You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Valuing stocks using the Benjamin Graham Formula.

- Thread starter extramild

- Start date

Hi folks,

This formula has cropped up in a couple of value investing books

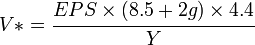

V* = EPS X (8.5+2g) X 4.4 / Y

It is essentially used to determine value,

Has anyone used it, ran any tests with it, found it to be any use?

Regards

Extramild

It would be useful to know what g and Y stand for and what industrial context it is being used, but that aside I would never start with EPS as a means to value a company for investment purposes.

Some explaination of inputs

Formula: Intrinsic value = E × (2g + 8.5) × 4.4/Y

E is the current annual earnings per share.

g is the annual earnings growth rate — 5 percent would be figured as a

“5.” (Graham would have suggested using a conservative number for

growth.)

8.5 is the base P/E ratio for a stock with no growth.

Y is the current interest rate, represented as the average rate on highgrade corporate bonds. Note that lower bond rates make the intrinsic

value higher, as future earnings streams are worth more in a lower

interest rate environment.

Take Hewlett-Packard as an example. With current earnings (trailing 12

months) of $2.30 per share, a growth rate of 10 percent, and a corporate bon

interest rate of 6 percent, the intrinsic value is

$2.30 × [(2 × 10)+8.5)] × (4.4/6)

or $48.07 per share

BTW - this is taken from Value Investing for Dummies, I have the book in pdf version, if anybody wants it if they PM me and I can email it onto them if you are interested.

Regards

Extra

Formula: Intrinsic value = E × (2g + 8.5) × 4.4/Y

E is the current annual earnings per share.

g is the annual earnings growth rate — 5 percent would be figured as a

“5.” (Graham would have suggested using a conservative number for

growth.)

8.5 is the base P/E ratio for a stock with no growth.

Y is the current interest rate, represented as the average rate on highgrade corporate bonds. Note that lower bond rates make the intrinsic

value higher, as future earnings streams are worth more in a lower

interest rate environment.

Take Hewlett-Packard as an example. With current earnings (trailing 12

months) of $2.30 per share, a growth rate of 10 percent, and a corporate bon

interest rate of 6 percent, the intrinsic value is

$2.30 × [(2 × 10)+8.5)] × (4.4/6)

or $48.07 per share

BTW - this is taken from Value Investing for Dummies, I have the book in pdf version, if anybody wants it if they PM me and I can email it onto them if you are interested.

Regards

Extra

Here are the problems with this kind of calculation

- EPS is prone to manipulation and you need have a good knowledge of accounting to be able to adjust this down to a normalised figure.

- Why a P/E of 8.5, tech companies usually have higher P/Es while banks and insurance companies have much lower ones

- A growth rate of 10%, how so - the economic outlook is more like 2% or less, so how can you expect HP to grow so much faster given their product pipeline?

It is just not that simple!!!

Just to give you an idea, for me to figure out the EPS figure alone would take me a few days of analysis and then you have still got to come up with the others.

- EPS is prone to manipulation and you need have a good knowledge of accounting to be able to adjust this down to a normalised figure.

- Why a P/E of 8.5, tech companies usually have higher P/Es while banks and insurance companies have much lower ones

- A growth rate of 10%, how so - the economic outlook is more like 2% or less, so how can you expect HP to grow so much faster given their product pipeline?

It is just not that simple!!!

Just to give you an idea, for me to figure out the EPS figure alone would take me a few days of analysis and then you have still got to come up with the others.

Hi Jim - Thanks for the reply.

To answer your question directly

1. I would just average off the EPS for say 5 years and use that figure. If I suspected the published EPS figure to be open to maniplulation by a particular company I simply would pass on that company and invest in one I could trust.

You are not telling me you would invest in a company if you felt you could not trust their published EPS figure?

2. Why 8.5 - According to Graham that is about right to pay for a stock with no growth. It is an average I guess

3 A growth rate of 10% - i don't expect HP to grow at 10%. I was using this as example. You are correct most company grow at the rate of GNP expansion. The better ones more the poor ones less. The book I took this from was published in 2008 so things have changed since then for HP.

I guess Jim what you are saying is that you would have no truck with this calculation at all or would you see any worth in it at all?

To answer your question directly

1. I would just average off the EPS for say 5 years and use that figure. If I suspected the published EPS figure to be open to maniplulation by a particular company I simply would pass on that company and invest in one I could trust.

You are not telling me you would invest in a company if you felt you could not trust their published EPS figure?

2. Why 8.5 - According to Graham that is about right to pay for a stock with no growth. It is an average I guess

3 A growth rate of 10% - i don't expect HP to grow at 10%. I was using this as example. You are correct most company grow at the rate of GNP expansion. The better ones more the poor ones less. The book I took this from was published in 2008 so things have changed since then for HP.

I guess Jim what you are saying is that you would have no truck with this calculation at all or would you see any worth in it at all?

Thanks vandriver.

Benjamin Graham Formula

The original formula from Security Analysis is

where V is the intrinsic value, EPS is the trailing 12 month EPS, 8.5 is the PE ratio of a stock with 0% growth and g being the growth rate for the next 7-10 years.

However, this formula was later revised as Graham included a required rate of return.

The formula is essentially the same except the number 4.4 is what Graham determined to be his minimum required rate of return. At the time of around 1962 when Graham was publicizing his works, the risk free interest rate was 4.4% but to adjust to the present, we divide this number by today’s AAA corporate bond rate, represented by Y in the formula above.

M

mercman

Guest

3 A growth rate of 10% - i don't expect HP to grow at 10%.

And why not ?? I'd say they could easily surpass their present price from the low they are at the moment

And why not ?? I'd say they could easily surpass their present price from the low they are at the moment

We're not talking about price growth...

And why not ?? I'd say they could easily surpass their present price from the low they are at the moment

I wanted to talk about the formula and not HP but to answer your question directly as a contractror and as a direct employee I have worked for HP for about 7 years of my career in IT.

A great company when it was run by engineers with vision but done down by lack of focus and empire building.

It makes a tonne of money out of printer cartridges and very little out of anything else. It printer business is slowly being erroded by competation leaving loss making hardware sector and a services devision unable to complete with IBM/Dell.

Anyway back to main point what do you think of the formula?

M

mercman

Guest

Anyway back to main point what do you think of the formula?

IMO the formula may work fine, but there are so many different aspects and newsflow which drive prices up or down, it is impossible to use one technique to make any investment decision. How many times have the investment community read in the past few years about Buy and Hold. It is all a matter of personal investor choice and direction they choose to run with.