Brendan Burgess

Founder

- Messages

- 55,244

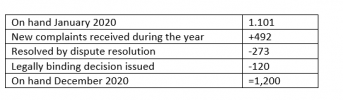

This is from the https://www.fspo.ie/documents/Overview_of_Complaints_2020-v1.pdf for 2020

I have compiled the table from the data.

Tracker mortgage related complaints Complaints identified as tracker mortgage interest rate related complaints continued to comprise a considerable element of the work of this Office in 2020, with 582 tracker mortgage complaints closed during the year. Of these, 273 were closed following mediation by the Dispute Resolution

Service and 120 of these complaints were closed following investigation and the issuing of a legally

binding decision. The remainder were closed at various stages of the process.

One bank ( BB: Danske) appealed to the High Court seeking to strike-down a tracker mortgage decision I issued in April 2020. In that decision I directed the bank to reinstate the complainants’ tracker mortgage interest rate. The High Court delivered its judgment in February 2021. The bank was refused the reliefs it had sought and was unsuccessful in all arguments. Therefore, my legally binding decision stands and the bank is required to restore the complainants’ tracker mortgage arrangement.

...

During 2020, we received an additional 492 tracker mortgage complaints. Therefore, tracker mortgage complaints will continue to comprise a considerable element of the work of this Office for some time to come. At the end of 2020, we had more than 1,200 tracker mortgage complaints on hand.

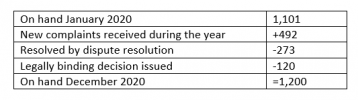

I have compiled the table from the data.

Tracker mortgage related complaints Complaints identified as tracker mortgage interest rate related complaints continued to comprise a considerable element of the work of this Office in 2020, with 582 tracker mortgage complaints closed during the year. Of these, 273 were closed following mediation by the Dispute Resolution

Service and 120 of these complaints were closed following investigation and the issuing of a legally

binding decision. The remainder were closed at various stages of the process.

One bank ( BB: Danske) appealed to the High Court seeking to strike-down a tracker mortgage decision I issued in April 2020. In that decision I directed the bank to reinstate the complainants’ tracker mortgage interest rate. The High Court delivered its judgment in February 2021. The bank was refused the reliefs it had sought and was unsuccessful in all arguments. Therefore, my legally binding decision stands and the bank is required to restore the complainants’ tracker mortgage arrangement.

...

During 2020, we received an additional 492 tracker mortgage complaints. Therefore, tracker mortgage complaints will continue to comprise a considerable element of the work of this Office for some time to come. At the end of 2020, we had more than 1,200 tracker mortgage complaints on hand.

Attachments

Last edited: