You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

KBC KBC told brokers" all fixed rate loans will roll onto trackers on expiry"

- Thread starter PadKiss

- Start date

- Status

- Not open for further replies.

I doubt anybody in 2006 thought that a fixed-rate borrower wouldn't be able to roll over to a tracker on expiry of their fixed-rate period. Not quite the same thing as saying that a borrower would have a contractual right to do so.

Would borrowers have even seen the flyer to brokers?

Good PR though.

Would borrowers have even seen the flyer to brokers?

Good PR though.

Brendan Burgess

Founder

- Messages

- 55,343

Covered in today's Indo by Charlie Weston

Discovery of document leaves KBC facing fresh tracker calls

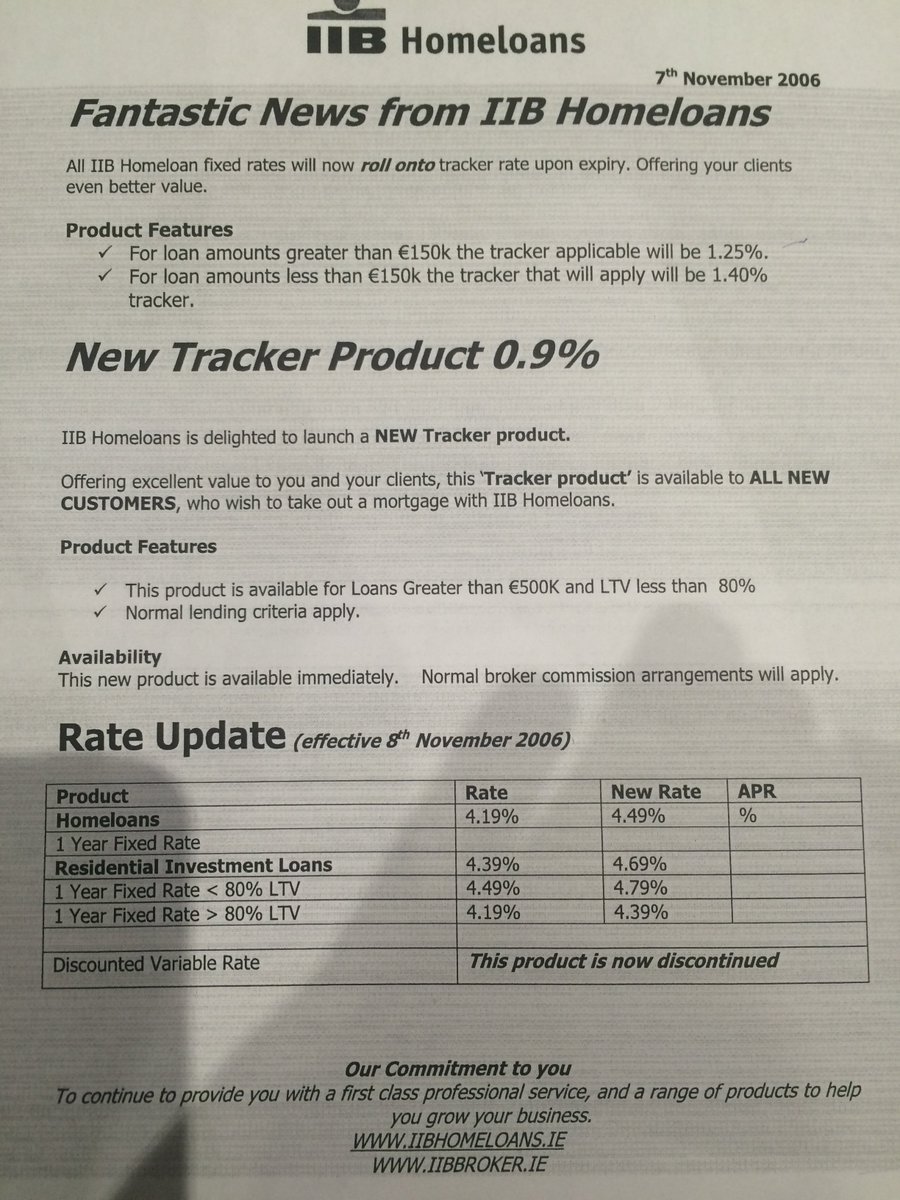

In November 2006 the bank sent brokers a circular entitled "Fantastic News from IIB Homeloans," document obtained by RTE News show.

The document states: "All IIB Homeloan fixed rates will now roll onto tracker rate upon expiry. Offering your clients even better value."

Hi Sarenco

Well if they were on a fixed rate in 2006, that did not expire until 2009, they would not have been able to roll onto trackers unless it was in their contract.

Let's examine the general point.

In 2006, Johnny, a customer of KBC, fixed. They didn't see this flyer. But their Fixed Rate Agreement said they would go onto SVR. Which would take precedence? What if their broker told them that they could get a tracker on expiry of the fixed and showed them the flyer?

Let's say Mary fixed in 2005. This flyer came out in 2006 after she fixed.. Her FRA said she would move onto the SVR. She didn't see the flyer either, but her broker told her about it. Again, not sure.

Today, KBC's ads claim to have the lowest repayments over the full life of the mortgage. That is blatantly untrue, so would a KBC customer have a right to lower repayments as a result?

I think that the flyer raises questions. But I don't think it's a game changer.

Discovery of document leaves KBC facing fresh tracker calls

In November 2006 the bank sent brokers a circular entitled "Fantastic News from IIB Homeloans," document obtained by RTE News show.

The document states: "All IIB Homeloan fixed rates will now roll onto tracker rate upon expiry. Offering your clients even better value."

I doubt anybody in 2006 thought that a fixed-rate borrower wouldn't be able to roll over to a tracker on expiry of their fixed-rate period. Not quite the same thing as saying that a borrower would have a contractual right to do so.

Hi Sarenco

Well if they were on a fixed rate in 2006, that did not expire until 2009, they would not have been able to roll onto trackers unless it was in their contract.

Let's examine the general point.

In 2006, Johnny, a customer of KBC, fixed. They didn't see this flyer. But their Fixed Rate Agreement said they would go onto SVR. Which would take precedence? What if their broker told them that they could get a tracker on expiry of the fixed and showed them the flyer?

Let's say Mary fixed in 2005. This flyer came out in 2006 after she fixed.. Her FRA said she would move onto the SVR. She didn't see the flyer either, but her broker told her about it. Again, not sure.

Today, KBC's ads claim to have the lowest repayments over the full life of the mortgage. That is blatantly untrue, so would a KBC customer have a right to lower repayments as a result?

I think that the flyer raises questions. But I don't think it's a game changer.

I think the flyer just adds to the case and would certainly mean that anyone fixing after November 7th would / should immediately be pu onto the stated tracker of 1.25% / 1.4% as stated.

For those who fixed before 7th Nov, it would suggest that IIB did not purposely put the SVR condition, but that it simply was copied and pasted from similar fixed rates contracts from before trackers were the norm.

Obviously it came up in some meeting at some stage and someone challenged it and they decided to put the flyer out to allay any confusion. - So theorectically you can apply it to fixed rates before Nov 7th, but only as additional eveidence rather that a solid single piece game changer.

So if you fixed after Nov 7th and you worked via a broker - you can demand the stated tracker rate now. If like ost of us and yiou fixed June/July/August its still a waiting game.

Howveer, if the source of the flyer had any other documentation to say that the rolloer to tracker would allpy to clients he/she already had organised fixed rates for, well that's a different story.

In any case, the train is gathering speed.

For those who fixed before 7th Nov, it would suggest that IIB did not purposely put the SVR condition, but that it simply was copied and pasted from similar fixed rates contracts from before trackers were the norm.

Obviously it came up in some meeting at some stage and someone challenged it and they decided to put the flyer out to allay any confusion. - So theorectically you can apply it to fixed rates before Nov 7th, but only as additional eveidence rather that a solid single piece game changer.

So if you fixed after Nov 7th and you worked via a broker - you can demand the stated tracker rate now. If like ost of us and yiou fixed June/July/August its still a waiting game.

Howveer, if the source of the flyer had any other documentation to say that the rolloer to tracker would allpy to clients he/she already had organised fixed rates for, well that's a different story.

In any case, the train is gathering speed.

Brendan Burgess

Founder

- Messages

- 55,343

I think the flyer just adds to the case and would certainly mean that anyone fixing after November 7th would / should immediately be pu onto the stated tracker of 1.25% / 1.4% as stated.

If you fixed after 7th November and made your decision based on this flyer, then you have a very strong case. You would have to overcome the problem of why you signed a Fixed Rate Agreement that conflicted with the flyer.

But if you have an email from your broker at the time telling you that you would get a tracker after your fixed rate expires, and you fixed based on the strength of that, then you have a good case.

Brendan

But the fact that the flyer says "all IIb home loan fixed rates will now roll into tracker" , should that statement not cover every case even if they fixed before Nov 06? To me that would state that all trackers that were fixed , regardless of when fixed, should roll onto tracker, as they say "offering your clients even better value"

I think that the flyer raises questions. But I don't think it's a game changer.

I wouldn't even go that far Brendan.

Here's the flyer:-

When read in the context of the document as a whole, it's clear to me that all it's saying is that all fixed rates that expired at that time (back in 2006) would roll onto the specified tracker rates. That's hardly news - we know that all banks continued to allow fixed-rate borrowers to roll onto tracker rates as late as summer 2008.

The document certainly doesn't contain any commitment or assurance that this offer would necessarily be extended to borrowers that chose to fix at that time (November 2006). It isn't even an advertisement for their fixed-rate products.

More of a damp squib than a smoking gun.

I'm surprised that RTE ran the story to be honest - I can't see anything in it.

I wouldn't even go that far Brendan.

Here's the flyer:-

When read in the context of the document as a whole, it's clear to me that all it's saying is that all fixed rates that expired at that time (back in 2006) would roll onto the specified tracker rates. That's hardly news - we know that all banks continued to allow fixed-rate borrowers to roll onto tracker rates as late as summer 2008.

