Hi

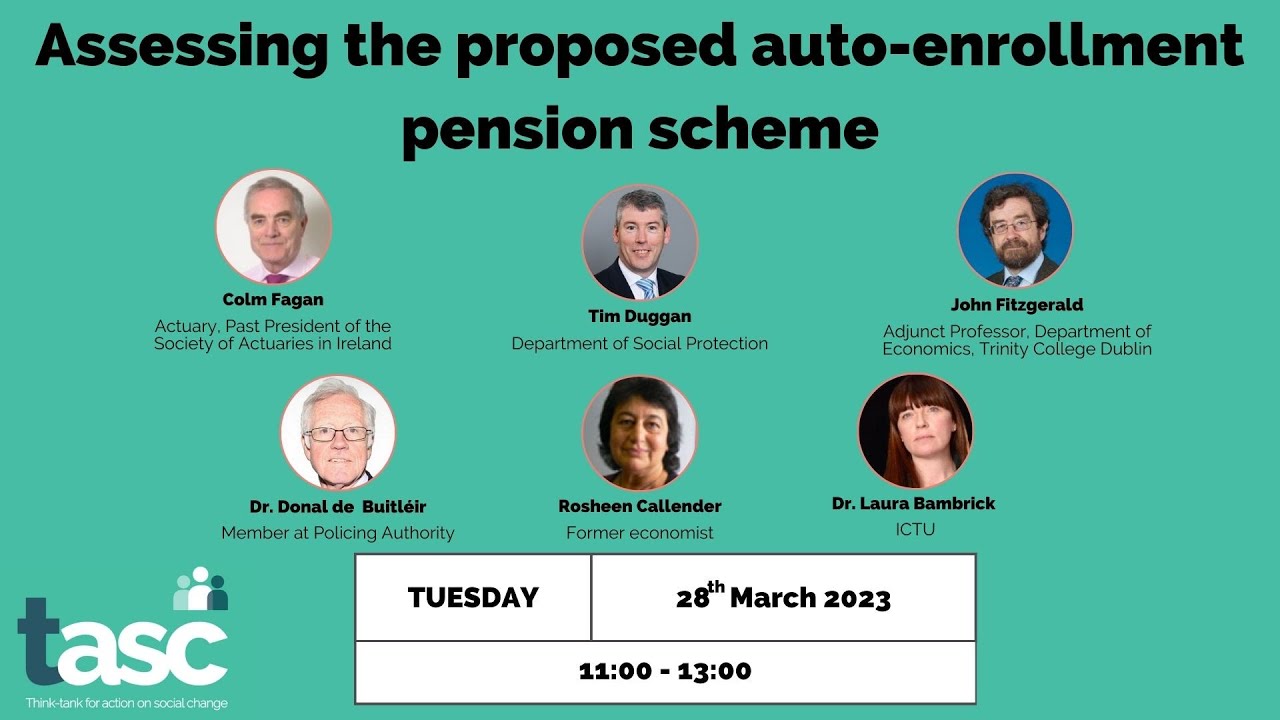

@Brendan Burgess . Thanks for that. You can add that my presentation starts at 54:00 and your contribution at 1:35:45.

You made a valid point in your contribution that some of the detail of AE can be finalised at a later stage, but a decision is required at the very start on the smoothed approach.

Unfortunately, Tim Duggan didn't answer your question, only the semi-related one of whether in-scheme drawdown would be in place by the time people retire.

He claimed that future innovation would make everything right. In my presentation

(slides 9, 10 11), I likened that to designing a car without brakes, and saying that brakes would be in place by the time it came to stopping the car.

The current discussion (mainly on this forum) on the flaws in lifestyle investing (at the heart of the DSP's proposed approach) shows how right I was to highlight the impossibility of welding a post-retirement solution to a pre-retirement product.

To recap, the "lifestyling" approach of shifting members' funds to 75% bonds and 25% cash by retirement works wonderfully if they're going to apply 75% to buy an annuity, taking a 25% cash lump sum, but it's a disaster at times like this, when interest rates have risen sharply over a short period, if the member wants to do something different. I was alerted recently to a case of someone who was defaulted into this type of fund a year before retirement and lost over 20% due to the sharp rise in bond yields and the resulting fall in value.

That just couldn't happen with the smoothed approach.