Indeed...and it's a question of how much 'control' they have. Don't get me wrong, I'd encourage a greater distribution. However, if you are saying that China can flip a switch and 'end' bitcoin this very day, that's not the case. Could they cause short term temporary disruption? - sure.I'd have thought people who put forward the argument of Bitcoin as a safe haven form meddling governments wouldn't have thought giving China such control was a good idea

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The impact of Bitcoin "Halving"

- Thread starter Duke of Marmalade

- Start date

China can flip a switch and 'end' bitcoin this very day, that's not the case.

I think you underestimate their abilities. Whether they want to or not is the more important factor.

You could well be right in both cases, Leo - quite happy to accept that. I just don't see it as a concern this very day. To your second point, the longer this goes on, the harder it becomes to snuff out bitcoin and cryptocurrencies.I think you underestimate their abilities. Whether they want to or not is the more important factor.

Duke of Marmalade

Registered User

- Messages

- 4,686

WARNING This post is not about the halvening.

Intrinsic value or tethered thereto - this to me is the fatal flaw in bitcoin. Paul Fax Machine Krugman agrees as do most eminent economists. I am aware that bitcoin enthusiasts don't rate this. Nonetheless the fact this subject wasn't even on the exam suggests heavy bias on the part of the compilers

Price stability

Possibility of going to zero or thereabouts (I have noticed that those in the investor community who recommend btc as an uncorrelated asset invariably do a CYA and concede that it could go to zero)

General acceptability as a transaction currency

Sustainable low transaction costs (watch the fees balloon after a few more halvenings, maybe even after this one)

