You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

"My shares have fallen 30% what should I do?" "Is this a good time to invest in the stock market?"

- Thread starter Brendan Burgess

- Start date

Just to be clear, I wasn't offering advice.....just explaining my turbulent thinking.....

However, a question.....

"Even if you had been unlucky and bought at the very top in September 1929 you would still have averaged 1.86%pa taking in the Great Depression and World War II. To put that into context today that's about 18 years interest from the bank each and every year!"

What would money on deposit, or in bonds have done over the 15 years p.a. versus 1.8% because it's not 1.8% p.a. versus todays return that would count.....or is that thinking flawed?

Also, I'm hoping we don't have to hope for a World War-like event for explosive growth if a crash happens

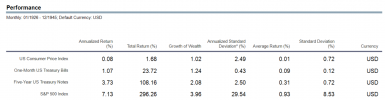

Its a good point. Here is the data for inflation, T Bills and short term bonds over that period compared to US Equities

Source: Ibbotson data courtesy of © Stocks, Bonds, Bills and Inflation Yearbook™, Ibbotson Associates, Chicago (annually updated works by Roger C. Ibbotson and Rex A. Sinquefield).Currency: USD Copyright 2018 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

Attachments

Do you still own the bank shares , they have really only performed strongly in the last month or so. Also explains why the iseq has had such a great month , banks still dominate the index. There appears to be a rotation out of us and tech stocks back to the unfashionable sectors like banks as the vaccine rollout cranks up and the "old economy " come back to lifeup 4% year to date , happy enough , ive only three positions , two irish companies and one well known american E commerce company

gained 9.65% in 2020 which was good and almost all down to a particular EV company turning things around for me but an irish bank also delivered , was still under water as late as August 1st of last year

Last edited:

NotMyRealName

Registered User

- Messages

- 145

Great work Marc, I tip my hat to you. I did not know the answer to my question when I posed it, but baselines are important when making comparisons.

I'm glad the OP is back in positive territory again although there is a difference between 1 year return and Year to date...

The OP could pose the question again.....this time asking

....."My shares are up 4% ,what should I do?"

That's when the psychology reveals itself.

One of the reasons that timing markets doesn't work is that we may not accurately evaluate ,or accept ,what a reasonable profit is. So when it's there, we don't take it.....we think it can be more.

The problem is that markets "take the escalator up and the elevator down". I can imagine ( not identify... imagine ) many possible causes for a market drop.....MANY.. although it probably won't be one of them....if it happens.

I can't think of 1 event that would cause a market surge of of a similar magnitude ( say 20% or so) in a single day.

I don't know what the OP's investment timeline is but that's important.

I have a conflicted view on all of this as I have significant market exposure through pension and ETFs but I also have a good cash reserve fund.

I'm glad the OP is back in positive territory again although there is a difference between 1 year return and Year to date...

The OP could pose the question again.....this time asking

....."My shares are up 4% ,what should I do?"

That's when the psychology reveals itself.

One of the reasons that timing markets doesn't work is that we may not accurately evaluate ,or accept ,what a reasonable profit is. So when it's there, we don't take it.....we think it can be more.

The problem is that markets "take the escalator up and the elevator down". I can imagine ( not identify... imagine ) many possible causes for a market drop.....MANY.. although it probably won't be one of them....if it happens.

I can't think of 1 event that would cause a market surge of of a similar magnitude ( say 20% or so) in a single day.

I don't know what the OP's investment timeline is but that's important.

I have a conflicted view on all of this as I have significant market exposure through pension and ETFs but I also have a good cash reserve fund.

Last edited:

galway_blow_in

Registered User

- Messages

- 2,102

Do you still own the bank shares , they have really only performed strongly in the last month or so. Also explains why the iseq has had such a great month , banks still dominate the index. There appears to be a rotation out of us and tech stocks back to the unfashionable sectors like banks as the vaccine rollout cranks up and the "old economy " come back to life

No, i dont , im content to have done what i did with the bank in question , it doesnt pay a dividend where as the REIT,s im in do , the e comerce company does not but the growth is so good , i dont mind

there was no "original poster" to this thread it was basically a reboot of another thread where investors were worried about the carnage on the markets in early march 2020, it was the fastest stock market sell off in financial history , the hot areas of the markets like Tesla and bitcoin had the biggest falls I remember. But there was no refuge because even "safe" government bonds started selling off aswell that was probably the reason the central banks stepped in so fast.'m glad the OP is back in positive territory again although there is a difference between 1 year return and Year to date...

