since this discussion has descended into a debate about what risk means to investors this is a relevant piece in the FT

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wealth Management - How to Invest €6M - Where to Get Advice

- Thread starter Always Learning

- Start date

Gordon Gekko

Registered User

- Messages

- 7,936

OP, with the amounts involved, I’d be wary of dealing with smaller providers or people touting for business online.

I would organise a beauty parade and go and speak to 4/5 of the biggest wealth managers in the country.

I would listen to what they have to say and ask tough questions. There is no such thing as a silly question. If they can’t answer your question, they’re spoofing.

I would organise a beauty parade and go and speak to 4/5 of the biggest wealth managers in the country.

I would listen to what they have to say and ask tough questions. There is no such thing as a silly question. If they can’t answer your question, they’re spoofing.

Gordon Gekko

Registered User

- Messages

- 7,936

One further tip, when you want to engage with them, don’t under any circumstances cold call. You’re at the mercy of the eejit who picks up the call as he/she will claim you as a prospect. The best people tend to be busy. Pop emails to the CEOs and they’ll stick their best teams on it. Simon Howley, Keith Ryan, Eddie Clarke, Brian Weber, Pat Cooney.

Gordon Gekko

Registered User

- Messages

- 7,936

I wouldn’t, no.That sounds like great practical advice and a useful list. Would you expect much variation in fees among that group, or vs this board's well known commentators.

@Always Learning Learning , first, hat's off to you. You have your financial stability house in order in your thirties. You've been humble in your posts but I doubt it's all down to pure luck. Acknowledge your inputs & resulting outcomes.

I would strongly echo what Brendan & other wrote here about diversification & also dollar cost averaging & getting professionally trained on markets & investing. You can afford the time & the cost now. Maybe it could be a new career that you come to love rather than a means to a 200k end?

One thing that I didn't read in this thread is considering where you will live. In your shoes I would be looking at my options for living internationally incl. Ireland for some of the time. There are potential lifestyle & wealth preservation benefits of being resident in different territories.

Spread your investments:

A mattress expert may for example turn his skills to couches or office chairs or fitting out trains. You get the idea. Think laterally here.

Best of luck to you!

I would strongly echo what Brendan & other wrote here about diversification & also dollar cost averaging & getting professionally trained on markets & investing. You can afford the time & the cost now. Maybe it could be a new career that you come to love rather than a means to a 200k end?

One thing that I didn't read in this thread is considering where you will live. In your shoes I would be looking at my options for living internationally incl. Ireland for some of the time. There are potential lifestyle & wealth preservation benefits of being resident in different territories.

Spread your investments:

- Equities & ETF / trackers.

- Diversify within your Equities & ETF's across geography, sectors & risk profiles.

- Property in Ireland (consider REIT's - you get the exposure without the headache of managing properties & tenants)

- Property overseas (strong Market due diligence is warranted here).

- Marc alluded to the fire & flood risk associated with physical properties. Again diversify your physical across domestic & perhaps international geographies. Imagine you buy the block of 20 & it burns down one night or the whole block has a materials or structural problem.

- Physical gold or other precious metals. Gold is VAT free afaik.

- Cryptocurrencies (get educated on this topic)

- DEFI (decentralized finance - as a lender)

- Take a look at NTMA's offerings for pig iron.

A mattress expert may for example turn his skills to couches or office chairs or fitting out trains. You get the idea. Think laterally here.

Best of luck to you!

Brendan Burgess

Founder

- Messages

- 54,679

I would strongly echo what Brendan & other wrote here about diversification & also dollar cost averaging

Just to be absolutely clear : I said nothing about dollar cost averaging. It is a fiction.

Brendan

Fair enough.Just to be absolutely clear : I said nothing about dollar cost averaging. It is a fiction.

Brendan

I was attributing that to another contributor.

That sounds like great practical advice and a useful list. Would you expect much variation in fees among that group, or vs this board's well known commentators.

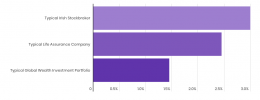

I suppose you could conduct some sort of ex ante cost comparison

Typical Life Assurance contract based on Zurich LifeSave Investment Bond fund specific informational booklet Dimensional World Equity Fund.

Typical Irish Stockbroker based on MiFID II ex-post cost disclosure document.

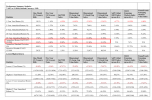

Or maybe some sort of ex post analysis after costs over a decade

In Search of the Perfect Investment Portfolio

Many investors find it difficult to achieve returns offered by the markets due to a misunderstanding of investment risk, costs and taxes.

You know, to avoid the risk of being overly prejudiced

Gordon Gekko

Registered User

- Messages

- 7,936

I have a number of questions and observations regarding the above post:

- Note the use of the term “Irish Stockbroker” in the chart; nobody mentioned stockbrokers or stockbroking services

- Also note the use of the term “life assurance company”; nobody mentioned life assurance; what’s the thinking behind the use of either term?

- These are then compared with a “Global Wealth Investment Portfolio”; what is that and who manages it? What research resources do they have? Are there any performance figures available (independently vetted of course)?

- Who put the chart together? Someone unbiased I hope

- Where are those costs and charges numbers coming from? I have never seen a MiFID disclosure with 3% on it or a life company charge of 2.5%, particularly for a sum in the millions

I am entitled to my personal view, and it’s that I’m very wary of people marketing their services via internet forums.

- Note the use of the term “Irish Stockbroker” in the chart; nobody mentioned stockbrokers or stockbroking services

- Also note the use of the term “life assurance company”; nobody mentioned life assurance; what’s the thinking behind the use of either term?

- These are then compared with a “Global Wealth Investment Portfolio”; what is that and who manages it? What research resources do they have? Are there any performance figures available (independently vetted of course)?

- Who put the chart together? Someone unbiased I hope

- Where are those costs and charges numbers coming from? I have never seen a MiFID disclosure with 3% on it or a life company charge of 2.5%, particularly for a sum in the millions

I am entitled to my personal view, and it’s that I’m very wary of people marketing their services via internet forums.

Please feel free to like this post if you think Professional advisers should give some of their time pro-bono to assist people to make better financial decisions

5A Guidelines for Professional Advisors e.g. mortgage brokers, accountants, architects, etc.

Askaboutmoney welcomes professional advisors to post in their own name on topics relating to their area of expertise. You are welcome to put in your website as part of your signature. If you do not have a website, you can put in your email address instead. Many professional contributors have got useful business through askaboutmoney and, of course, many users have found good professional advisors through askaboutmoney. It is very easy for a user to assess the quality of a professional advisor from reading their posts on askaboutmoney.It is also educational for other users. For these reasons, you must post the replies publicly, rather than by Private Message. The main principle is "No advertising". Do not send Private Messages to users, except in reply to their PM to you. Do not invite the poster to contact you. Do not invite posters to send you a Private Message. Do not include your contact details on any post not relating directly to your area of professional advice. Do not use a slogan in your signature "e.g. Ireland's best advisor". It may be better to contribute to other discussions through a separate account. Send a Private Message to me and I will set up a separate user name for you. Example: Liam Ferguson

Marc Westlake CFP®, TEP, APFS, EFP ,QFA

CHARTERED, CERTIFIED & EUROPEAN FINANCIAL PLANNER™ professional

AND REGISTERED TRUST & ESTATE PRACTITIONER

5A Guidelines for Professional Advisors e.g. mortgage brokers, accountants, architects, etc.

Askaboutmoney welcomes professional advisors to post in their own name on topics relating to their area of expertise. You are welcome to put in your website as part of your signature. If you do not have a website, you can put in your email address instead. Many professional contributors have got useful business through askaboutmoney and, of course, many users have found good professional advisors through askaboutmoney. It is very easy for a user to assess the quality of a professional advisor from reading their posts on askaboutmoney.It is also educational for other users. For these reasons, you must post the replies publicly, rather than by Private Message. The main principle is "No advertising". Do not send Private Messages to users, except in reply to their PM to you. Do not invite the poster to contact you. Do not invite posters to send you a Private Message. Do not include your contact details on any post not relating directly to your area of professional advice. Do not use a slogan in your signature "e.g. Ireland's best advisor". It may be better to contribute to other discussions through a separate account. Send a Private Message to me and I will set up a separate user name for you. Example: Liam Ferguson

Marc Westlake CFP®, TEP, APFS, EFP ,QFA

CHARTERED, CERTIFIED & EUROPEAN FINANCIAL PLANNER™ professional

AND REGISTERED TRUST & ESTATE PRACTITIONER

Last edited:

Jim Stafford

Registered User

- Messages

- 631

Given your recent success in in running a business and then selling it, you should consider investing in a business that is exiting Receivership or Examinership. You could focus on companies that have sales of at least, say, €5 million, and that have a good balanced management team in place so that you could restrict your role to that of an Non Executive Director ("NED").

