Yeah they're gone Paul. Considered the 10 but took a chance on the 5 in the hope that the rates will have settled come the end of that period.Remember that you can have:

@Brendan Burgess said his inclination was to fix for 10 years. That has the advantage of only having to worry about rate fluctuations for the remaining 9.5 years of your mortgage (versus 14.5 years if you fix for 5 years).

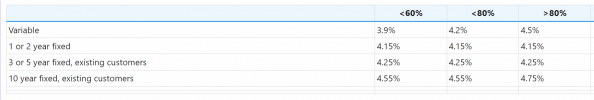

- A 5-year fix at 3.5% – a monthly repayment of €803, or

- A 10-year fix at 3.8% – a monthly repayment of €824

Either way (but especially if you fix for 5 years), you should put an annual reminder in your calendar to review your mortgage to see if switching lender makes sense.

Have you already sent off the form to fix?

Thanks to you all for the guidance. Probably something I should've taken more notice of a year ago but lesson learned. I'll take your advice with the annual reminder, thanks.