moneymakeover

Registered User

- Messages

- 910

I have been considering how to allocate

my pension , what risk to take

One rationale regarding investing in equities is: we can depend on one thing: currency devaluing.

Every time there is a crisis governments across the world will respond by printing money.

The value of the sp500 (say 4400) market cap is around $38 trillion.

Economic activity has been reduced if anything during the pandemic and yet it has doubled over past 5 years.

Further money printing, in the next crisis will see the markets go even higher.

I say all this by way of explanation as to why it makes sense to remain invested in equities long term in a pension portfolio.

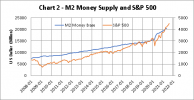

To illustrate,

seekingalpha.com

seekingalpha.com

my pension , what risk to take

One rationale regarding investing in equities is: we can depend on one thing: currency devaluing.

Every time there is a crisis governments across the world will respond by printing money.

The value of the sp500 (say 4400) market cap is around $38 trillion.

Economic activity has been reduced if anything during the pandemic and yet it has doubled over past 5 years.

Further money printing, in the next crisis will see the markets go even higher.

I say all this by way of explanation as to why it makes sense to remain invested in equities long term in a pension portfolio.

To illustrate,

Money Supply: A Good Predictor For S&P 500 Index

The relation between the stock market and money supply is examined at different lags to formulate a predictive model for the stock market.

Last edited: