A friend in US has 440 cons before emigrating in mid 90s.She is wondering if US cons can be used to reach 520 treshold for minimum pension.She has been told yes and no by DSP. Would anyone know if after using US cons to get US pension, these same US cons can then be used to get pro rata contributory here. Would seem kinda generous but latest from Sligo is that this is how it currently works ie. get your US pension and then use US cons to get over 520 threshold, and qualify for small pro rata Irish pension.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

State pension averaging rules implication on pension amount at retirement age

- Thread starter Chewbacca

- Start date

Most countries have a threshold somewhere between 1 and 15 years. Ireland is not unusual in that matter.You're right actually come to think of it. I think I've been looking through the wrong end of the telescope, so to speak.

A more pertinent question might be to ask how it arose that people could get more than their total contributions would entitle them to.

A system that unfairly benefits some people makes those treated fairly feel like victims.

Worse, the 520 contributions threshold is utterly egregious

Capital punishment was not unusual once eitherMost countries have a threshold somewhere between 1 and 15 years. Ireland is not unusual in that matter.

They should at the very least refund the contributions adjusted for inflation and interest.

You're right actually come to think of it. I think I've been looking through the wrong end of the telescope, so to speak.

A more pertinent question might be to ask how it arose that people could get more than their total contributions would entitle them to.

A system that unfairly benefits some people makes those treated fairly feel like victims.

Worse, the 520 contributions threshold is utterly egregious

Their scheme, their rules. If you want them changed, then talk to your local TD! [You'll probably find that opposition TDs will listen more sympathetically!]

Bear in mind too, that Ireland's most generous Socialist, Mary Lou McBountiful has PROMISED to revert the State Pension Age to 65 as soon as she takes power; adding that "I don't really understand demographics, but they can look after themselves."

Last edited:

PRSI contributions go to cover more than the State Pension. So "refunding" any portion related to the State Pension is entirely impractical.Capital punishment was not unusual once either

They should at the very least refund the contributions adjusted for inflation and interest.

They should at the very least refund the contributions adjusted for inflation and interest.

If you wrote to DSP and offered to waive your State Contributory Pension entitlement in exchange for having your lifetime PRSI contributions refunded, either (a) their actuary would have a heart attack; or (b) they'd bite your hand off and promptly agree!

Hope it’s ok to just jump in here? This thread has caught my eye.

I won’t reach SPA for c17 years. So will the three years’ summer months I worked ages 16 to 18 (stamped), be included and my contributions averaged over 50 years? Even though I then had a break in PRSI payments while studying for 4/5 years.

If so, this is actually criminal!

I won’t reach SPA for c17 years. So will the three years’ summer months I worked ages 16 to 18 (stamped), be included and my contributions averaged over 50 years? Even though I then had a break in PRSI payments while studying for 4/5 years.

If so, this is actually criminal!

Some countries like Germany do that. You get a refund of all your contributions if you have not reached the required 5 years minimum. You must apply before you reach German pension age. It will be too late afterwards.Capital punishment was not unusual once either

They should at the very least refund the contributions adjusted for inflation and interest.

No averaging for you. Those summer jobs won't change anything for you. Your pension will be fully under TCA. All what will matter is how many contributions ( and a certain number of credits) you have accrued by the time you reach pension age.Hope it’s ok to just jump in here? This thread has caught my eye.

I won’t reach SPA for c17 years. So will the three years’ summer months I worked ages 16 to 18 (stamped), be included and my contributions averaged over 50 years? Even though I then had a break in PRSI payments while studying for 4/5 years.

If so, this is actually criminal!

The vagaries of the Irish State Pension would make it a suitable choice for a Mastermind specialist subject.No averaging for you. Those summer jobs won't change anything for you. Your pension will be fully under TCA. All what will matter is how many contributions ( and a certain number of credits) you have accrued by the time you reach pension age.

And the Jobseekers Benefit and 65s Benefit rules could be your second scecialistThe vagaries of the Irish State Pension would make it a suitable choice for a Mastermind specialist subject.

subject when you sail through the first round.

yes but most countries have that as an absolute minimum to qualify for a basic proportion of the full state pension, in Uk that would only entitle you to £60 per week but in Ireland some people can qualify for a full state pension or a very high proportion of it with just that bare minimum of contributionsMost countries have a threshold somewhere between 1 and 15 years. Ireland is not unusual in that matter.

but when and why was the average contribution system ever introduced, the poor impoversished country that existed up the 1980s could never have afforded such a system, even people that don't qualify for a full state pension are still being very generously dealt with getting a far higher pension than their contributions warranted.

I don't know when the averageing was introduced.

I have been following State Pension for twnety years at least, and it has always been there.

It can favour people with patchy SI records, which applied to many people in 1950s/60s/70s/80s Ireland.

