I have about a year to go to my 65th birthday and taking benefits from my DB pension.

I have been getting annual valuations and from last year to this year the TV has dropped a massive 17% (down from €541,930 to €450,418).

Previous to that the TV had been going up very nicely from year to year. And while I have a basic understanding of why the TV has dropped, I was still shocked to see over €100,000 chopped off the figure.

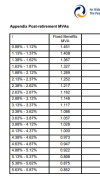

I had been thinking that a TV just before retirement date was going to be best for me but given the dramatic fall in value, it is now looking like I’d be better off sticking with the deferred pension (€24,230).

That is unless something dramatically positive happens in the next short few months.

Anybody have any views on what is likely to happen by April next year? Any possibility the TV might revert to something like last year’s value? Or is it more likely that there will be a further drop in value?

In any event, anybody with a DB pension, be forewarned that your TV is most likely drastically reduced from a previous valuation.

I have been getting annual valuations and from last year to this year the TV has dropped a massive 17% (down from €541,930 to €450,418).

Previous to that the TV had been going up very nicely from year to year. And while I have a basic understanding of why the TV has dropped, I was still shocked to see over €100,000 chopped off the figure.

I had been thinking that a TV just before retirement date was going to be best for me but given the dramatic fall in value, it is now looking like I’d be better off sticking with the deferred pension (€24,230).

That is unless something dramatically positive happens in the next short few months.

Anybody have any views on what is likely to happen by April next year? Any possibility the TV might revert to something like last year’s value? Or is it more likely that there will be a further drop in value?

In any event, anybody with a DB pension, be forewarned that your TV is most likely drastically reduced from a previous valuation.