So leave the full amount in a single premium policy and start again from scratch saving into a policy with a 1% AMC? Would I not be missing out on compounding then?And adding onto Ger's post, if you did cash it in, you'd be better investing it as a single premium not connected to the regular premium plan as single premium contracts have better pricing than regular premium ones. You could get an even lower amc on the lump sum payment.

You'd want to do your sums and see when the break even point is on crystallising the fund now and taking the tax hit.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Should I close my investment fund and lose units built to switch to a lower cost fund?

- Thread starter david_

- Start date

Hearing that I would not get the 101% allocation if I switched makes me even more confused about how much I could potentially save in reduced AMC over 15 years.In addition to the potential tax implications that Steven mentioned ( assume OP paid in €25K - exit tax liability €2,050. Reinvest €27,950 and value grows to €30,000 - another €840.50 liability. If value of the €27,950 dropped on the new plan then the exit tax paid on the old plan won't be added back). Granted, these may be only short-term downsides but they're there if OP couldn't go the full term to wash out the cost by the 0.5% pa saving.

Also, if OP was receiving 101% allocation on original plan it's very likely that the €27,950 would not receive that on a new plan, from the same provider. The 1% isn't a provider cost, but a Government one, and the providers cover it on some plans. That reduces margin so it would be unreasonable to expect that they would pay it again on a value that they've already added it to. There's a note about this on the product profile that intermediaries would have access to but a customer would not see that.

Gerard

So let’s say I switch, despite the tax implications you have laid out. I am still committed to saving at least €500 per month for 15 years.

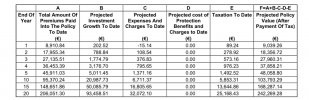

When I began my plan I started saving €750 a month and was provided with a projected benefits document for my policy. In 15 years time I would have paid €16,800 in “expenses and charges”, doubling to €32,072 after another 5 years, more than I would pay in tax. And in the case where I am in a position to keep saving past 15 years, I would be looking at a huge amount of my savings lost to expenses and charges. This is why I was thinking that switching to the lower AMC policy would save me potentially thousands of euros, given how much these charges add up to.

The real issue I have is that I don’t know how to calculate the expenses and charges that the same fund with a 1% AMC (and apparently 100% allocation) would result in, so I don’t know how much of a difference switching would really make in the long run.

Attachments

Gordon Gekko

Registered User

- Messages

- 7,936

The point that seems to be missed here is that the tax on any existing gains will be payable anyway on the eighth anniversary. So it shouldn’t be that much of a consideration. The issues are only really potential compounding on that tax over the next five-ish years and paying the levy again on a new policy. Who’s to say markets go up over the next few years?

Steven Barrett

Registered User

- Messages

- 5,457

If you do it, I would look at a single premium policy for the lump sum as they are priced better than regular premiums.So leave the full amount in a single premium policy and start again from scratch saving into a policy with a 1% AMC? Would I not be missing out on compounding then?

How would you miss out on compounding if the money is invested?