

If your family hasn't got a history of health issues and your currently healthy and personally wish to work even to a part time extent until you physically can't even after pension age, does health and income insurance still apply? I'm not saying I'm a workaholic but I don't think I ever wish to be 100% idle even during "retirement".

How much is an annual average health insurance policy for someone in their 40's? Sort of a how long is a piece of string question I suppose. I never really thought of getting health insurance before and anytime I did think of it I just sort of thought of it as another expense you may not need and if you do the insurance company will probably try wriggle out of it. I think many people that have it, started it via their work which if that had of been an option to me I probably would have availed of it. Just something I never put too much heed into. But maybe I should!

When you start talking of Income protection then as well, it just starts to seem a bit crazy paying all these policies that you may not need. It starts to sound a bit like all the streaming subscriptions some folk have and are constantly cancelling and resigning up, etc.

If your family hasn't got a history of health issues and your currently healthy and personally wish to work even to a part time extent until you physically can't even after pension age, does health and income insurance still apply? I'm not saying I'm a workaholic but I don't think I ever wish to be 100% idle even during "retirement".

The query specifically asks if it should be in VWCE which is a global equity ETF tracking the FTSE All-World index.The query in this thread seems to be along the lines of whether cash should be on deposit or in an ETF. But what kind of ETF?

The S&P500 and Dow Jones in this chart doesn't include dividends. The actual return compared to Gold and Silver is much higher (which don't pay dividends obviously).View attachment 9503Stocks vs. Gold and Silver - Updated Chart | Longtermtrends

Which was the best investment in the past 30, 50, 80, or 100 years? This chart compares the performance of the S&P 500, the Dow Jones, Gold, and Silver. Including dividends leads to a very different picture.www.longtermtrends.net

View attachment 9503Stocks vs. Gold and Silver - Updated Chart | Longtermtrends

Which was the best investment in the past 30, 50, 80, or 100 years? This chart compares the performance of the S&P 500, the Dow Jones, Gold, and Silver. Including dividends leads to a very different picture.www.longtermtrends.net

We will agree to disagree on this one. If you look at the past 20 years then the picture is totally different. Here is a chart for you.

You can also read this article from FT https://www.ft.com/content/945ee113-abeb-456c-ac01-751b3a21678f

Just over the past 5 years, Gold has been performing better than the S&P500 so we're witnessing something special. You can obviously not agree with me but overall I am very happy to have included Gold in my portfolio and I am very confident to advise other people to follow suit but obviously it is a personal decision.

Attachments

Some possibly stupid questions:

1. Are the various Vanguard funds ETFs?

2. Are they therefore subject to the infamous deemed disposal rule?

3. If so, are they conisdered a good investment choice for after tax money and as an invest vehicle that will better deposit rates and over a 10 yr horizon?

pls note 70% net wealth already in pension, all equities.

1. Are the various Vanguard funds ETFs?

2. Are they therefore subject to the infamous deemed disposal rule?

3. If so, are they conisdered a good investment choice for after tax money and as an invest vehicle that will better deposit rates and over a 10 yr horizon?

pls note 70% net wealth already in pension, all equities.

Yes, Vanguard creates the fund. Shares in the fund are bought and sold on the stock exchange.1. Are the various Vanguard funds ETFs?

Yes.2. Are they therefore subject to the infamous deemed disposal rule?

Over 10 years you would expect equities to beat deposits.3. If so, are they conisdered a good investment choice for after tax money and as an invest vehicle that will better deposit rates and over a 10 yr horizon?

If you decide to invest in equities, your options are individual shares, a conglomerate, an ETF, or a fund from a life insurance company. Each one has benefits and drawbacks.

Key Post - The different ways for investing directly in the stock market

This thread is for someone who has decided to invest directly in the stock market. It is not to discuss the wisdom of investing. It is not to discuss investing via a pension fund I want to describe the different methods, explain how to invest , explain the taxation and set out the pros and...

www.askaboutmoney.com

Statistically and historically speaking there is a higher expected value from putting your lump sum into the market immediately compared to drip feeding (i.e. dollar-cost-averaging in your lump sum).

Psychologically it's much harder to put it all in, in one go, as it feels risky and prices sometimes go down for a while.

There is always the risk that just after you invest it, all markets will start dropping for a period of time and you could have gotten a better return by waiting.

But we don't have a crystal ball, so we can't know, so the best is to look at studies of the past that show in general the best strategy is to put it all in now.

Psychologically it's much harder to put it all in, in one go, as it feels risky and prices sometimes go down for a while.

There is always the risk that just after you invest it, all markets will start dropping for a period of time and you could have gotten a better return by waiting.

But we don't have a crystal ball, so we can't know, so the best is to look at studies of the past that show in general the best strategy is to put it all in now.

irishfinanceguy

Registered User

- Messages

- 209

May I ask where to buy this Vanguard VUAA?60% Vanguard VUAA- annual fund charge 0.07%

40% Berkshire Hathaway.

irishfinanceguy

Registered User

- Messages

- 209

Can I ask why the Invesco one specifically?I don't think it's reckless, given your long term horizon.

I am on the same boat, also aiming for the long term. Roughly 50% VWCE and 50% cash here.

I suppose you are aware of the many pitfalls of ETFs - crippled compounding, no offsetting losses, inheritance tax issues, etc. Still, I tend to accept the drawbacks in face of the many positives, also taking into account that maybe ETF taxation will be lowered or simplified over time.

Here is what I am considering, by order of preference:

* Invesco's alternative to VWCE going forward, for the lower 0.15% expense ratio (ISIN IE000716YHJ7)

* Allocating maybe 15-20% to conglomerate stocks for the more favourable CGT and long term compounding, mainly Berkshire Hathaway (even though it's 30% Apple) and potentially Merkel.

* Investments trusts also for CGT

My worry with Berkshire is Warren himself. Any investment trusts youd recommend?

Trade Republic, Lightyear etc will offer VUAA.May I ask where to buy this Vanguard VUAA?