This article is based on the Briefing Note I did which is below:

Briefing note on long-term mortgage arrears, court cases and repossessions

Recent data released by the Courts Service show a big fall off in court proceedings for repossessions

· 50% drop in court proceeding for possession between 2017 and 2018

· 80% drop in court proceedings issued since the peak

· Central Bank quarterly reports show the exact same trend.

· Estimates of “up to 20,000 in the Courts System” is a gross exaggeration – true figure is c. 7,000

· Very strange that 23,000 borrowers are over two years in arrears, but only 7,000 proceedings issued – could the Central Bank’s figures for arrears be wrong again?

· C. 100,000 borrowers have had their mortgages restructured

· The ordinary mortgage holder who is paying their mortgage is paying about €250 a month more than necessary because of the lack of any sanction for those who don’t pay their mortgage

Is it time to cancel the tsunami warning?

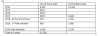

How many court proceedings have been issued over the last 5 years?

The Circuit Court gets its data from counting the actual proceedings lodged.

The Central Bank bases their figures on reports from the banks and does not cross-check them with the Courts Service. It is likely that some lenders are including solicitors’ letters as “legal proceedings”.

Based on the more reliable Courts Service data, over the last 5 years, 21,500 proceedings have been issued.

This includes some buy to lets as the Courts Service is not always able to distinguish family homes from buy lets.

It also includes proceedings issued twice for the same mortgage as many proceedings were struck out because of various legal challenges.

The number of proceedings issued has dropped by 80% since the peak in 2014.

The number of proceedings issued has halved between 2017 and 2018.

The unreliable Central Bank data show the exact same trend – an 80% fall since 2014 and a 53% fall between 2017 and 2018.

How many court proceedings are still outstanding?

Some campaigners claim that there are up to 20,000 cases in the legal system. But when asked, they can’t provide any source or basis for this estimate.

In November, the Community Action Network said in a

report: “There are currently an estimated 20,000 possession cases before the courts”

In the

Irish Times Saturday Feb 2nd , “In his recent study of the Irish mortgage market, NUIG’s Padraic Kenna said he found that “the big bulk of cases are stuck in the courts system, and they’re being sent round and around and looking for adjournments. He estimates that there could be up to 20,000 mortgage holders in this legal limbo.”

The Courts Service does not produce this data. But a review of the courts lists for possession cases shows that most of them come from 2017 and 2018. So here is my estimate.

It’s probably around 7,000.

So the 20,000 is a huge exaggeration.

How many of these will end in repossessions?

Banks issue proceedings for possession as a last resort when the borrower is paying nothing and not engaging with them. Often the proceedings result in engagement and the agreed withdrawal of the proceedings.

Roughly 20% of proceedings issued result in a court order being made.

So, based on the 7,000 proceedings in existence, about 1,400 of these will end in orders for possession.

Very little. Someone who got into difficulty 5 years ago but who has paid their normal repayments in full for the past three years, could be classified as two years in arrears until they pay the arrears or until the bank capitalises them.

Some borrowers may even have agreed a restructuring but the arrears are still outstanding. However, normally the banks capitalise arrears after the borrower adheres to the restructuring for 12 months.

Why are there only 7,000 proceedings in the system if there are 23,000 borrowers over two years in arrears?

Not easy to answer this one.

Some borrowers are paying enough so that the lender realises that there is no point whatsoever in issuing legal proceedings as they will not get an order.

Some more are still in the Mortgage Arrears Resolution Process.

Some are protected by Personal Insolvency Arrangements or applications for them.

Some more are trying to find solutions such as Mortgage to Rent or have otherwise agreed to voluntary sales.

It’s also possible that the Central Bank’s figure for 23,000 in arrears over two years is wrong. There is no way to independently validate it. Bank of Ireland and AIB publish arrears figures in their annual reports which are much lower, but Bank of Ireland in particular has a much lower level of arrears than the market.