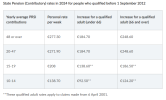

See the table attached. Even if your average was as low as 20 weeks pa, you got practically the full pension!!

I've heard two people praising a now deceased former taoiseach who helped relatives of theirs to get pensions, somehow.I don't know when the averageing was introduced.

I have been following State Pension for twnety years at least, and it has always been there.

It can favour people with patchy SI records, which applied to many people in 1950s/60s/70s/80s Ireland.

See the table attached. Even if your average was as low as 20 weeks pa, you got practically the full pension!!

View attachment 9340

I've heard two people praising a now deceased former taoiseach who helped relatives of theirs to get pensions, somehow.

Thing about that is, most of the people who praise politicians (alive, dead or zombie) for getting them "something", haven't a clue whether or not they were entitled to get that "something" in the first place!

It's called clientelism and Ireland is still riddled with it.

Id say that is close to it alright, we all know that pensions are highly political in ireland, it was probably cobbled together as a system in order to get as many people as possible into the system and an adequate pension. That would guarantee a strong pro government voting base. Sure even now we see Michael Martin flying kites for 20 euro increase in state pension even though the sustainability of this into the future is questionable, the workers of today paying taxes for all this wont qualify for such a generous state pension ( generous in terms of allowing so many people get close to a full pension without the corresponding contributions)It can favour people with patchy SI records, which applied to many people in 1950s/60s/70s/80s Ireland.

I send this question to DSP

"I asked in a previous email.

If after applying can a person cancel their pension application if the calculated pension is not at the level they were expecting ?

You replied

A pension cannot be deferred once it goes into payment

Does this mean that the person could defer their pension if they canceled their application before they receive their first pension payment.

I have read that this is possible.

If this is the case it would be very useful in the case I have outlined."

The reply to this email was

"Yes you can cancel the drawdown date if it has not gone into payment."

This is presumably a yes to my question.

So the pension can be cancelled before a payment is received.

Anybody close to the next averaging band should opt to collect payments at their local post l office. This way they have total controll over collecting their pension payment.

If they opt for payment into their bank account and the decision letter is delayed in the post they could receive an unwanted pension payment and become locked into a pension lower than they calculated.

"I asked in a previous email.

If after applying can a person cancel their pension application if the calculated pension is not at the level they were expecting ?

You replied

A pension cannot be deferred once it goes into payment

Does this mean that the person could defer their pension if they canceled their application before they receive their first pension payment.

I have read that this is possible.

If this is the case it would be very useful in the case I have outlined."

The reply to this email was

"Yes you can cancel the drawdown date if it has not gone into payment."

This is presumably a yes to my question.

So the pension can be cancelled before a payment is received.

Anybody close to the next averaging band should opt to collect payments at their local post l office. This way they have total controll over collecting their pension payment.

If they opt for payment into their bank account and the decision letter is delayed in the post they could receive an unwanted pension payment and become locked into a pension lower than they calculated.

Last edited:

What we are considering doing, in a situation where DSP cannot or will not clarify the situation regarding my wife's PECs (which could move her into a higher band), is applying to make a year's Voluntary Contributions in the year when she turns 66, but before she applies for the Contributory Pension.

When her application to pay VCs is accepted (as it will be), she will be allowed 12 months to make the payment, however, she won't do so until she has received the letter from DSP informing her what pension band she is in.

If she's in the higher band, then she will simply withdraw the VC application; but if she is placed in the lower band, then she will purchase the additional year and then immediately ask DSP pensions section to re-calculate her yearly average.

It's a bit tedious and really shouldn't be necessary, but DSP's incompetence leaves her without any option.

When her application to pay VCs is accepted (as it will be), she will be allowed 12 months to make the payment, however, she won't do so until she has received the letter from DSP informing her what pension band she is in.

If she's in the higher band, then she will simply withdraw the VC application; but if she is placed in the lower band, then she will purchase the additional year and then immediately ask DSP pensions section to re-calculate her yearly average.

It's a bit tedious and really shouldn't be necessary, but DSP's incompetence leaves her without any option.

The voluntary contributions would not be counted for the year of her 66th birthday.

They only count contributions for the averaging method up to the last complete tax year before the pension is started.

If she was short reaching average 19.5 at age 66, she would have to wait until 1st January of the next year to start her pension with the extra voluntary contributions included.

If this turns out to be the case remember that 1 extra year will be added to her averaging divisor.

Hopefully she makes 19.5 at 66.

They only count contributions for the averaging method up to the last complete tax year before the pension is started.

If she was short reaching average 19.5 at age 66, she would have to wait until 1st January of the next year to start her pension with the extra voluntary contributions included.

If this turns out to be the case remember that 1 extra year will be added to her averaging divisor.

Hopefully she makes 19.5 at 66.