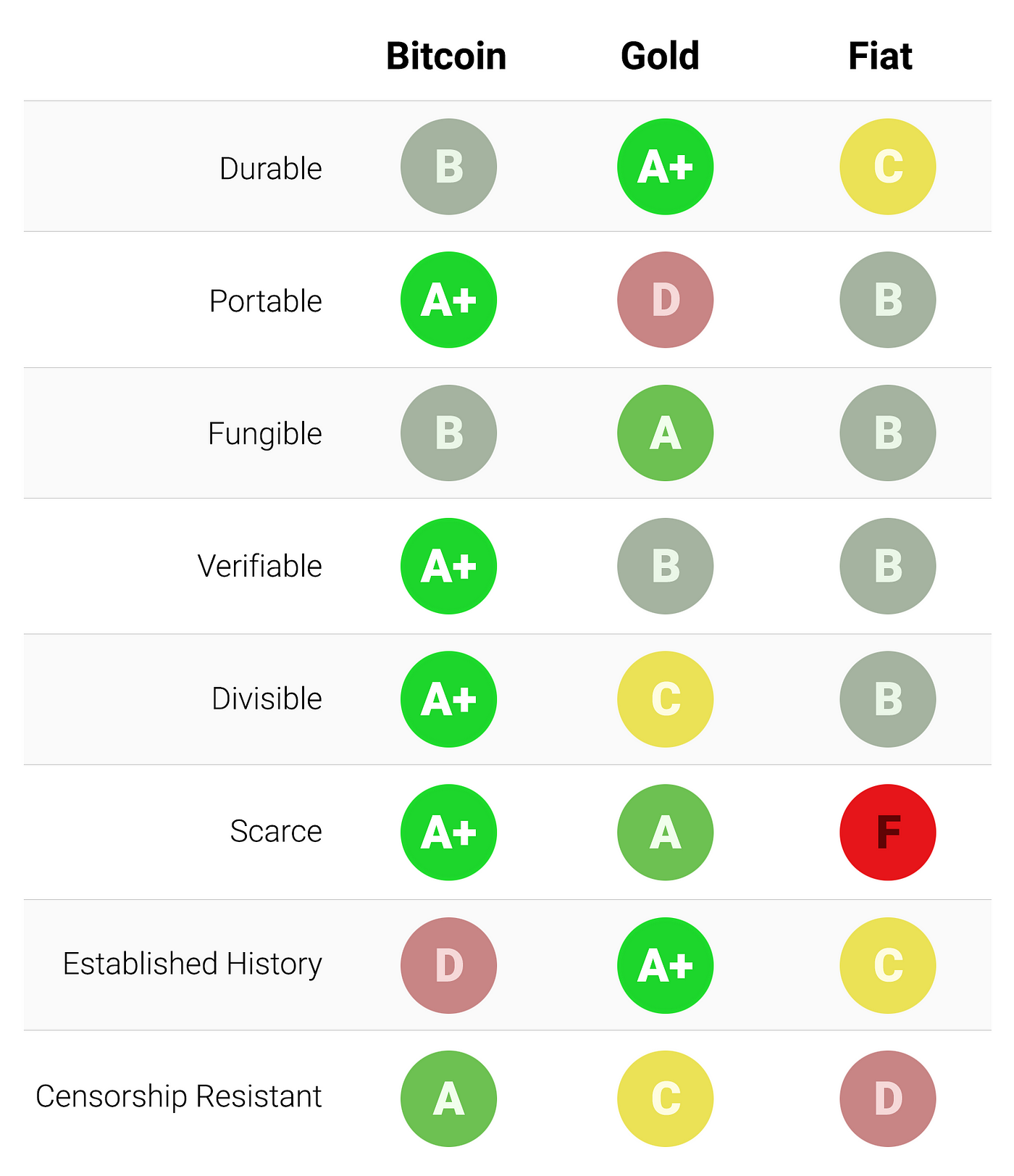

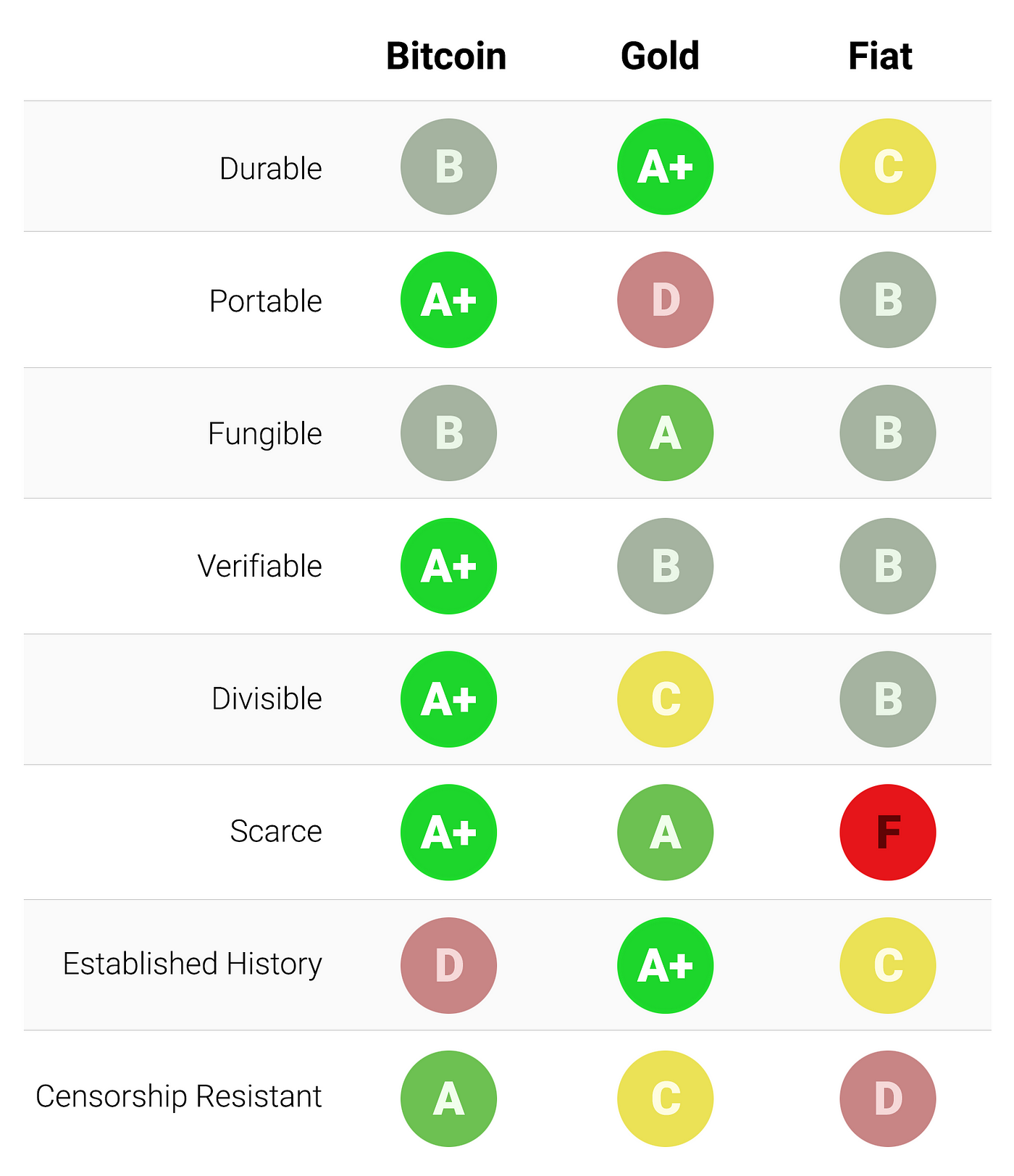

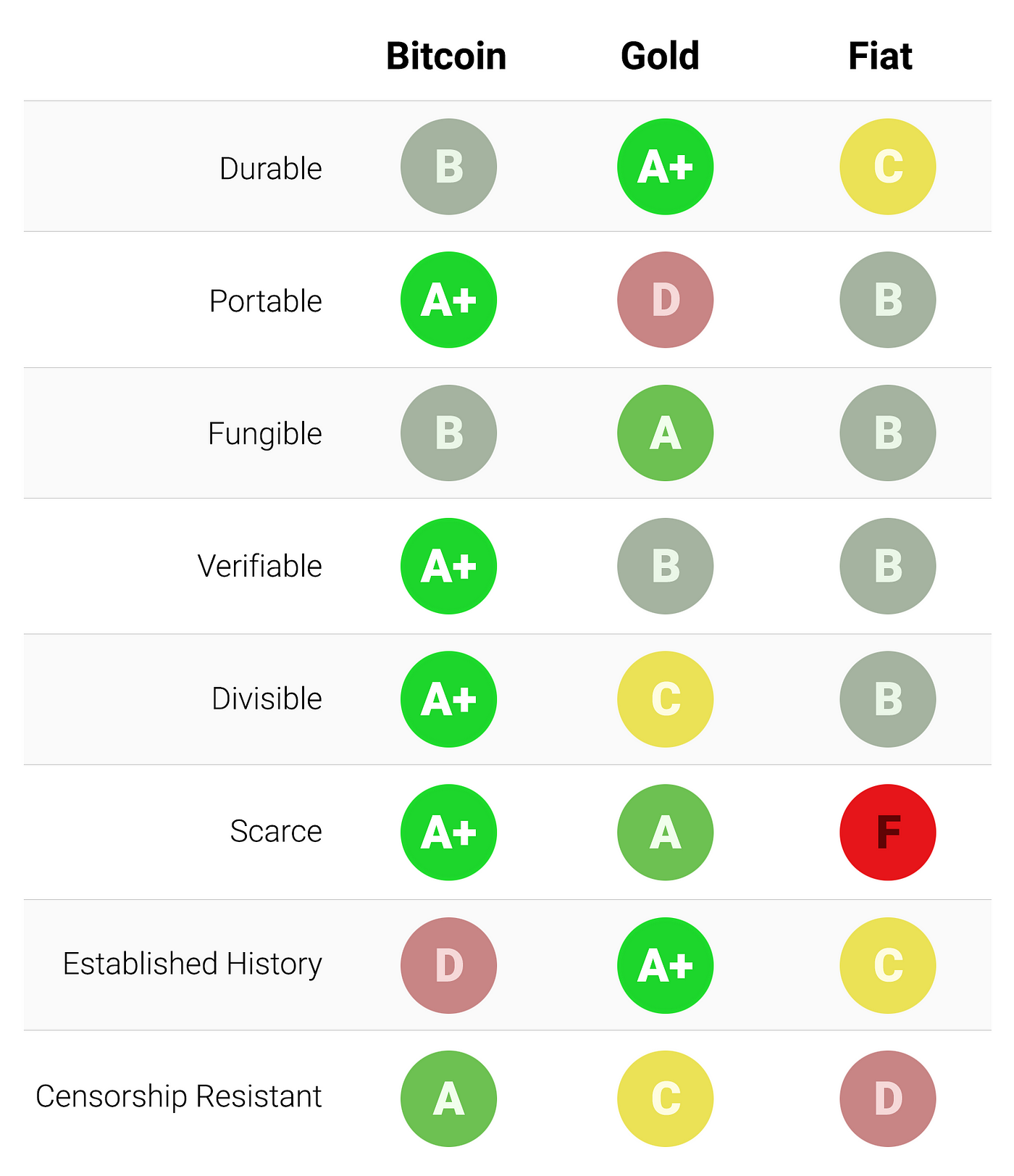

Care to givuz a source. Just to see if there is a bias (as you are fond to accuse others of). I see that Established History was thrown in, at which we all know Bitcoin is a bit of a dunce. However, this could be a ruse to impress us of the objectivity of the exercise. A few subjects were left out of the exam which are by no means negligible:

Intrinsic value or tethered thereto - this to me is the fatal flaw in bitcoin. Paul Fax Machine Krugman agrees as do most eminent economists. I am aware that bitcoin enthusiasts don't rate this. Nonetheless the fact this subject wasn't even on the exam suggests heavy bias on the part of the compilers

Price stability

Possibility of going to zero or thereabouts (I have noticed that those in the investor community who recommend btc as an uncorrelated asset invariably do a CYA and concede that it could go to zero)

General acceptability as a transaction currency

Sustainable low transaction costs (watch the fees balloon after a few more halvenings, maybe even after this one)

Last edited:

