You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Where should I invest €70k for three years?

- Thread starter deco87

- Start date

podgerodge

Registered User

- Messages

- 1,035

Oh looking at those figures I may re think …..again !!thank you podgerodge@deco87 is there a reason you would pick the state savings giving you €2,800 instead of PTSB giving you €4,352?

PTSB 3 Year Deposit Scheme is best deposit rate in an Irish bank. Its compounding too with 3% AER so final return just over 9% at end of term and before DIRT.

PTSB have a useful calculator on their website too to show returns.

Just ensure you select Lump Sum then In Branch set up.

PTSB have a useful calculator on their website too to show returns.

Just ensure you select Lump Sum then In Branch set up.

johnny2shoes

Registered User

- Messages

- 42

I have almost €100K in an AIB current account and up to now didn't bother me as there was almost zero interest on deposits.

Today I tried to switch €80k into a deposit account on line with desk top PC. No joy there. No heading etc. Phoned them and was told it could only be done on the App in mobile phone.

Tried that but ran into many obstacles. Rang them and spent the next hour following directions given by a haughty lady who found it difficult to believe that her instructions didn't work. Eventually she decided to seek help at her end and put me on hold for about 10 minutes. We start again but fail at the same page as before.

She now decides that my only option is a personal appointment at my local branch and puts me on hold while she phones

them. Comes back to me to say good bye and apologise for the failure.

Five minutes later my bank rings my land line and I say Hello in response to the question 'is that Mr xxxxxxx. She can't hear

me and hangs up. Now she rings my mobile and asks do I need an appointment to open a deposit account.

She then asks me to hang on while she consults her diary. Next Wednesday is the 1st available date before anybody in my local branch of AIB will meet me.

I find it almost incredible the security layers AIB have in place. Nobody can access my account on line with a PC or Lap top as I have to OK the access with my phone. Having got access they won't allow me open a Deposit Account here but on the phone they tell me this is allowed through the AIB App on my phone. From above we know that this failed even with the help of somebody from head office.

I presume I'm not alone with this AIB problem ? Are Bank of Ireland just as impossible with security layers that don't work?

Today I tried to switch €80k into a deposit account on line with desk top PC. No joy there. No heading etc. Phoned them and was told it could only be done on the App in mobile phone.

Tried that but ran into many obstacles. Rang them and spent the next hour following directions given by a haughty lady who found it difficult to believe that her instructions didn't work. Eventually she decided to seek help at her end and put me on hold for about 10 minutes. We start again but fail at the same page as before.

She now decides that my only option is a personal appointment at my local branch and puts me on hold while she phones

them. Comes back to me to say good bye and apologise for the failure.

Five minutes later my bank rings my land line and I say Hello in response to the question 'is that Mr xxxxxxx. She can't hear

me and hangs up. Now she rings my mobile and asks do I need an appointment to open a deposit account.

She then asks me to hang on while she consults her diary. Next Wednesday is the 1st available date before anybody in my local branch of AIB will meet me.

I find it almost incredible the security layers AIB have in place. Nobody can access my account on line with a PC or Lap top as I have to OK the access with my phone. Having got access they won't allow me open a Deposit Account here but on the phone they tell me this is allowed through the AIB App on my phone. From above we know that this failed even with the help of somebody from head office.

I presume I'm not alone with this AIB problem ? Are Bank of Ireland just as impossible with security layers that don't work?

Gordon Gekko

Registered User

- Messages

- 7,373

An Irish 2027 bond.

Thank you I’m about to do this -PTSB 3 Year Deposit Scheme is best deposit rate in an Irish bank. Its compounding too with 3% AER so final return just over 9% at end of term and before DIRT.

PTSB have a useful calculator on their website too to show returns.

Just ensure you select Lump Sum then In Branch set up.

It’s as safe as the credit union they tell

Me - 100k state guaranteed - that was my major worry thks

Wow@deco87

Have you considered the State Savings 10-Year Solidarity Bond?

22% return if left on deposit for the full 10 years

No DIRT due

Easy withdrawal with 7 days notice

So, for €70k that would = €15,400 in interest (they call it a 'bonus') after 10 years

That’s a great return for sure ! Ah it’s a bit long time wise for me - thanks so much for letting me know

2.01% AER for a 10 year term isn't really a great return.Wow

That’s a great return for sure ! Ah it’s a bit long time wise for me - thanks so much for letting me know

They call it 'interest' here:So, for €70k that would = €15,400 in interest (they call it a 'bonus') after 10 years

Ireland State Savings - 10 Year National Solidarity Bond | Products | State Savings

Our 10 year National Solidarity Bond is a secure and straight forward way to save, offering the highest return of our products.

Year 10 AER2.01% Interest22.00% Your Return€1,220.00

Is that 1.220 over 10 years !!!!They call it 'interest' here:

Ireland State Savings - 10 Year National Solidarity Bond | Products | State Savings

Our 10 year National Solidarity Bond is a secure and straight forward way to save, offering the highest return of our products.www.statesavings.ie

What better / safe / equivalent deposit returns are out there over 10 years?2.01% AER for a 10 year term isn't really a great return.

Irish life is tied agent with PTSB. Is an investment with Irish Life separate to investment in PTSB in terms of the bank compensation scheme? (e.g. if 70k in both Irish Life and PTSB - is each treated separately).

You'd have to check the exact wording of investment agreement but I would think if you're being referred to Irish Life your exposure would be with them and not PTSB. So it would not be covered by the DGS. In general:

PTSB is a bank so a deposit would be covered by the DGS i.e., deposits up to €100k are fully covered.

Irish life is not a bank so it's not covered by the DGS. In the event of their failure I presume they would be covered by the investor compensation fund i.e., 90% of the first €20k would be covered.

Explainer - What compensation schemes protect consumers of authorised firms?

A central part of the Central Bank of Ireland’s mandate is to protect consumers. One of the ways we do this is by overseeing a number of important compensation schemes which protect consumers of authorised financial firm. Read our full explainer here.

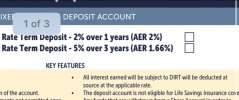

Sorry now !!!! Just saw this last minute -message from my credit union!!

5% max 50k though ! 3 years - deposit -

Would I better off doing this with 50 k then 20 into TSB.

Sorry for late insert !!!

Oh what would 50 k be worth after dirt after 3 years - at 5% thanks

5% max 50k though ! 3 years - deposit -

Would I better off doing this with 50 k then 20 into TSB.

Sorry for late insert !!!

Oh what would 50 k be worth after dirt after 3 years - at 5% thanks

Attachments

Which credit union is this? ThanksSorry now !!!! Just saw this last minute -message from my credit union!!

5% max 50k though ! 3 years - deposit -

Would I better off doing this with 50 k then 20 into TSB.

Sorry for late insert !!!

Oh what would 50 k be worth after dirt after 3 years - at 5% thanks

Do you know if this is available for under 18 year olds and do you need to have an existing/other account with PTSB. Website is very poor! Thank you.By comparison, 3 years fixed with PTSB would earn 4,352 after DIRT

Last edited: