You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

KBC Summary of the KBC Cohorts

- Thread starter Trustnobody

- Start date

Thanks Peemac, this would be more evidence that they should have defined exactly what the roll off rate was for fixed rate customers in their mortgage contracts, Lenders prevailing variable rate could be anything. Also wonder why did they not publish their tracker rate only the 12month Discount Tracker >150K, or is this not a comprehensive list?

Gimmestrength

Registered User

- Messages

- 44

Thanks Peemac... what would be even more interesting to find out is the products being actively sold in 05, 06, 07.

Agree with John... how these rates were defined in contracts would give a fuller picture. Suspect the definitions were far from clear

Agree with John... how these rates were defined in contracts would give a fuller picture. Suspect the definitions were far from clear

The problem is that IIB never defined clearly what the prevailing variable rate was. In the Handbook that was published in May 07, The prevailing variable rate was never mentioned once or defined like all the other rates that were available to the customer. Every other rate opinion was clearly defined.how these rates were defined in contracts would give a fuller picture. Suspect the definitions were far from clear

The prevailing variable rate could of been any of the rates products that IIB were offering at the time.

Customers that were given the same handbook as me, with the list of different types of rate products that were available to them, which included the tracker options,must have a strong case going to the Ombudsman. Will the information in the handbook not hold any power against KBC?

Gimmestrength

Registered User

- Messages

- 44

If the flyer can then the handbook can too. The inclusion of the flyer cohort was an arbitrary decision by the bank and we know they arbitrarily decided on cut off dates on this leaving people with the same contract and expectation either impacted or not impacted... which is unfair and against the spirit of the tracker review framework

Gimmestrength

Registered User

- Messages

- 44

I have done some trawling and found this from the Irish Times Friday business supplement in August 2005 - it seems to have been a weekly feature. It lists rates (source: IFSRA/Central Bank) under rate type (SVR, tracker etc). It doesn't list IIB under SVR. This of course, in itself, is not conclusive proof of anything but adds to the overall picture of what was/wasn't available or being pushed by the bank at a particular time

Attachments

Daisy duke

Registered User

- Messages

- 66

What are people’s thoughts on how KBC handled Top Up’s during the flyer period?. My main mortgage was drawn down in Dec 06 and deemed not impacted as my application date was prior to Nov 06 and the release of the flyer. I drew down on 3 yr fixed to roll off to “lenders prevailing rate”. I took out a Top Up in Sept 07, this too has been deemed not impacted and KBC will not give me a definitive answer as to why. Contracts for both my main mortgage and Top Up are identical in that they roll off to prevailing rate. In my mind the Top Up should have given me the option of a tracker as this was clearly in scope of the flyer dates. Any thoughts?

Gimmestrength

Registered User

- Messages

- 44

What are people’s thoughts on how KBC handled Top Up’s during the flyer period?. My main mortgage was drawn down in Dec 06 and deemed not impacted as my application date was prior to Nov 06 and the release of the flyer. I drew down on 3 yr fixed to roll off to “lenders prevailing rate”. I took out a Top Up in Sept 07, this too has been deemed not impacted and KBC will not give me a definitive answer as to why. Contracts for both my main mortgage and Top Up are identical in that they roll off to prevailing rate. In my mind the Top Up should have given me the option of a tracker as this was clearly in scope of the flyer dates. Any thoughts?

Hi Daisy Duke as I understand it the flyer applied to new business only which would explain why the top ups are deemed not impacted. However have a good look at your contracts and the special conditions and also get Padraic Kissane to have a look. He is the world expert in this stuff and will give you an independent expert view on whether you he feels you have a case or not.

One thing is for sure do not take the bank's word that you are not impacted.... that has been their default position on many cases that later turned out to be impacted. They have been dragged through this process kicking and screaming and continue to prevaricate

Hi Peemac,

The the term SVR is on our letter, for a buy to let.