I have seen savvy businesspeople make serious money from making such investments.

Many companies exiting Examinership have an existing working capital cash flow cycle (i.e. stock into debtors into cash) so that in some cases the only investment required is to make a dividend payment to creditors.

Given that you have recently sold a business, you will have first hand experience of Due Diligence. Due Diligence costs are much less when purchasing a business from a Receiver or an Examiner.

Jim Stafford

I have seen savvy businesspeople make serious money from making such investments.

Many companies exiting Examinership have an existing working capital cash flow cycle (i.e. stock into debtors into cash) so that in some cases the only investment required is to make a dividend payment to creditors.

Given that you have recently sold a business, you will have first hand experience of Due Diligence. Due Diligence costs are much less when purchasing a business from a Receiver or an Examiner.

Jim Stafford

Last edited:

Always Learning

Registered User

- Messages

- 142

@fonduster - thanks for that post. I was away for a few days over the weekend so I'm only catching up on posts now. That's very interesting and gives me some genuine food for thought. I appreciate you taking the time from your day to send it. I don't know what an EIIS scheme is, but I will bring this up with my financial advisors (when I pick one) and learn about them.I would agree with most people here that given the amount of money you are dealing with, i would diversify and not invest all your money in property in one region. I think i would split the money as follows if i was in your situation:

A return of 1.5% on stocks for a 2.5M investment is not getting me very excited. I need start reading a little more on that front and figure out why I would go that route or is the only answer to that in order to diversify and not have everything tied up in property? The thing about property for me is that provided I spread it out a bit and maybe split it commercial and retail, I see it as an investment that I literally can't lose on. If I don't have any borrowings, it doesn't really matter to me if the market crashed or not, the rent will still be coming in (for the most part) and I'll just ride out the crash. Eventually it will come around again.

That being said, I've been pretty much sold on the idea from the responses here that diversification is the way to go, suppose common sense should really have told me that from the start. The lingering question is to what degree I'm going to split it.

@_OkGo_ - thanks for that.

This is a good point and one I had not considered. I'm definitely guilty of thinking a little too short term. It's a flaw I've noticed about myself and need to correct if I'm going to make the best of this money. Thanks for highlighting that.I don't think much will change in the short term but it is a realistic assumption that housing needs, supply and standards will improve over the next 10-20 years. Do you really want to be left holding 50 units of the worst possible stock? This type of property could suffer the most in terms of rental yield and asset value.

@Gordon Gekko

Thanks for the suggestion, I'll do that.Pop emails to the CEOs and they’ll stick their best teams on it. Simon Howley, Keith Ryan, Eddie Clarke, Brian Weber, Pat Cooney.

Always Learning

Registered User

- Messages

- 142

Thanks Jim, but I have zero interest in that. I'm very risk averse at this point after being burned in the crash. Not me personally, but my father suffered pretty bad during the crash. He had a lot, he lost everything after taking poor borrowing advice from banks and poor investment advice from others. I and he both swore if we ever made it back, we would play it safe, not borrow and only invest in safe ventures (I know nothing is completely safe).Given your recent success in in running a business and then selling it, you should consider investing in a business that is exiting Receivership or Examinership. You could focus on companies that have sales of at least, say, €5 million, and that have a good balanced management team in place so that you could restrict your role to that of an Non Executive Director ("NED").

I have seen savvy businesspeople make serious money from making such investments.

Many companies exiting Examinership have an existing working capital cash flow cycle (i.e. stock into debtors into cash) so that in some cases the only investment required is to make a dividend payment to creditors.

Given that you have recently sold a business, you will have first hand experience of Due Diligence. Due Diligence costs are much less when purchasing a business from a Receiver or an Examiner.

Jim Stafford

So now that I'm fortunate enough to be back in a good position again, I just want to find a nice portfolio that I can invest our money in to create a passive income with a low risk. I'm done with managing employees and all the stress that brings with.

A return of 1.5% on stocks for a 2.5M investment is not getting me very excited.