The document certainly doesn't contain any commitment or assurance that this offer would necessarily be extended to borrowers that chose to fix at that time (November 2006). It isn't even an advertisement for their fixed-rate products.

More of a damp squib than a smoking gun.

I'm surprised that RTE ran the story to be honest - I can't see anything in it.

Flyer is quite clear if you are talkiing about fixed rate in the flyer starting after 7th November. Take the fixed rate as detailed in the flyer and you roll off onto the tracker rates detailed.

It would be interesting if any broker has a client that fixed after November 7th 2006 and see what the fixed rate instruction was and what differences here are between that insruction and instructions prior.

But I would agree that its not a game changer, but it just adds more substance to the Central Bank review and I presume a copy of it has been sent in to the relevant investigation team.

Flyer is quite clear if you are talkiing about fixed rate in the flyer starting after 7th November. Take the fixed rate as detailed in the flyer and you roll off onto the tracker rates detailed.

You would really have to artificially stretch the language to arrive at anything like that interpretation.

I don't agree that the flyer adds more substance to any argument - it's a non-event.

Again great work by Padriac at approaching this.

Can I ask if anyone knows when did KBC start using the word "tracker"? I haven't seen it once in any of my documents I signed in 2006.

I think what we need to know is was the "variable rate" I signed for in 2006 the actual "standard variable rate" that IIB offered everyone at the time. If so that is clearly the misleading part.

Can I ask if anyone knows when did KBC start using the word "tracker"? I haven't seen it once in any of my documents I signed in 2006.

I think what we need to know is was the "variable rate" I signed for in 2006 the actual "standard variable rate" that IIB offered everyone at the time. If so that is clearly the misleading part.

hockeygirl

Registered User

- Messages

- 1

Hi everyone, I'm following your thread as I too was a KBC fixed interest customer but now on variable rate. I was going through my mortgage documents and came across the product brochure. It definitely had tracker in the brochure. I drew down in Nov 2006 but the book was given to me in June 2006. Hope that helps pcoleman.

Brendan Burgess

Founder

- Messages

- 55,343

More of a damp squib than a smoking gun.

It's not a game changer, but I don't agree that it's a damp squib.

To be fair, I am not sure what that flyer means.

If KBC had vague wording in their Fixed Rate Agreement, then I think that the vague wording in this would certainly lead a borrower to have a legitimate expectation that they were going to be put on a tracker at a specific margin.

If the Fixed Rate Agreement was clear, then this flyer won't help very much.

If the Fixed Rate Agreement or original mortgage said "prevailing rate", then I think that the borrowers can claim the 1.25% and 1.4% rates with some justification.

If the broker says that he sold the KBC mortgage because of this flyer, then it would also help.

Brendan

This attracted my interest on Friday when I read the Indo.

We took out a mortgage in Jan 07 with IIB and decided to fix for 3 years @ 5.45 . When that term was up in 2010, trackers were off the table and 'hard cheese' was what we thought..

I spent this morning reading our documents from 07, and it mentions reverting to prevailing interest rate at end of the fixed term. Is that relevant? And does the fact that we never had a tracker mean I've no business looking for one now?..even with of this flyer coming to light from November 06.

We took out a mortgage in Jan 07 with IIB and decided to fix for 3 years @ 5.45 . When that term was up in 2010, trackers were off the table and 'hard cheese' was what we thought..

I spent this morning reading our documents from 07, and it mentions reverting to prevailing interest rate at end of the fixed term. Is that relevant? And does the fact that we never had a tracker mean I've no business looking for one now?..even with of this flyer coming to light from November 06.

Brendan Burgess

Founder

- Messages

- 55,343

I met someone yesterday who had a complaint in with the FSO.

He fixed in Dec 2006 and was told by KBC that when the fixed rate ended, he would go onto a tracker. He didn't pay any attention to the Fixed Rate Agreement. He remembers the call but has no further details. The FSO rejected his complaint.

Although he was not aware of the letter to the brokers, it does back up his story that it was their policy to switch people to trackers.

Brendan

He fixed in Dec 2006 and was told by KBC that when the fixed rate ended, he would go onto a tracker. He didn't pay any attention to the Fixed Rate Agreement. He remembers the call but has no further details. The FSO rejected his complaint.

Although he was not aware of the letter to the brokers, it does back up his story that it was their policy to switch people to trackers.

Brendan

I don't think anybody would dispute that KBC's policy was to allow borrowers to roll over to trackers in 2006 on the expiry of their fixed rate terms.

However, that doesn't mean that borrowers ever had a contractual right to roll over to trackers or that KBC ever committed to keep this policy in place for any specific period.

Nothing in the flyer changes anything in this regard, IMO.

However, that doesn't mean that borrowers ever had a contractual right to roll over to trackers or that KBC ever committed to keep this policy in place for any specific period.

Nothing in the flyer changes anything in this regard, IMO.

- Status

- Not open for further replies.