It wouldn’t be that hard to move to Northern Ireland and commute if the tax burden got too high here.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Low-paid workers’ exemption from tax base ‘unfair’ on middle earners

- Thread starter Purple

- Start date

A broader tax base has been recommended by just about everyone who has examined our tax system.

Wealth taxes are fair and equitable. Most wealth accumulated in Ireland in the last decade is not as a result of work or sacrifices made by working people. It's due to capital appreciation.

...on principal residential property?

As far as the social welfare for so called lone parent scammers or a one income household they should be getting help from the welfare system. Unmarried couples cohabiting get notting but yet revenue classes them as single and the state as a couple for means. Notting against a mother or father who is not working getting welfare weather there in a relationship or married or not. Id fully support that.

The issue is where a couple cohabit but the mother claims to be a lone parent. I'm aware of a number of cases where she rents the house from her partner (who lives in the house) and claims HAPS. That is serious fraud and it is common. It is very common for the mother to claim to be a lone parent to get social housing even though the father/partner is actually living with her and their children.In terms of cohabiting couples, they are broadly treated the same as married couples for any means tested social welfare payment

Of course, that's where most of the wealth is. If the owner doesn't have the income to pay it then roll it over with a moderate interest rate and charge it on their estate when they die....on principal residential property?

It's a very common practice on the continent, they even have categories of permits specifically for that cohort; Frontaliers.You'd need the employer to facilitate that as there would be implications for them. Covid and remote working has brought that to the fore and most of the large employers who didn't already already have introduced rules stating employees must live within the jurisdiction.

Granted UK < > ROI is not the same as EU < > EU.

Fair enough but where I was going with that is the observation that residential property is already tax'd so that slice of wealth would either be excluded from the wealth tax or double tax'd or removed the LPT.Of course, that's where most of the wealth is. If the owner doesn't have the income to pay it then roll it over with a moderate interest rate and charge it on their estate when they die.

Last edited:

It's only a very small tax. The tax on a house worth €1.3 million is only €1,400 a year. If that rolled up, with interest, for 50 years it would still only amount to less than 10% of the value of the property.Fair enough but where I was going with that is the observation that residential property is already tax'd so that slice of wealth would either be excluded from the wealth tax or double tax'd or removed the LPT.

It's only a very small tax. The tax on a house worth €1.3 million is only €1,400 a year. If that rolled up, with interest, for 50 years it would still only amount to less than 10% of the value of the property.

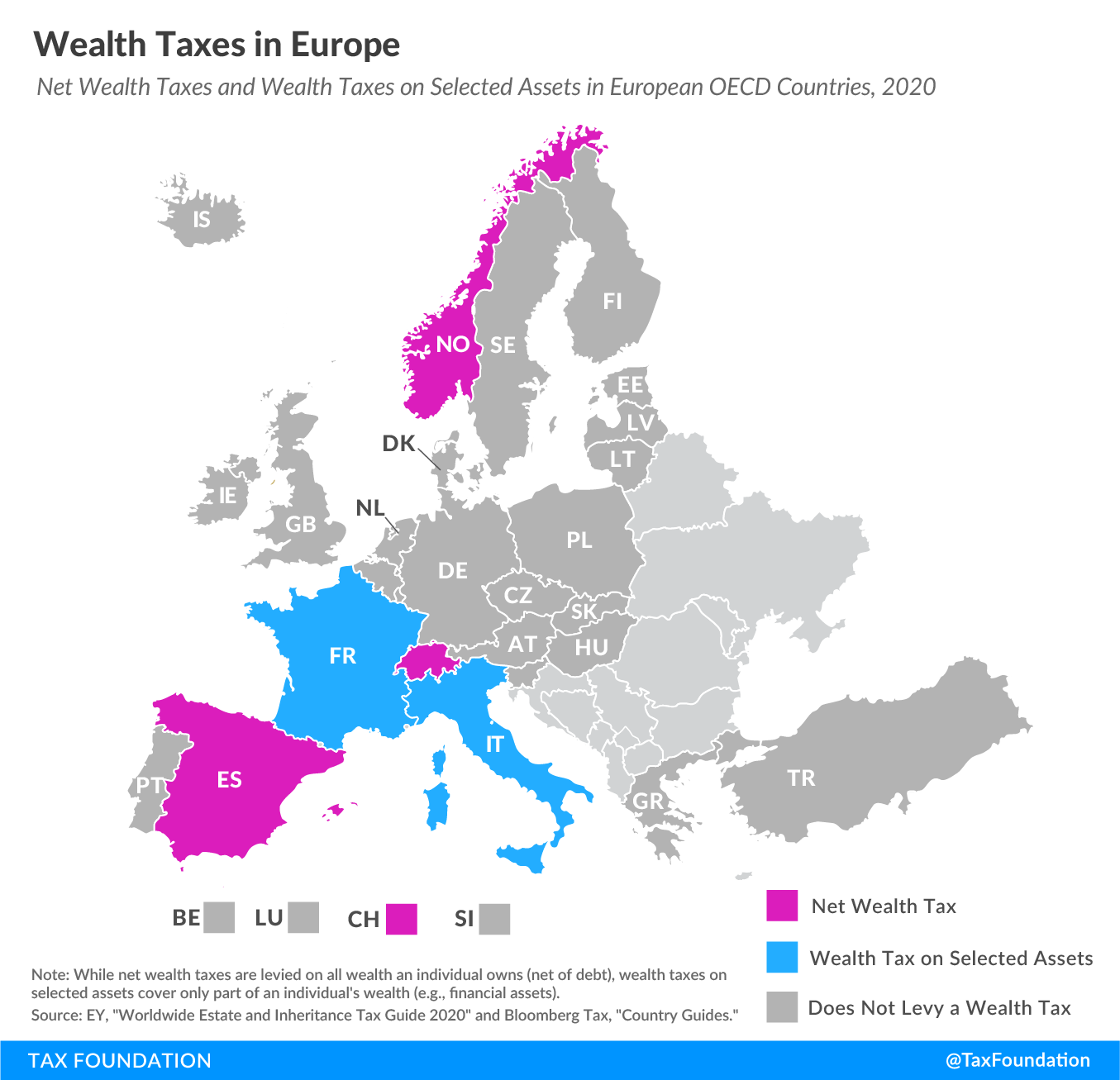

Wealth Taxes in Europe

Net wealth taxes are recurrent taxes on an individual’s wealth, net of debt. The concept of a net wealth tax is similar to a real property tax. But instead of only taxing real estate, it covers all wealth an individual owns. As today’s map shows, only three European countries covered levy a net...

For reference:

Net Wealth Taxes

Norway levies a net wealth tax of 0.85 percent on individuals’ wealth stocks exceeding NOK1.5 million (€152,000 or US $170,000), with 0.7 percent going to municipalities and 0.15 percent to the central government. Norway’s net wealth tax dates to 1892. Under COVID-19-related measures, individual business owners and shareholders who realize a loss in 2020 are eligible for a one-year deferred payment of the wealth tax.Spain’s net wealth tax is a progressive tax ranging from 0.2 percent to 3.75 percent on wealth stocks above €700,000 ($784,000; lower in some regions), with rates varying substantially across Spain’s autonomous regions (Madrid offers a 100 percent relief). Spanish residents are subject to the tax on a worldwide basis while nonresidents pay the tax only on assets located in Spain.

Switzerland levies its net wealth tax at the cantonal level and covers worldwide assets (except real estate and permanent establishments located abroad). The tax rates and allowances vary significantly across cantons. The Swiss net wealth tax was first implemented in 1840.

Wealth Taxes on Selected Assets

France abolished its net wealth tax in 2018 and replaced it that year with a real estate wealth tax. French tax residents whose net worldwide real estate assets are valued at or above €1.3 million ($1.5 million) are subject to the tax, as well as non-French tax residents whose net real estate assets located in France are valued at or above €1.3 million. Depending on the net value of the real estate assets, the tax rate is as much as 1.5 percent.Italy taxes financial assets held abroad without Italian intermediaries by individual resident taxpayers at 0.2 percent. In addition, real estate properties held abroad by Italian tax residents are taxed at 0.76 percent.

Sophrosyne

Registered User

- Messages

- 1,590

Potential wealth taxes would be administered by Revenue, one of our more efficient branches of Government administration.It's a very common practice on the continent, they even have categories of permits specifically for that cohort; Frontaliers.

Granted UK < > ROI is not the same as EU < > EU.

The real problem is the design of a wealth tax for Ireland that would be worth the effort and yield more than just token amounts.

The ESRI published a Working Paper dated November 2016, which compared results based on models of existing household wealth taxes across Europe. It concluded:

“Due to the imperfect correlation between income and wealth, we find that in almost every scenario, a non-negligible proportion of the tax would be collected from households in the lowest income deciles.”

As an article in the IT summarized, that the problem with wealth taxes is “There not enough rich people”.

Last edited:

So playing out that scenario a little...

If much of the potential wealth sits in lower income households, levying a wealth tax would in many cases force a liquidation of wealth to cater to to the wealth tax bill, right? So their wealth is eroded by the tax.

Those same low income households are presumably paying low income tax.

Not sure where this goes just trying to play it out hypothetically...

Is Ireland unique in that much of the wealth tax would be harvested from low income households (assuming that assertion is accurate)?

If much of the potential wealth sits in lower income households, levying a wealth tax would in many cases force a liquidation of wealth to cater to to the wealth tax bill, right? So their wealth is eroded by the tax.

Those same low income households are presumably paying low income tax.

Not sure where this goes just trying to play it out hypothetically...

Is Ireland unique in that much of the wealth tax would be harvested from low income households (assuming that assertion is accurate)?

Sophrosyne

Registered User

- Messages

- 1,590

So playing out that scenario a little...

If much of the potential wealth sits in lower income households, levying a wealth tax would in many cases force a liquidation of wealth to cater to to the wealth tax bill, right? So their wealth is eroded by the tax.

Those same low income households are presumably paying low income tax.

Not sure where this goes just trying to play it out hypothetically...

Is Ireland unique in that much of the wealth tax would be harvested from low income households (assuming that assertion is accurate)?

This is the ESRI Working Paper.

Last edited:

Why would that happen?So playing out that scenario a little...

If much of the potential wealth sits in lower income households, levying a wealth tax would in many cases force a liquidation of wealth to cater to to the wealth tax bill, right?

Property taxes can be deferred and levied on the estate. What other wealth is held in low income households?

Yes, all wealth is eroded by taxes. Taxes transfer wealth, they do not destroy it.So their wealth is eroded by the tax.