I’m curious where you are getting the 1.5% figure from

In this post I showed that the average return of the US market has been over 10%pa since 1926

Post in thread 'Wealth Management - How to Invest €6M - Where to Get Advice'

https://www.askaboutmoney.com/threads/wealth-management-how-to-invest-€6m-where-to-get-advice.226060/post-1754715

And in this post that investors should focus on a total return approach rather than trying to get by on a natural yield

Post in thread 'Wealth Management - How to Invest €6M - Where to Get Advice'

https://www.askaboutmoney.com/threads/wealth-management-how-to-invest-€6m-where-to-get-advice.226060/post-1754715

Last edited:

Always Learning

Registered User

- Messages

- 142

A guy called Fonduster posted quite a lengthy response which was quite informative. It seems to have been removed now.I’m curious where you are getting the 1.5% figure from

In this post I showed that the average return of the US market has been over 10%pa since 1926

Post in thread 'Wealth Management - How to Invest €6M - Where to Get Advice'

https://www.askaboutmoney.com/threads/wealth-management-how-to-invest-€6m-where-to-get-advice.226060/post-1754715

And in this post that investors should focus on a total return approach rather than trying to get by on a natural yield

Post in thread 'Wealth Management - How to Invest €6M - Where to Get Advice'

https://www.askaboutmoney.com/threads/wealth-management-how-to-invest-€6m-where-to-get-advice.226060/post-1754715

@Brendan Burgess - was that post removed for some reason? I wanted to look back on it to read over again as I found it helpful.

@Marc - in the post from Fonduster he explained how he has split his portfolio and said he was getting a 1.5% return on stocks. At least that's how I read it anyway.

Your regarding the returns of 10% had me very intrigued and I intend to follow up on that and talk to a financial planner regarding that as a possible option, it almost seems too good to be true? Are you saying that if ten years ago I'd have invested €6M in the S&P 500 market across a general base of blue chip companies, I would be earning around 10% per year on that? Without the need for having to pay property management companies and deal with shitty tenants not paying rent and spend money upgrading buildings etc?

The last 10 years have been a particularly good time to invest in the USA and in tech stocks in particular (not a good idea to think you should do this NOW but over the last 10 yearsA guy called Fonduster posted quite a lengthy response which was quite informative. It seems to have been removed now.

@Brendan Burgess - was that post removed for some reason? I wanted to look back on it to read over again as I found it helpful.

@Marc - in the post from Fonduster he explained how he has split his portfolio and said he was getting a 1.5% return on stocks. At least that's how I read it anyway.

Your regarding the returns of 10% had me very intrigued and I intend to follow up on that and talk to a financial planner regarding that as a possible option, it almost seems too good to be true? Are you saying that if ten years ago I'd have invested €6M in the S&P 500 market across a general base of blue chip companies, I would be earning around 10% per year on that? Without the need for having to pay property management companies and deal with shitty tenants not paying rent and spend money upgrading buildings etc?

The US Large cap market is up 388.32% and the tech heavy Nasdaq is up 713.68%

€6m invested 10 years ago would be worth €23,299,200 on the S&P 500 and €42,820,800 on the Nasdaq - NOT what you should expect over the next 10 years but certainly what you would have made over the last 10.

This excercise is all about managing your expectations

That 10% number is the average annual return of the US Market since the 1920s with dividends reinvested. This period included the Great Depression, World War 2, Vietnam, Korea, the Cold War, The Gulf War, the 1987 crash, the tech collapse in 2000, the financial crisis in 2008 etc.

We can never know what the average will be in the future but the past gives some indication of what we might expect and also how the markets generally shrug off whatever news story is scaring investors this week.

Global capital markets reward people for putting their capital to work and from that they deduct their fees and taxes. That's it. Nothing complicated. The hard part is getting to understand that that is the answer and everything else you read or are told about "wealth management" is really just marketing.

I have written a detailed guide which sets out what you really need to know about this

Investment Philosophy

At Global Wealth, we don’t manage investments, we manage investors

This table shows that for more risky parts of the market (think small businesses) the average annual return has been even higher on average

This is the logical explanation as to why you were able to sell your own business for so much

Last edited:

Wow! Do some professional advisors have access to a time machine for clients to use?The last 10 years have been a particularly good time to invest in the USA and in tech stocks in particular (not a good idea to think you should do this NOW but over the last 10 years

Average returns are not the only relevant consideration when you are drawing from a portfolio – the sequence of returns is also important.Your regarding the returns of 10% had me very intrigued and I intend to follow up on that and talk to a financial planner regarding that as a possible option, it almost seems too good to be true? Are you saying that if ten years ago I'd have invested €6M in the S&P 500 market across a general base of blue chip companies, I would be earning around 10% per year on that?

This short note from BlackRock explains the concept -