This strengthens the case for the "prevailing variable rate" cohort imo. No ambiguity when svr is specified! Considerable ambiguity when the "prevailing variable rate" is specified , and even more so taken in the context of the Framework document and the Consumer Protection Code. Frankly, all things considered, I'm struggling to see how anyone can argue that the "prevailing variable rate" cohort shouldn't have been offered a tracker rate after coming off a fixed rate !

unfortunate

Registered User

- Messages

- 142

Has anyone, on any side, anywhere come across anything concrete, written or recorded that says that SVR is or isn't the PVR. No one, including IIB/KBC, seems to be able to definitively prove one way or the other what's what, and it all goes in circles. Surely there's a definition somewhere........ as everything else in contracts or T&Cs is defined within an inch of its life!!!???

Hi all not sure if this is tight thread but I’ve been offered redress with KBC on the following -

Loan 1 - investment property 1.5% above Euribor taken out in 2007

Loan 2 - commercial loan 1.2% above Euribor also take out in 2007

Both loans originally take out with IIB and have been fully performing and subsequently sold to Beltany in Dec 2018

After loans were sold I noticed that the rates and margin did not tally over last few years as Euribor has been negative & KBC had been charging 0 + Margin on both loans.

I complained and over 8 weeks they eventually conceded that the rates charged were not correct - not in their view but due to the fact that my solicitor and the banks solicitors had correspondence in 2010 whereby Euribor was mentioned.

They have aggregated that 3000€ and 26000€ was overcharged based on this premise and they offered 60€ and 500€ compensation on top of the redress.

I’m not sure but I would feel this is a bit paltry? Maybe I’m being a bit disingenuous as they were not home loans but the amount of stress involved in dealing with the Bank has been considerable especially as both performing loans were sold off to Beltany.

Maybe this standard redress?

Loan 1 - investment property 1.5% above Euribor taken out in 2007

Loan 2 - commercial loan 1.2% above Euribor also take out in 2007

Both loans originally take out with IIB and have been fully performing and subsequently sold to Beltany in Dec 2018

After loans were sold I noticed that the rates and margin did not tally over last few years as Euribor has been negative & KBC had been charging 0 + Margin on both loans.

I complained and over 8 weeks they eventually conceded that the rates charged were not correct - not in their view but due to the fact that my solicitor and the banks solicitors had correspondence in 2010 whereby Euribor was mentioned.

They have aggregated that 3000€ and 26000€ was overcharged based on this premise and they offered 60€ and 500€ compensation on top of the redress.

I’m not sure but I would feel this is a bit paltry? Maybe I’m being a bit disingenuous as they were not home loans but the amount of stress involved in dealing with the Bank has been considerable especially as both performing loans were sold off to Beltany.

Maybe this standard redress?

Bitthedust

Registered User

- Messages

- 7

Hi there,Just remembered that the Irish times published mortgage interest rates every week in their property supplement right through the early to late 2000's

If you have a subscription you'll be able to access the archive.

You can also join national library of Ireland and can read back issues on site there.(microfiche)

Gimmestrength

Registered User

- Messages

- 44

Yes the IT published them in their business supplement every Friday in a feature called PriceWatch Finance. The figures were provided by IFSRA (central bank) so very reliable

Hi All,

I have been watching for quite some time now everything to do with redress from KBC and thought I would share our situation.

We took out a mortgage with KBC in 2005 and somehow or other none of the boxes were ticked by us stating what type of mortgage we wanted.This was only brought to our attention within the past month.

Our Loan Offer letter stated Interest Rate 3.45 Variable.

Currently our queries relate to why we were never informed of the material fact that we had not been informed there was no preference given by us and also on who decided to put us on 3.45 Variable if not us.

Only last November I was emailed stating that a tracker was available to us in 2005 but this was not our preferred rate at that time which is completely at odds with the latest email which stated the application was received by them with no chosen rate and was drawn down in March 2005 on the standard variable rate as per the signed letter of offer.

But nowhere does it state SVR on the Offer Letter, just Interest Rate 3.45% Variable.

An internal fax states please issue the following loan offer.Details as follows.

Loan Type: Repayment

Interest Only:No

Interest Rate:%..that is correct..no percentage inserted.

Rate Type: Discount..what does this mean???

Currently going through the motions.

Any thoughts??

Regards,

Prudent1

I have been watching for quite some time now everything to do with redress from KBC and thought I would share our situation.

We took out a mortgage with KBC in 2005 and somehow or other none of the boxes were ticked by us stating what type of mortgage we wanted.This was only brought to our attention within the past month.

Our Loan Offer letter stated Interest Rate 3.45 Variable.

Currently our queries relate to why we were never informed of the material fact that we had not been informed there was no preference given by us and also on who decided to put us on 3.45 Variable if not us.

Only last November I was emailed stating that a tracker was available to us in 2005 but this was not our preferred rate at that time which is completely at odds with the latest email which stated the application was received by them with no chosen rate and was drawn down in March 2005 on the standard variable rate as per the signed letter of offer.

But nowhere does it state SVR on the Offer Letter, just Interest Rate 3.45% Variable.

An internal fax states please issue the following loan offer.Details as follows.

Loan Type: Repayment

Interest Only:No

Interest Rate:%..that is correct..no percentage inserted.

Rate Type: Discount..what does this mean???

Currently going through the motions.

Any thoughts??

Regards,

Prudent1

Hi Prudent1,

By any chance were you given a handbook w that explained what products were available to you when you took out the mortgage?.

If you think you have a case contact P.kissane and for around 180 euro including vat, he will tell you if u have a case or not.

By any chance were you given a handbook w that explained what products were available to you when you took out the mortgage?.

If you think you have a case contact P.kissane and for around 180 euro including vat, he will tell you if u have a case or not.

This might help, From the wayback machine.Log onto

IIB Homeloans Mortgage Rates

last updated : 1/12/2004

Homeloans - New Business Rates

APR CPT

over

20 Yrs CPT

over

25 Yrs

Variable 3.5 5.77 4.98

Discount Variable (12 months) new 3.4 5.39 4.58

Discount Variable (24 months) new 3.4 5.54 4.74

Tracker upto 92% LTV, under EUR250k 3.32 5.67 4.87

Tracker upto 92% LTV, over EUR250k 3.17 5.6 4.79

1yr Fixed (New Business) 3.4 5.39 4.58

2yr Fixed 3.55 5.83 5.03

3yr Fixed 3.67 6 5.22

5yr Fixed 3.97 6.27 5.5

RIPs - New Business Rates

APR CPT

over

20 Yrs CPT

over

25 Yrs

Variable 3.7 5.85 5.05

1yr Fixed>80% 3.59 5.59 4.79

1yr Fixed<80% 3.57 5.49 4.69

2yr Fixed 3.77 5.95 5.16

3yr Fixed 3.92 6.16 5.38

5yr Fixed 4.13 6.27 5.5

EUR250k LTV <80% 3.3 5.67 4.87

EUR250k LTV >80% 3.4 5.72 4.93

EUR500k LTV <80% 3.17 5.6 4.79

Homeloans: Credit will be based on a multiple of salary. Maximum loan to value 90%. The cost per month of €100,000, 20 year variable rate mortgage at APR 3.5% is €577.00.

Please note: For first time buyers loan to value (LTV) is 92%

Warning: Your home may be at risk if you do not keep up repayments on a mortgage or on any other loan secured on it. Terms and conditions apply. Security and insurance required.

Note: The above rates are provided for guidance purposes only and do not form part of any legal contract or understanding. No legally binding loan agreement shall come into existence until such time as a formal loan offer letter (which includes IIB Homeloans standard terms and conditions) has been signed by both the customer and IIB Homeloans.

