You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Avant Money launches a new mortgage today from < 2%

- Thread starter Deeks1

- Start date

Brendan Burgess

Founder

- Messages

- 55,283

The CEO will be interviewed on Radio 1 Business - don't know what time, but it's usually about 7.50 am.

Charlie Weston has covered it in today's Indo

www.independent.ie

www.independent.ie

Charlie Weston has covered it in today's Indo

Home-loan price war: lowest rates in 10 years as new lender shakes up market

A new mortgage lender backed by a Spanish banking giant is set to shake up the market here with the lowest lending rates.

Last edited:

Brendan Burgess

Founder

- Messages

- 55,283

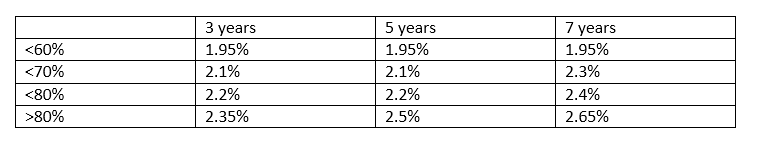

Here are their fixed rates

Update: Some or most of the brokers are charging an application fee of €500. It's not clear if this is refundable if your mortgage is not approved.

It doesn't say it on its website, but you will also be able to have part of your mortgage variable

< 70% LTV : 2.5%

>70% LTV: 2.75%

Switchers, movers and first-time buyers will be able to avail of these new products exclusively through a number of Ireland’s leading mortgage brokers from today.

Mortgages will be available to all customers, subject to the normal Central Bank of Ireland lending rules on loan-to-value and loan-to-income. Appointed mortgage brokers will be ready to guide customers on the range of Avant Money products and the various lending rules that apply.

Update: Some or most of the brokers are charging an application fee of €500. It's not clear if this is refundable if your mortgage is not approved.

It doesn't say it on its website, but you will also be able to have part of your mortgage variable

< 70% LTV : 2.5%

>70% LTV: 2.75%

Switchers, movers and first-time buyers will be able to avail of these new products exclusively through a number of Ireland’s leading mortgage brokers from today.

Mortgages will be available to all customers, subject to the normal Central Bank of Ireland lending rules on loan-to-value and loan-to-income. Appointed mortgage brokers will be ready to guide customers on the range of Avant Money products and the various lending rules that apply.

- Mortgages are available on homes that are the primary dwelling (i.e. not for investment buy-to-let properties)

Attachments

Last edited:

Brendan Burgess

Founder

- Messages

- 55,283

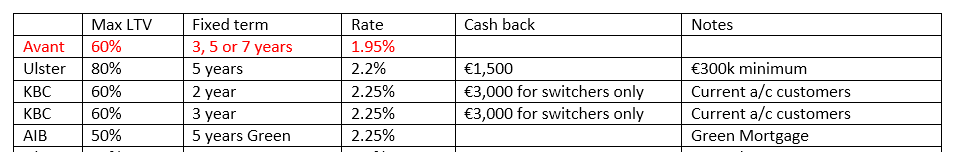

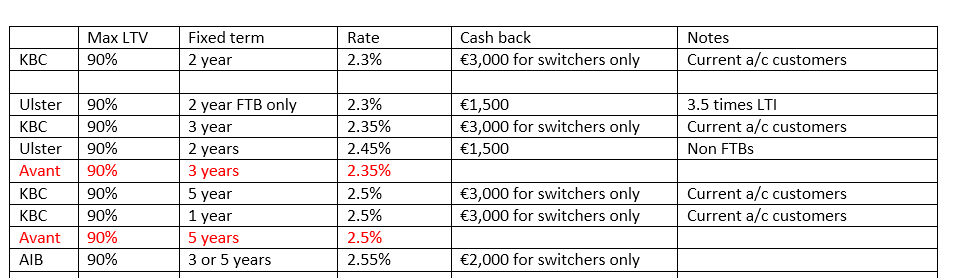

Avant is very good value at <60% LTV. Anyone who qualifies for this should consider switching to Avant.

Anyone with an LTV over 60% can get a lower effective rate through one of the cash back lenders

Anyone with an LTV over 60% can get a lower effective rate through one of the cash back lenders

Attachments

Last edited:

Brendan Burgess

Founder

- Messages

- 55,283

I understand that Avant will be quite selective in their underwriting.