Last edited:

up 4% year to date , happy enough , ive only three positions , two irish companies and one well known american E commerce company

gained 9.65% in 2020 which was good and almost all down to a particular EV company turning things around for me but an irish bank also delivered , was still under water as late as August 1st of last year

With just 3 stocks your position is very risky. I suspect you know that.

The MSCI return in 2020 was 15.9% so your 9.65% was a very poor return. I wonder was the risk you took justified.

galway_blow_in

Registered User

- Messages

- 2,102

With just 3 stocks your position is very risky. I suspect you know that.

The MSCI return in 2020 was 15.9% so your 9.65% was a very poor return. I wonder was the risk you took justified.

It wasn't a poor return as had I held the three stocks I started with on January 1st to December 31st ,I'd be looking at an even lower return, owning the market is difficult in Ireland due to fund rules

I don't understand ?It wasn't a poor return as had I held the three stocks I started with on January 1st to December 31st ,I'd be looking at an even lower return, owning the market is difficult in Ireland due to fund rules

galway_blow_in

Registered User

- Messages

- 2,102

I don't understand ?

i began the year ( january 1st ) with three particular stocks which i bought towards the end of 2019 , had i simply held on to those stocks through 2020 , i would not have achieved a 9% performance.

on owning the MSCI index , i realise it outperformed my choices but the rules around owning funds in Ireland make that option unattractive to me as i cant put gains against past losses as that is not allowed with irish domiciled funds

Last edited:

galway_blow_in

Registered User

- Messages

- 2,102

I was suggesting the return on the MSCI as a benchmark rather than as a alternative investment.

OK, are you clear now otherwise?

The last year especially 2021 has been the best period ever for me with investments, not in terms of performance but in terms of absolute gains . I havn't bought or sold that much since before the corona but all my investments have got revalued upwards. I missed out on alot of the revaluation after the corona sell off as I wasn't invested that much in the US technology boom, although I did benefit from investing in the "old tech " revaluations after 2011 when the dot com techs like Microsoft, Intel and Cisco got revalued. In the last year the hated banking stocks and financials along with energy Europe and UK markets are finally getting the big uplift as the "great rotation" theme now has the big wind in its sails.

However the corona sell off of March 2020 hit my portfolio very hard as I was overweight in all the above areas and had little US tech exposure, just shows its best not to react to markets when they go crazy. But March 2020 was a violent sell off its easy to forget that now because it was all over so fast

However the corona sell off of March 2020 hit my portfolio very hard as I was overweight in all the above areas and had little US tech exposure, just shows its best not to react to markets when they go crazy. But March 2020 was a violent sell off its easy to forget that now because it was all over so fast

moneymakeover

Registered User

- Messages

- 959

There was a thread, unfortunately closed, "the longest bull market in history"

My question, there is "noise" now in the markets and a recent 3% drop, I'm wondering is the bull market due to reverse?

The factors I see are: fed printing and easing make it impossible for markets to reverse, essentially inflation has pushed up stocks irreversibly.

On the other hand inflation is coming along with interest rate rises: will that cause the stock market to drop?

Say if fed increases interest rates, then there will be sell off in bonds? Even more reason to be in equities?

Thinking of say pension, is there a reason to rethink portfolio?

My question, there is "noise" now in the markets and a recent 3% drop, I'm wondering is the bull market due to reverse?

The factors I see are: fed printing and easing make it impossible for markets to reverse, essentially inflation has pushed up stocks irreversibly.

On the other hand inflation is coming along with interest rate rises: will that cause the stock market to drop?

Say if fed increases interest rates, then there will be sell off in bonds? Even more reason to be in equities?

Thinking of say pension, is there a reason to rethink portfolio?

Steven Barrett

Registered User

- Messages

- 5,462

Are you trying to time the market?There was a thread, unfortunately closed, "the longest bull market in history"

My question, there is "noise" now in the markets and a recent 3% drop, I'm wondering is the bull market due to reverse?

The factors I see are: fed printing and easing make it impossible for markets to reverse, essentially inflation has pushed up stocks irreversibly.

On the other hand inflation is coming along with interest rate rises: will that cause the stock market to drop?

Say if fed increases interest rates, then there will be sell off in bonds? Even more reason to be in equities?

Thinking of say pension, is there a reason to rethink portfolio?

When using projections for future growth of equities, we use 5% - 6% annualised return. the last 10 years has an annualised return of 14.33%. There is bound to be some falls and returns will reduce more in line with their long term mean, which still produces good returns.

If you want to protect what you have, you should create a sale point on all of your investments and when it has made a certain gain, sell it and stick it in cash. Otherwise, you are guessing when you hit the top of the market. Central banks buying bonds has changed the rules of the game too. Covid shutdown should have caused a recession but it didn't because of bond buying and PUP payments. Will the next big event get a bailout too? Who knows. We don't know what it is yet.

Steven

http://www.bluewaterfp.ie (www.bluewaterfp.ie)

There was a thread, unfortunately closed, "the longest bull market in history"

My question, there is "noise" now in the markets and a recent 3% drop, I'm wondering is the bull market due to reverse?

The factors I see are: fed printing and easing make it impossible for markets to reverse, essentially inflation has pushed up stocks irreversibly.

On the other hand inflation is coming along with interest rate rises: will that cause the stock market to drop?

Say if fed increases interest rates, then there will be sell off in bonds? Even more reason to be in equities?

Thinking of say pension, is there a reason to rethink portfolio?

Time in the Market, not Timing the Market

When should I invest? The answer is always now because investors are rewarded for time IN the market not timing the market.

moneymakeover

Registered User

- Messages

- 959

My own basic understanding of the pros and cons currently

Cons

Energy issues, gas prices, China crisis

Climate change feeding into energy crisis

US government uncertainty Ruth the debt ceiling

US disagreement about the infrastructure spend 1.5 trillion/3.5 trillion

Tapering of fed purchases

Increase US, UK, euro interest rates from low base.

5 years of solid 14% annual stock market. Must be time for a change

Still in pandemic

Chip shortages

Supply chain issues

Pros

Huge amount of cash in the system. Has to go somewhere.

General global political stability

Low interest rates

High demand for goods

Strong labour supply (from pandemic unemployed)

Overall I'm leaning towards continued stock market gains. The pros still outweigh the cons. That could change.

Cons

Energy issues, gas prices, China crisis

Climate change feeding into energy crisis

US government uncertainty Ruth the debt ceiling

US disagreement about the infrastructure spend 1.5 trillion/3.5 trillion

Tapering of fed purchases

Increase US, UK, euro interest rates from low base.

5 years of solid 14% annual stock market. Must be time for a change

Still in pandemic

Chip shortages

Supply chain issues

Pros

Huge amount of cash in the system. Has to go somewhere.

General global political stability

Low interest rates

High demand for goods

Strong labour supply (from pandemic unemployed)

Overall I'm leaning towards continued stock market gains. The pros still outweigh the cons. That could change.

But you must be prepared for rapid sell offs like what happened in March 2020, falls of 30% and more. We are talking about an energy crisis now and shortages of gas and petroleum and rising prices. Last year we briefly had a "negative" oil prices due to traders needing to dump it at any price. There were ridiculous headlines like "The End of Oil" and energy company shares were selling for ridiculous prices, how silly and premature that looks now. But I bet many investors dumped energy stocks back then based on those headlines.

I see stock markets now performing as they should now in inflationary environments, the high income european stock markers full of old world stocks like financials and energy that make money today are now outperforming the tech heavy US markets. Once you made sure not to put too much money in tech the stock markets are protecting you from inflation now

CuriousGeorge11

Registered User

- Messages

- 59

This was certainly an interesting read looking back, obviously nobody could have predicted the huge bull run covid in effect caused