IIB Homeloans Mortgage Rates

last updated : 1/12/2004

Homeloans - New Business Rates

APR CPT

over

20 Yrs CPT

over

25 Yrs

Variable 3.5 5.77 4.98

Discount Variable (12 months) new 3.4 5.39 4.58

Discount Variable (24 months) new 3.4 5.54 4.74

Tracker upto 92% LTV, under EUR250k 3.32 5.67 4.87

Tracker upto 92% LTV, over EUR250k 3.17 5.6 4.79

1yr Fixed (New Business) 3.4 5.39 4.58

2yr Fixed 3.55 5.83 5.03

3yr Fixed 3.67 6 5.22

5yr Fixed 3.97 6.27 5.5

RIPs - New Business Rates

APR CPT

over

20 Yrs CPT

over

25 Yrs

Variable 3.7 5.85 5.05

1yr Fixed>80% 3.59 5.59 4.79

1yr Fixed<80% 3.57 5.49 4.69

2yr Fixed 3.77 5.95 5.16

3yr Fixed 3.92 6.16 5.38

5yr Fixed 4.13 6.27 5.5

EUR250k LTV <80% 3.3 5.67 4.87

EUR250k LTV >80% 3.4 5.72 4.93

EUR500k LTV <80% 3.17 5.6 4.79

Homeloans: Credit will be based on a multiple of salary. Maximum loan to value 90%. The cost per month of €100,000, 20 year variable rate mortgage at APR 3.5% is €577.00.

Please note: For first time buyers loan to value (LTV) is 92%

Warning: Your home may be at risk if you do not keep up repayments on a mortgage or on any other loan secured on it. Terms and conditions apply. Security and insurance required.

Note: The above rates are provided for guidance purposes only and do not form part of any legal contract or understanding. No legally binding loan agreement shall come into existence until such time as a formal loan offer letter (which includes IIB Homeloans standard terms and conditions) has been signed by both the customer and IIB Homeloans.

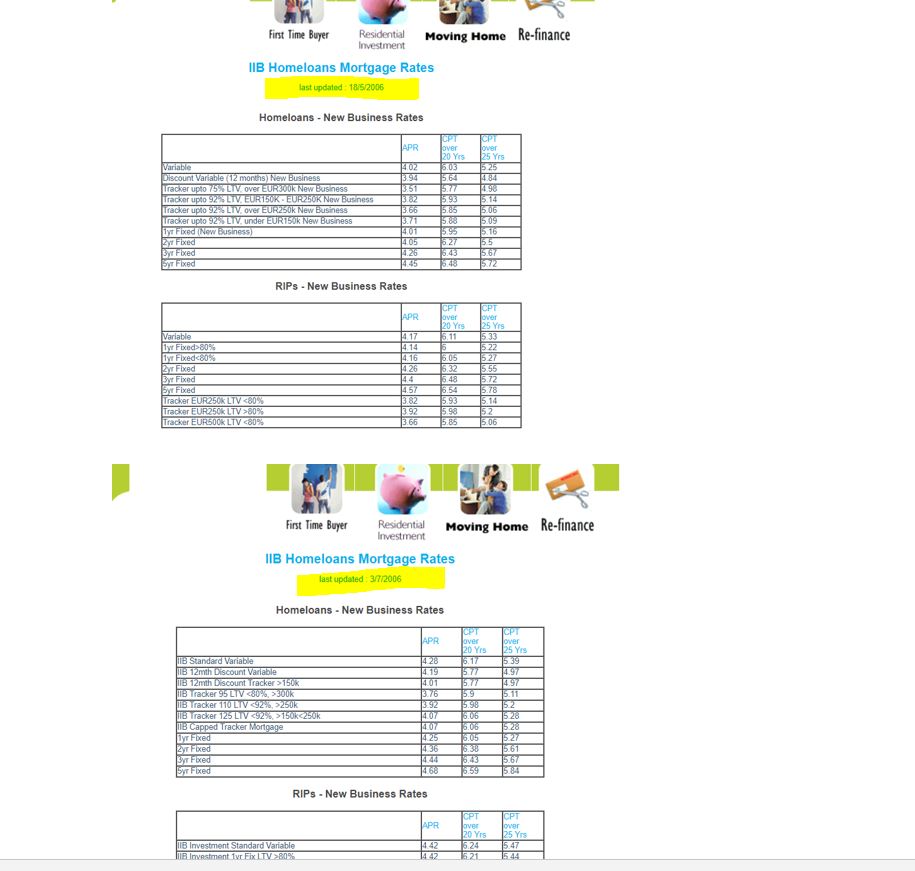

And Again from 2006 standard variable rate of 3.45%mentioned but none of the rates are actually 3.45% therefore they could hardly be called SVR if they arent I should think.