And as they say in their press release:

They also have geographic limitations

Currently, they are Dublin county plus any town within 30km of Dublin county border, Cork city plus locations within 30km of Cork city centre, Galway city plus locations within 30km of Galway city centre, Limerick city plus locations within 20km of Limerick city centre and Waterford city plus locations within 20km of Waterford city centre.

source

Brendan

And as they say in their press release:

- Stable employment with no obvious risk to future employment prospects

They also have geographic limitations

Currently, they are Dublin county plus any town within 30km of Dublin county border, Cork city plus locations within 30km of Cork city centre, Galway city plus locations within 30km of Galway city centre, Limerick city plus locations within 20km of Limerick city centre and Waterford city plus locations within 20km of Waterford city centre.

source

Brendan

Attachments

Last edited:

Brendan Burgess

Founder

- Messages

- 55,283

| Appointed Brokers | Location | Website |

| Affinity Advisors | Dublin 2 | affinityadv.ie/ |

| All Financials | Dublin 5 | allfinancials.ie/ |

| Doddl | Dublin 2 | doddl.ie |

| Dowling Financial | Dublin 3 | dowlingfinancial.ie/ |

| DSOB Financial Services | Dublin 7 | None |

| Finance One | Dublin 2 | financeone.ie/ |

| Financial Solutions | Co. Dublin | financesolutions.ie/ |

| First Rate Financial Planning | Dublin 15 | www.firstrate.ie |

| Frank Lenny Financial | Dublin 2 | franklenny.com/ |

| Howth Financial Services | Co Dublin | http://www.howthfinancial.ie/ (www.howthfinancial.ie) |

| Irish Mortgage Brokers | Dublin 1 | mortgagebrokers.ie/ |

| Irish Mortgage Corporation | Dublin 2 | irishmortgage.com/ |

| MMPI | Dublin 4 | mmpi.ie/ |

| Mortgageline | Dublin 9 | |

| Mymortgages | Cork | mymortgages.ie/ |

| Park Financial | Dublin 12 | parkfinancial.ie/ |

| Prendergast Maguire | Co. Wicklow | [broken link removed] |

| Sherry Fitzgerald Financial Services | Dublin 1 | sherryfitz.ie/financial-services |

| Vision Financial Solutions Limited | Dublin 6 | visionfinancial.ie/ |

Nice! Welcome Avant! Can you overpay any of the fixed without penalty?

Also have they published their fixed rate break calculation?

Brendan Burgess

Founder

- Messages

- 55,283

Good interview by Brian Finn with the CEO of Avant Money

1) No requirement to buy mortgage protection or insurance from Avant to get these rates. The CEO said "I don't know where that idea has come from?"

2) They have invested a lot in this project and so they want to make a big splash - they will not be cherry picking. They will not be limiting it to public servants and some professionals.

He also said something like "Ireland has the highest rates in the eurozone after Greece and Latvia. There is no reason for that."

Brendan

1) No requirement to buy mortgage protection or insurance from Avant to get these rates. The CEO said "I don't know where that idea has come from?"

2) They have invested a lot in this project and so they want to make a big splash - they will not be cherry picking. They will not be limiting it to public servants and some professionals.

He also said something like "Ireland has the highest rates in the eurozone after Greece and Latvia. There is no reason for that."

Brendan

Brendan Burgess

Founder

- Messages

- 55,283

Can you overpay any of the fixed without penalty?

It would be unlikely.

Brendan

1) No requirement to buy mortgage protection or insurance from Avant to get these rates. The CEO said "I don't know where that idea has come from?"

I had posted that here, based on their business model in Spain.

I wonder do RTE read AAM?

Brendan Burgess

Founder

- Messages

- 55,283

I wonder do RTE read AAM?

I am sure that they do.

But they also read emails from me suggesting what questions to ask their upcoming interviewees

Brendan

Brendan Burgess

Founder

- Messages

- 55,283

Just two brokers outside Dublin?

They are restricting lending to Dublin, Cork and Galway.

Any other t&c. I see that one needs to Also have a deposit of 40% to avail of rate as a FTB or switcher.

So it doesn't apply to a non FTB applicant buying a new home?

I think they missed an opportunity to bring 10 year and 15 year fixed rates at 2.5% or lower. THAT would have been a game changer. 0.2% difference in what is on the market already is not much of a game changer but at least it gives a competitive offering that will keep rates down generally

Brendan Burgess

Founder

- Messages

- 55,283

Also have a deposit of 40% to avail of rate as a FTB or switcher.

Where are you seeing that?

As far as I can see the criteria are the same for FTBs, Second Time Buyers and switchers?

Brendan