Most of my ideas on property letting are being well expressed by others so I will not address those points.

However there is one point that I think is being mishandled.

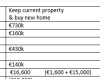

I suggest that using the marginal rate of tax is not appropriate. The tax rate should be the landlords effective rate, or in many cases including my own, it is appropriate to apply the various reliefs and standard rate first to the rental income.

As a self employed person with rental income, I look at my rental income as my base income. I have a contract for a set rent for a year ahead, almost everything I need to do is already done. Having provided and furnished the property I just have to collect the rent.

For my day job, I have to find work, I have to do the work, I have to get paid. Thats marginal income. If I take on a new contract for €10k I will pay €5.2k tax

However there is one point that I think is being mishandled.

I suggest that using the marginal rate of tax is not appropriate. The tax rate should be the landlords effective rate, or in many cases including my own, it is appropriate to apply the various reliefs and standard rate first to the rental income.

As a self employed person with rental income, I look at my rental income as my base income. I have a contract for a set rent for a year ahead, almost everything I need to do is already done. Having provided and furnished the property I just have to collect the rent.

For my day job, I have to find work, I have to do the work, I have to get paid. Thats marginal income. If I take on a new contract for €10k I will pay €5.2k tax