https://web.archive.org/web/2006052...ates/?paraID=-1&MainMenuID=140&SubMenuID=-999

IIB Homeloans Mortgage Rates

last updated : 18/5/2006

Homeloans - New Business Rates

APR CPT

over

20 Yrs CPT

over

25 Yrs

Variable 4.02 6.03 5.25

Discount Variable (12 months) New Business 3.94 5.64 4.84

Tracker upto 75% LTV, over EUR300k New Business 3.51 5.77 4.98

Tracker upto 92% LTV, EUR150K - EUR250K New Business 3.82 5.93 5.14

Tracker upto 92% LTV, over EUR250k New Business 3.66 5.85 5.06

Tracker upto 92% LTV, under EUR150k New Business 3.71 5.88 5.09

1yr Fixed (New Business) 4.01 5.95 5.16

2yr Fixed 4.05 6.27 5.5

3yr Fixed 4.26 6.43 5.67

5yr Fixed 4.45 6.48 5.72

RIPs - New Business Rates

APR CPT

over

20 Yrs CPT

over

25 Yrs

Variable 4.17 6.11 5.33

1yr Fixed>80% 4.14 6 5.22

1yr Fixed<80% 4.16 6.05 5.27

2yr Fixed 4.26 6.32 5.55

3yr Fixed 4.4 6.48 5.72

5yr Fixed 4.57 6.54 5.78

Tracker EUR250k LTV <80% 3.82 5.93 5.14

Tracker EUR250k LTV >80% 3.92 5.98 5.2

Tracker EUR500k LTV <80% 3.66 5.85 5.06

CPT means the "cost per thousand".In order to calculate your monthly repayment,multiply the cpt by the amount borrowed. Example, if you look at the standard variable rate of 3.45%, over 25 years the CPT is €4.98. eg €4.98 * 200k borrowed equals monthly repayment of €996. Therefore once you know what the CPT is you can easily calculate your monthly repayment.

Homeloans: Credit will be based on a multiple of salary. Maximum loan to value 90%. The cost per month of €100,000, 20 year variable rate mortgage at APR 3.5% is €577.00.

IIB Homeloans is a subsidiary of IIB Bank. IIB Bank Ltd., is regulated by the Financial Regulator. Terms and conditions apply. Security and insurance is required.

The maximum mortgage is 95% of the property value. As a general rule, loan amounts are subject to monthly repayments not exceeding 30% to 40% of disposable income and will vary according to individual circumstances.

A typical variable mortgage rate of €100,000 over 20 years costs €603.00 per month (APR 4.02%) excluding insurance. The cost of your monthly repayments may increase. A 1% interest rate rise will increase this repayment to €657.00 (APR 5.07%) excluding insurance. This is an increase of €54.00 per month.

Warning: If you do not keep up repayments, you may lose your home. Variable Rate Loans: The Payment Rates on this Housing Loan may be adjusted by the lender. Rates quoted above correct at time of print (March 2006).

Please note: For first time buyers loan to value (LTV) is 92%

Note: The above rates are provided for guidance purposes only and do not form part of any legal contract or understanding. No legally binding loan agreement shall come into existence until such time as a formal loan offer letter (which includes IIB Homeloans standard terms and conditions) has been signed by both the customer and IIB Homeloans.

https://web.archive.org/web/2006052...ates/?paraID=-1&MainMenuID=140&SubMenuID=-999

