Steven Barrett

Registered User

- Messages

- 5,274

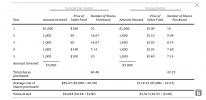

You have 12 contributions in that 1 year. One of them is invested for 1 year. One of them is invested for 1 month, 1 for 2 months etc. You need to give your investments time.The bigger Mercer pension I no longer contribute to. My current Aon one in new job, I am trying to pay as much as possible into. % salary plus AVCs My intention is to build this up quickly. So far in 1 year in new job with Aon pension, its in the negative

When it comes to time, investing and gambling are polar opposites. With gambling, you are more likely to win in the short term but the longer your gamble, the more likely the house wins. It is the opposite with investing. You have a greater chance of losing in the short term but the longer you leave your money there, the less likely you are to lose.

Were you in the wrong type of fund in the first place? It's very easy to invest in equities when you are getting double digit returns. You only truly find out your true risk appetite when your fund is falling in value.I see the general advice here is to hold tough and wait for upswing, but I'm understandably jittery with this advice.

Thanks for all responses. I really appreciate this platform.

Steven

http://www.bluewaterfp.ie (www.bluewaterfp.ie)