That's very perceptive of you, your Dukeness - impressive. Indeed it's not. However, it is in response to a post on this thread - which wasn't about the halving....just as I responded to your post...which wasn't about the halving. Thanks for helping to clear that up.WARNING This post is not about the halvening.

Indeed I do care to provide a source - it's at the very end of the post.Care to givuz a source.

Ah, we need to verify that? Well the evidence is stacking up against you, your Dukeness. You took issue with my last post not being halving related and conveniently skipped over the previous couple of posts by another contributor (the posts that I responded to) and yet you have no commentary for them on the matter. Could it be that it's because they support your equally skewed view of the world as it relates to bitcoin and crypto?Just to see if there is a bias (as you are fond to accuse others of).

Discussed in the analysis.A few subjects were left out of the exam which are by no means negligible:

Price stability

Intrinsic value or tethered thereto

General acceptability as a transaction currency

You mean like oil? No, that's a mistake - it can't be like oil because oil goes into minus money. Bitcoin ticks a hell of a lot of boxes but even it can't stretch to that. No, I guess you mean the currency that died yesterday - the Iranian Rial. Or was it the FIAT currency and banking system that hit rocks last week - The Lebanese Pound? Hell, we have not got all day. Let's not go through them all - as it is a case of going through them all as ALL FIAT currencies fail at one point or another - with the average lifespan being 27 years. You mentioned the CYA which comes with ALL investment products. Tell me - do they provide that warning for Euros, Lebanese Pounds and other sorts of monopoly money?Possibility of going to zero or thereabouts (I have noticed that those in the investor community who recommend btc as an uncorrelated asset invariably do a CYA and concede that it could go to zero)

Well, firstly - have you and your fellow travellers not been telling us that bitcoin is going to zero? If that's the case, how would this be a thing? Let me help you with that just in case anyone 'has lost leave of their senses' and doesn't at the very least accept the opposite as a possible outcome...Sustainable low transaction costs (watch the fees balloon after a few more halvenings)

Systems surrounding bitcoin (i.e. exchanges and exchange infrastructure) are much improved since the last market high. I expect that they will perform better next time round. Furthermore, a layer 2 solution in the form of Lightning Network continues to emerge. The eco-system surrounding bitcoin and crypto continues to be built out. This will all play a part in terms of transaction fees.

Just for kicks, here's an example of a bitcoin transaction fee - . Tell me this....what would AIB or BoI charge for that type of transfer? I mean, there is the €100,000 banking guarantee to be bought n' paid for so I wouldn't be so mean as to expect it to cost any less than $0.68 cents.

Last edited:

Duke of Marmalade

Registered User

- Messages

- 4,686

And to be fair it makes its bias clear - it is headed The Bullish Case For BitcoinIndeed I do care to provide a source - it's at the very end of the post.

The rest of your post indicates that you might have misinterpreted the thrust of my post - it happens.

I was not seeking your written answers on the subjects - I am well aware of what they would be. I was merely pointing out that some very important subjects were omitted from the exam.

I see now that the bias was unashamedly upfronted in the source though there may be others like me who would have missed this key point in your post.

Hilarious! This is your critique of the guy's analysis? Bravo! If that's the best you can muster. If you were approaching this discussion with any objectivity, you'd go through his analysis and critique it. I guess you're not capable of that.And to be fair it makes its bias clear - it is headed The Bullish Case For Bitcoin

You want to silence me? Eh, no - respectfully - no. And anyone shouldn't want that. Anyone should be able to walk away from a public discussion having seen all facets and sides to it - and go away and make up their own mind.The rest of your post indicates that you might have misinterpreted the thrust of my post - it happens. I was not seeking your written answers on the subjects - I am well aware of what they would be.

Except - as I pointed out - but it seems you're not happy with - he has addressed them in his analysis. Please read it and go through it.I was merely pointing out that some very important subjects were omitted from the exam.

Hilarious! The guy carried out his analysis and that's his take away. If you truly believe in discussion (rather than trying to lord it over someone with your smart alec comments), then you'd go through his analysis and point out the inaccuracies (if that's what you believe).I see now that the bias was unashamedly upfronted in the source though there may be others like me who would have missed this key point in your post.

Duke of Marmalade

Registered User

- Messages

- 4,686

I was pointing out that the graphic was misleading, very misleading in its glaring omissions. I don't think that is smart alicky.

I will as you recommend read the source, though I cannot in any way pretend to do so with an open mind on the subject no more than I would have an open mind on an article with a headline proclaiming evidence of the existence of the tooth fairy.

I will as you recommend read the source, though I cannot in any way pretend to do so with an open mind on the subject no more than I would have an open mind on an article with a headline proclaiming evidence of the existence of the tooth fairy.

As a store of value, it doesn't have glaring omissions. The items you brought up refer to day to day currency use - and as I informed you, he covers those items in the study itself. The graphic is not a stand alone item. It comes part and parcel with his analysis.I was pointing out that the graphic was misleading, very misleading in its glaring omissions.

If you have a genuine interest in discussing the topic, then that's very much within your ability. You may however choose not to - that's a personal decision.I will as you recommend read the source, though I cannot in any way pretend to do so with an open mind on the subject no more than I would have an open mind on an article with a headline proclaiming evidence of the existence of the tooth fairy.

Essentially, what you are saying is that you don't like the conclusion that he had arrived at. If he had arrived at the conclusion that digital assets and currencies are rubbish, then you wouldn't even bring this up. If you find deficiencies in his work and his analysis - kindly point them out. Disprove his thesis - have at it. As it stands right now, what you came up with - they're items that he covers in the analysis. They're items largely that implicate a day to day transactional currency as opposed to a store of value (which his graphic specifically addresses).

That old chestnut hasn't been rolled out since 2017 and the 'blockchain not bitcoin' mantra from the banks. Tell me this - how long did 'tulipmania' last? And for bonus points, how do tulips score in terms of the fundamental characteristics of a good store of value below?Based on this thread I think I'm going to buy a load of tulip bulps from the Dutch as an investment in these uncertain times.

An oil futures contract around about now would be perfect for you. How about some crisp Iranian Rials?

Mischaracterise to your hearts content.

Last edited:

Duke of Marmalade

Registered User

- Messages

- 4,686

Better than bitcoin for sure. But how are you going to store them?Based on this thread I think I'm going to buy a load of tulip bulps from the Dutch as an investment in these uncertain times.