IIB Homeloans Mortgage Rates

last updated : 18/5/2006

Homeloans - New Business Rates

APR CPT

over

20 Yrs CPT

over

25 Yrs

Variable 4.02 6.03 5.25

Discount Variable (12 months) New Business 3.94 5.64 4.84

Tracker upto 75% LTV, over EUR300k New Business 3.51 5.77 4.98

Tracker upto 92% LTV, EUR150K - EUR250K New Business 3.82 5.93 5.14

Tracker upto 92% LTV, over EUR250k New Business 3.66 5.85 5.06

Tracker upto 92% LTV, under EUR150k New Business 3.71 5.88 5.09

1yr Fixed (New Business) 4.01 5.95 5.16

2yr Fixed 4.05 6.27 5.5

3yr Fixed 4.26 6.43 5.67

5yr Fixed 4.45 6.48 5.72

RIPs - New Business Rates

APR CPT

over

20 Yrs CPT

over

25 Yrs

Variable 4.17 6.11 5.33

1yr Fixed>80% 4.14 6 5.22

1yr Fixed<80% 4.16 6.05 5.27

2yr Fixed 4.26 6.32 5.55

3yr Fixed 4.4 6.48 5.72

5yr Fixed 4.57 6.54 5.78

Tracker EUR250k LTV <80% 3.82 5.93 5.14

Tracker EUR250k LTV >80% 3.92 5.98 5.2

Tracker EUR500k LTV <80% 3.66 5.85 5.06

CPT means the "cost per thousand".In order to calculate your monthly repayment,multiply the cpt by the amount borrowed. Example, if you look at the standard variable rate of 3.45%, over 25 years the CPT is €4.98. eg €4.98 * 200k borrowed equals monthly repayment of €996. Therefore once you know what the CPT is you can easily calculate your monthly repayment.

Homeloans: Credit will be based on a multiple of salary. Maximum loan to value 90%. The cost per month of €100,000, 20 year variable rate mortgage at APR 3.5% is €577.00.

IIB Homeloans is a subsidiary of IIB Bank. IIB Bank Ltd., is regulated by the Financial Regulator. Terms and conditions apply. Security and insurance is required.

The maximum mortgage is 95% of the property value. As a general rule, loan amounts are subject to monthly repayments not exceeding 30% to 40% of disposable income and will vary according to individual circumstances.

A typical variable mortgage rate of €100,000 over 20 years costs €603.00 per month (APR 4.02%) excluding insurance. The cost of your monthly repayments may increase. A 1% interest rate rise will increase this repayment to €657.00 (APR 5.07%) excluding insurance. This is an increase of €54.00 per month.

Warning: If you do not keep up repayments, you may lose your home. Variable Rate Loans: The Payment Rates on this Housing Loan may be adjusted by the lender. Rates quoted above correct at time of print (March 2006).

Please note: For first time buyers loan to value (LTV) is 92%

Note: The above rates are provided for guidance purposes only and do not form part of any legal contract or understanding. No legally binding loan agreement shall come into existence until such time as a formal loan offer letter (which includes IIB Homeloans standard terms and conditions) has been signed by both the customer and IIB Homeloans.

@Prudent1

Above show "apr" which the banks had to show.

It's great for short term loans, but mean little for long term loans that can vary in rates over the loan period.

In mortgages the apr assumes that the rate is constant for the period and is inclusive of costs. A fixed rate apr assumes that the rate returning after the fixed rate is the current variable rate.

Headline rates are the rates advertised and a headline 3.45% mortgage rate would equate to an apr of just over 3.5%. I think paragraph in above post is just showing an example of how to calculate cost.

Above show "apr" which the banks had to show.

It's great for short term loans, but mean little for long term loans that can vary in rates over the loan period.

In mortgages the apr assumes that the rate is constant for the period and is inclusive of costs. A fixed rate apr assumes that the rate returning after the fixed rate is the current variable rate.

Headline rates are the rates advertised and a headline 3.45% mortgage rate would equate to an apr of just over 3.5%. I think paragraph in above post is just showing an example of how to calculate cost.

Thanks Prudent1

I think your search does show when IIB started to use SVR in the Home Loans Mortgage Rates advertising/explanation information on their website. Pre July 3rd 2006 the rate was described as Variable, then update on July 3rd 2006 to SVR. As we have said all along, no mention of SVR in any of our loan documentation for 2005 customers. If they changed/rebranded the rate they should have contacted their customers and explained at that time.

I think your search does show when IIB started to use SVR in the Home Loans Mortgage Rates advertising/explanation information on their website. Pre July 3rd 2006 the rate was described as Variable, then update on July 3rd 2006 to SVR. As we have said all along, no mention of SVR in any of our loan documentation for 2005 customers. If they changed/rebranded the rate they should have contacted their customers and explained at that time.