BIG-notorious

Registered User

- Messages

- 152

@zephyro

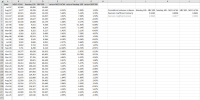

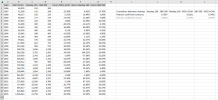

I looked at the correlation between Nasdaq 100, S&P 500, and MSCI All world using the 1 January values for each year from 1986 to 2025 inclusive. The results are copied in from Excel to the table below:

As you can see, even though Nasdaq - MSCI have the lowest correlation, it's still 97.8% correlation. Anything over 80% is considered very strong. 97.8% is near perfect correlation. S&P Vs MSCI is even higher (the MSCI started in Dec 1978 so I had a few more years of data to compare with the S&P).

I'm not looking to defend the Nasdaq 100 as an investment choice. But I'm 100% going to follow the numbers and not my heart.

@joe sod Pointing only to the specific isolated data points which support your fixed opinion is pretty much the definition of cherry-picking. For example, you've totally ignored my actual numbers from 2001 to 2020 and now you've moved your focus to 2002 to 2014.

I looked at the correlation between Nasdaq 100, S&P 500, and MSCI All world using the 1 January values for each year from 1986 to 2025 inclusive. The results are copied in from Excel to the table below:

| Nasdaq- S&P | Nasdaq- MSCI | S&P-MSCI | |

| Pearson Coefficient | 0.982841038 | 0.97858094 | 0.99573 |

As you can see, even though Nasdaq - MSCI have the lowest correlation, it's still 97.8% correlation. Anything over 80% is considered very strong. 97.8% is near perfect correlation. S&P Vs MSCI is even higher (the MSCI started in Dec 1978 so I had a few more years of data to compare with the S&P).

- How is diversification achieved by investing in a global index instead of the Nasdaq 100 or S&P 500?

- How is it even an argument to say that this index has outperformed the comparators over the last four decades and that's the biggest reason to believe it will underperform them going forward?

I'm not looking to defend the Nasdaq 100 as an investment choice. But I'm 100% going to follow the numbers and not my heart.

@joe sod Pointing only to the specific isolated data points which support your fixed opinion is pretty much the definition of cherry-picking. For example, you've totally ignored my actual numbers from 2001 to 2020 and now you've moved your focus to 2002 to 2014.

- In case you're wondering (and because I was wondering, and also for sh1ts and giggles) I plugged in 2002-2014 into my spreadsheet for a DCA into the Nasdaq 100 on January 1st of each year, with the same adjustment for inflation. My money would have almost exactly doubled before accounting for currency fluctuations and inflation (which I couldn't be bothered to check because you clearly don't care what the numbers say anyway).