No matter how many times you say it, it seems that some people don't take heed...Have you completed and sent in the CF83 form?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Key Post Step by step guide to applying for UK State Pension

- Thread starter Brendan Burgess

- Start date

newuser1234

New Member

- Messages

- 3

No, not yet.

That form I referenced was to determine if I was eligible, I did the gov ID checks and then inputted my national insurance number and was told I was eligible. It listed all the gaps years then too.

That form I referenced was to determine if I was eligible, I did the gov ID checks and then inputted my national insurance number and was told I was eligible. It listed all the gaps years then too.

So do that first and do it today, you are running out of time.No, not yet

newuser1234

New Member

- Messages

- 3

Ok, thanks.

Hillwalker123

Registered User

- Messages

- 27

Thanks a million, all doneJust send in the CF83 form; add a cover letter if you wish. Send by recorded delivery

A family member filled in the CF83 last year and was told they will have to pay Class 3 contributions for the 18 back years. They put the decision on the long finger but would like to pay the figure now. Have they only until the 5th April to find the money and make the payment or can they pay after the 5th April as the CF83 has already been processed? Thanks folks.

Yes, but check the payment dates on the letter they were sent. There are penalties for late payment.can they pay after the 5th April

Key Post - Deadline 5th April 2025

UPDATE : You have four days. Don't delay. If you have an NI number, fill in the CF83 and send by recorded delivery. If you can't find your NI number, take a day off work and drive to Newry / Enniskillen / Derry, and go in person to the office there. Bring all your ID stuff. UPDATE: worst...

www.askaboutmoney.com

Annieindublin

Registered User

- Messages

- 540

Apply and let them decide?

Key Post - Deadline 5th April 2025

UPDATE : You have four days. Don't delay. If you have an NI number, fill in the CF83 and send by recorded delivery. If you can't find your NI number, take a day off work and drive to Newry / Enniskillen / Derry, and go in person to the office there. Bring all your ID stuff. UPDATE: worst...

www.askaboutmoney.com

Just a hint for anyone completing a last minute CF83 online.

I spend ages trying to find this on their website today for a friend and eventually got there .

Go to this link: https://www.tax.service.gov.uk/guidance/apply-to-pay-ni-contributions-abroad/start/about-this-form

Click Continue

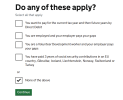

Then from here, Click None of the above:

And then it gives you the option to apply online, after which you can log in with your government gateway ID

They really made it hard to find this ..

I spend ages trying to find this on their website today for a friend and eventually got there .

Go to this link: https://www.tax.service.gov.uk/guidance/apply-to-pay-ni-contributions-abroad/start/about-this-form

Click Continue

Then from here, Click None of the above:

And then it gives you the option to apply online, after which you can log in with your government gateway ID

They really made it hard to find this ..

Attachments

I believe that this question is purely related to this specific issue :hi filling out CF83 form online and just wondering wha tthe right answer to the question "Telling us how HMRC error affected you" thanks in advance for any info

"Between November 2017 and April 2019, HMRC’s guidance was incorrect. If you did not apply or your application was refused because of the incorrect guidance, you may be able to pay at the original rates. You can provide details if you think you may have been affected."

It is - hence my question.question is purely related to this specific issue :

Yes or No to Question about "Telling us how HMRC error affected you" I left UK in 1996 with 3 years emplyment and have been working in Ireland since, just wondering if theres any advantage to ticking the box and claim I didnt apply 2017-2019 due to incorrect guidance

None.any advantage to ticking the box and claim I didnt apply 2017-2019 due to incorrect guidance