Brendan Burgess

Founder

- Messages

- 54,419

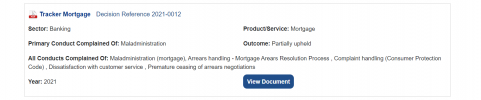

The Ombudsman has just published 25 Tracker decisions today

[broken link removed]

I have extracted the three substantially upheld decisions and attached them to this post.

Here is my initial summary of them.

The Ombudsman’s summary

Only 3 substantially upheld

Bank of Scotland case

This is an example of a case, where the borrower would have been laughed out of the High Court if they had taken a case. The Ombudsman legislation gives him much wider discretion.

Compensation case 1 - ptsb

5 Partially upheld - the borrowers would conclude that these were losses

It can be seen from the tracker related decisions published with this digest that 17 complaints were not upheld. I believe it is likely that it will continue to be the case that a large number of

complaints relating to tracker interest rates on mortgage loans will not be upheld. This is because some complainants have unrealistic expectations, believing that their desire to have a tracker interest rate provides a basis for requiring their bank to grant them one. There seems to be a lack of understanding, by some complainants, that for a person to have an entitlement to a particular tracker interest rate there must be some contractual or other obligation on their bank entitling them to such a rate.

1152 complaints on hand

Two issues which are often raised on Askaboutmoney

[broken link removed]

I have extracted the three substantially upheld decisions and attached them to this post.

Here is my initial summary of them.

The Ombudsman’s summary

| Upheld | 8 |

| Dismissed | 17 |

| Total | 25 |

Only 3 substantially upheld

| Bank of Scotland case tracker restored – customer not advised that fixing would lose tracker |

| Ptsb - Additional compensation of €52k |

| Ptsb - Additional compensation of €45k |

Bank of Scotland case

- Started on a tracker of ECB + 1%

- Fixed for 3 years

- When fixing the documentation said “at the end of the fixed rate you will go onto the Standard Variable Rate”

- Ombudsman held that they should also have spelled out “You will lose your tracker”

- Told BoSI to restored the tracker at ECB +1%

- Paid the borrower €2,500 compensation on top of the refund of €6,000 overcharged interest

- Ombudsman referred the matter to the Central Bank as other customers impacted by the same decision

- BoSI will apply the decision to all those affected

- In 2018, BoSI sold these mortgages to Pepper and BoSI has agreed with Pepper to put them all on trackers

This is an example of a case, where the borrower would have been laughed out of the High Court if they had taken a case. The Ombudsman legislation gives him much wider discretion.

Compensation case 1 - ptsb

- Two lads owned a house

- Their girlfriends lived with them.

- They tried to make the house more habitable but could not afford to do so because of the high mortgage rates

- They wanted to get married and could not afford to

- The automatic compensation was €9,500

- The Appeals panel rejected their appeal for more compensation

- Despite this, ptsb offered an extra €7,000 which the borrowers rejected

- The Ombudsman awarded them an extra €43,000 to bring it to €52,500

- Mother and daughter bought a house together

- €6,000 in automatic compensation

- They were in arrears which they would not have been if they had been charged correct rate

- The credit rating was damaged

- The daughter had to go to counselling for stress

- Appeals Panel rejected their appeal

- Ptsb offered to increase the compensation from €6,000 to €15,000

- Ombudsman awarded an extra €30,000 to bring it to €45,000 in total

5 Partially upheld - the borrowers would conclude that these were losses

| €3,000 additional compensation – had claimed over €50k |

| €3,000 for a delay in moving a mortgage to a new property |

| €3,000 Not entitled to tracker , but typo - |

| €2,500 Not entitled to trackers, but poor information |

| Not entitled to a tracker, but bank not adhering to CPC - Not sure of award or which case this is |

It can be seen from the tracker related decisions published with this digest that 17 complaints were not upheld. I believe it is likely that it will continue to be the case that a large number of

complaints relating to tracker interest rates on mortgage loans will not be upheld. This is because some complainants have unrealistic expectations, believing that their desire to have a tracker interest rate provides a basis for requiring their bank to grant them one. There seems to be a lack of understanding, by some complainants, that for a person to have an entitlement to a particular tracker interest rate there must be some contractual or other obligation on their bank entitling them to such a rate.

1152 complaints on hand

Two issues which are often raised on Askaboutmoney

- I moved house and the bank did not let me take my tracker. Ombudsman found in favour of the bank. No obligation to do so.

- I was never offered a tracker although they were available. The Ombudsman believe that the the borrowers could have informed themselves. But as the fixed rates were lower, he found it difficult to accept that they would have taken a tracker option if it had been offered.

Attachments

Last edited: