What utilities are you having trouble with?1) Utility IBAN Issue

There's a little bit about the rules here:

Bord Gais not accepting IBAN

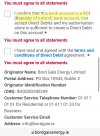

SEPA Consumer (Debtor) Rights Under the SEPA Direct Debit Core Scheme Rules and SEPA Regulation 260-2012 consumers can: Use a single account to pay a SEPA Direct Debit in any SEPA country Instruct their bank to refuse a SEPA Direct Debit Prohibit the application of any SEPA Direct Debit to...

www.askaboutmoney.com