Well you know me and my preferences, I’m heading for more bricks and mortar when the recession kicks in. Ups and downs and still property stands.Better than bitcoin for sure. But how are you going to store them?

If I were O’Leary even an oil futures contract, however tempting, is no good when faced with grounded planes for a future of no determinate length.That old chestnut hasn't been rolled out since 2017 and the 'blockchain not bitcoin' mantra from the banks. Tell me this - how long did 'tulipmania' last? And for bonus points, how do tulips score in terms of the fundamental characteristics of a good store of value below?

An oil futures contract around about now would be perfect for you. How about some crisp Iranian Rials?

Mischaracterise to your hearts content.

I’ve no skin in the Bitcoin game/pyramid/word that would be unacceptable/trend/sure thing/investment. But you clearly do.

I guess the irony was lost on you but as a rebuttal to your 'tulipmania' jibe, a reminder to people here that the world changes. When was the last time an otherwise solid asset class not only goes to zero but goes well beyond zero.If I were O’Leary even an oil futures contract, however tempting, is no good when faced with grounded planes for a future of no determinate length.

Another one with the tar and feathers out with your 'pyramid' and 'sure thing' reference. I mean, it's far easier to go with snide remarks than to actually elaborate and demonstrate/prove your point (if you even have one). Your 'pyramid' reference is just as empty as your 'tulipmania' reference - but believe that if you want to. Everyone can make up their own minds.I’ve no skin in the Bitcoin game/pyramid/word that would be unacceptable/trend/sure thing/investment.

If by that you mean do I think that blockchain technology and cryptocurrencies (in some cases - in conjunction with the emergence of AI/5G/IoT) - can be a positive development for society, I most certainly do.But you clearly do.

If that 'skin in the game' refers to my firm belief that whilst the current monetary system served its purpose during its era but that we can do better for the benefit of society as a whole, then you better believe it. And by that I mean that cryptocurrency can provide a means for ordinary people to retain their wealth in the event that a central bank screws up (which sooner or later they invariably always do).

If on the back of that, you are trying to identify some issue in my contributions here if I believe that and also hold BTC (which I do), then I don't see that as a disqualifier in any way. shape or form. Why would it? You think if I was to have some sort of affect on people's view of bitcoin here, that's going to matter a jot from an investment point of view? Bitcoin is a globally accessible digital asset, with a $160 billion + market capitalisation. I also hold a number of other cryptocurrencies (which don't have a digital gold/money use case) which I've never mentioned here. I mean, I'm really doing a remarkable job of shilling those here, right? (if that's the inference).

But I'm not the only one here with 'skin in the game'. The early proponents of bitcoin are often disliked (and bitcoin along with them) by some as they hold the opposite socio-political view. Committed statists who are fundamentally against a plan b for oftentimes inequitably run FIAT currencies. That's another form of skin in the game. I couldn't care less if they change their opinion. These are our very own fax machine people.

Everyone else can make up their own minds but for me, bitcoin is the native digital currency of the internet and the people's money.

Last edited:

Duke of Marmalade

Registered User

- Messages

- 4,686

Boss you may have found the missing link Satoshi was desperate for. If you do launch a new coin tethered to your poetry you will have to undertake to halve your creativity every so often.My poetry is scarce.

Brendan

Duke of Marmalade

Registered User

- Messages

- 4,686

So I have read Mr Boyapati's promo of bitcoin.

"Bitcoins are not backed by any physical commodity, nor are they guaranteed by any government or company, which raises the obvious question for a new bitcoin investor: why do they have any value at all? " Indeed. And it is the question that I ask. But the question doesn't even appear on the exam paper! In fact there are two key questions here, intrinsic value and government backing. Bitcoin would of course have scored an F on both and maybe for bitcoin enthusiasts those would be good scores on these questions.

Having looked at the exam paper again I think I would probably agree with the allotted scores but as I have repeatedly said I agree with the mainstream view that since it is tethered to nothing that is a fatal flaw.

It is like applying for a STEM course and handing in your Leaving Cert and the university asks "where are your maths resuts?". Oh, I'm hopeless at maths, didn't bother sitting that exam.

I don't think I could have put it better myself. "each market participant values the good based on their appraisal of whether and how much other participants will value it" exactly as Mr Fax Machine and the vast majority of mainstream economists have argued. It is pure speculation as to what the other speculators will speculate - a game. As soon as the satoshi drops that it is a BOHA it goes to zero, a risk that even the enthusiasts admit exists.Vijay Boyapati said:Bitcoins are not backed by any physical commodity, nor are they guaranteed by any government or company, which raises the obvious question for a new bitcoin investor: why do they have any value at all? Unlike stocks, bonds, real-estate or even commodities such as oil and wheat, bitcoins cannot be valued using standard discounted cash flow analysis or by demand for their use in the production of higher order goods. Bitcoins fall into an entirely different category of goods, known as monetary goods, whose value is set game-theoretically. I.e., each market participant values the good based on their appraisal of whether and how much other participants will value it.

"Bitcoins are not backed by any physical commodity, nor are they guaranteed by any government or company, which raises the obvious question for a new bitcoin investor: why do they have any value at all? " Indeed. And it is the question that I ask. But the question doesn't even appear on the exam paper! In fact there are two key questions here, intrinsic value and government backing. Bitcoin would of course have scored an F on both and maybe for bitcoin enthusiasts those would be good scores on these questions.

Having looked at the exam paper again I think I would probably agree with the allotted scores but as I have repeatedly said I agree with the mainstream view that since it is tethered to nothing that is a fatal flaw.

It is like applying for a STEM course and handing in your Leaving Cert and the university asks "where are your maths resuts?". Oh, I'm hopeless at maths, didn't bother sitting that exam.

The Boss' poetry is scarce. That is not trying to be smart alicky but it is my riposte to your Mr Fax Machine riff.Vijay said:Scarcity is perhaps the most important attribute of a store of value as it taps into the innate human desire to collect that which is rare. It is the source of the original value of the store of value.

Last edited:

To your second point, the longer this goes on, the harder it becomes to snuff out bitcoin and cryptocurrencies.

I think there's a risk that the pandemic is accelerating the move away from cash to contactless payments and centralised digital currencies like China are rolling out. Such moves may make it more difficult to cash out of cryptos, as you still can't really use them to buy stuff, any significant increase in restrictions on cashing out could lead to a collapse.

Duke of Marmalade

Registered User

- Messages

- 4,686

tecate you are wont to roll out Lebanon, Venezuela, Zimbabwe etc. in your demonisation of FIAT. Let me pose a similar question. Do you think an official police force is good for society? Of course, you may say no - there are those in the bitcoin community who appear to be of an anarchist persuasion. In which case ignore the rest of this post.

So if you have reached thus far I take it that you do think an official police force is a good, nay necessary, thing in a modern society. But it is very clearly open to abuse. Indeed one can cite many instances where it has been grossly abused; interestingly the Venn intersection of these instances with your own FIAT rogues' gallery is far from the empty set.

By analogy I put it to you that a well functioning FIAT currency can be very beneficial, nay necessary, for society and the fact that it is open to abuse and has indeed been abused should not mean that we should abandon it.

So if you have reached thus far I take it that you do think an official police force is a good, nay necessary, thing in a modern society. But it is very clearly open to abuse. Indeed one can cite many instances where it has been grossly abused; interestingly the Venn intersection of these instances with your own FIAT rogues' gallery is far from the empty set.

By analogy I put it to you that a well functioning FIAT currency can be very beneficial, nay necessary, for society and the fact that it is open to abuse and has indeed been abused should not mean that we should abandon it.

BTW I love your chart. Hands up I've no clue what it means. But I do know what real money is. What is funible? And is Fiat cars or something else? I suppose now that's probably a very stupid question.That old chestnut hasn't been rolled out since 2017 and the 'blockchain not bitcoin' mantra from the banks. Tell me this - how long did 'tulipmania' last? And for bonus points, how do tulips score in terms of the fundamental characteristics of a good store of value below?

An oil futures contract around about now would be perfect for you. How about some crisp Iranian Rials?

Mischaracterise to your hearts content.