Nicklesilver

Registered User

- Messages

- 57

Jante Yellen is proposing taxing unrealised capital gains in the US, could it catch on here?

could it catch on here?

Bonds are the means by which government funds everything, it's how they came up with 40 billion euros to pay for covid. If they did that it would cause a sell off in the bond market, a rise in interest rates and be a disaster for governments like Ireland. Surely they would also need to introduce it for investment properties as well then?Hopefully they don't try and widen that to include shares and bonds :mad:

marginalrevolution.com

marginalrevolution.com

It could be that at least half of the planned revenue from the policy would have come from ten individuals only. Fortunately, it is looking as if .According to Zucman’s analysis, Musk would pay as much as $50 billion under the tax over its first five years, while Bezos could pay as much as $44 billion.

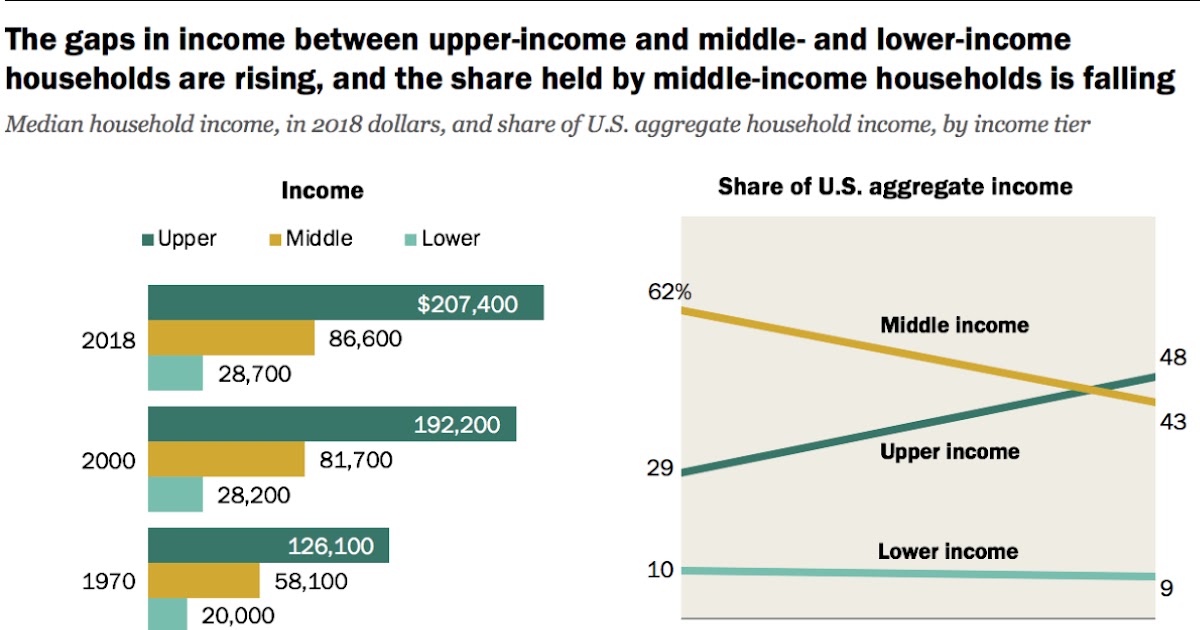

I agree with that but this;It's a pretty obvious way to rebalance an ecomomy which is, seriously, tilted towards those who accumulate capital.

seems like a bit of a blunt instrument.It should be extended and CGT should be the same as taxes on work. ( 20% on first 30k, then 40% on the rest). CGT should be applied to all assets, including the primary residence.

Why should someone accumulate €30,000 a year tax free simply due to property price inflation when someone with no property who is trying to save a deposit has to earn €60,000 to end up with that same €30k?Should CGT rates = income tax rates?

So if I work, and pay 48.5% marginal income tax (say 30% effective tax rate), and then purchase assets from that taxed income, any gain in the value of the asset should also be taxed at 48.5%??

I agree with that but it runs far deeper than the government. The mistake we make is thinking that they can actually change things. They can't. The vested interests are too deep rooted. No government can dig them out.My problem is that all the talk is for more taxes and more spending. Not about growing the economy and cutting waste, eg the childrens hospital. Ireland is not well run despite our politicians being the highest paid. The state is growing quicker than the wealth creation which pays for it.

And how do we propose to tax this notional gain of 30k!!Why should someone accumulate €30,000 a year tax free simply due to property price inflation when someone with no property who is trying to save a deposit has to earn €60,000 to end up with that same €30k?

Inherited wealth is creating a very two-tier society. Unless we're going to give a council house to everyone who doesn't inherit one we have to do something different. A good start would be to tax the gain as an estate tax when granny dies. Then their kids/grandkids can pick over what's left.

Yes we do, but it can roll over until it's sold.And how do we propose to tax this notional gain of 30k!!

Thís sort of thinking that sees a house as just an asset is what's kinda wrong with our attitude to housing...its a home fundamentally. We all need to live somewhere..a wee 2 up/down in Manor Street in Dublin is suddenly worth 500k is not the fault of the person who bought it in the last recession for 250k.

Do we tax this 250k gain on individuals earning the industrial wage of 45k each!!

High income taxes are a bigger disincentive to work. We can't attract talent because there's nowhere to live and income taxes are too high. As long as we conflate income and wealth we'll have a narrow unbalanced taxation system.It appears that it’s not going ahead in the US. Moderate democrats are against it. All the billionaires will just leave.

we should never forget that capital is mobile. If Irish taxes keep increasing money and business and smart people will go to where they get the highest return. Basic economics. Basis of the EU.