Brendan Burgess

Founder

- Messages

- 54,685

Looking at these rates for a friend who is paying 5% to Finance Ireland

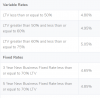

Variable rates

ICS has clearly the lowest rate. Even after their initial charges, they are still cheaper. They charge Legal Fees

€1,168.50 + Outlays and an Application Fee 0.5% of the loan amount. This is capped at €1,500.

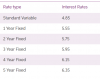

The cheapest fixed rate seems to be AIB 1 year at 5.55%.

ICS seems to be the clearest and the lowest and probably the most flexible.

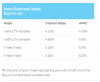

www.icsmortgages.ie

www.icsmortgages.ie

3.75% for <60% capital and interest.

For a €150k loan, they charge initial fees of €2,000 which is an upfront fee of 1.3% or about 0.3% a year over 5 years.

Ulster Bank sets out their rates clearly as well but they are very expensive

digital.ulsterbank.ie

digital.ulsterbank.ie

At least, they are tied to their SVR, so that is some protection from arbitrary increases.

Bank of Ireland does not seem to quote the rates on their website.

Worse, it appears to me that if you follow the links on their https://personalbanking.bankofireland.com/borrow/mortgages/investor/why-boi/

investor page, they bring you to the home loan rates.

AIB is very clear and simple, if expensive.

It's bizarre in my opinion that they complain about the difficulty in repossessing properties and yet they don't appear to have different rates for different LTVs. Maybe if the top LTV is 70%, there isn't much difference between 70% and 50%?

Variable rates

ICS has clearly the lowest rate. Even after their initial charges, they are still cheaper. They charge Legal Fees

€1,168.50 + Outlays and an Application Fee 0.5% of the loan amount. This is capped at €1,500.

The cheapest fixed rate seems to be AIB 1 year at 5.55%.

ICS seems to be the clearest and the lowest and probably the most flexible.

Rates | ICS Mortgages | Residential Mortgages

The ICS Brand was established in 1864 and has remained a leading and trusted brand in the mortgage market throughout its 150-year history.

3.75% for <60% capital and interest.

For a €150k loan, they charge initial fees of €2,000 which is an upfront fee of 1.3% or about 0.3% a year over 5 years.

Ulster Bank sets out their rates clearly as well but they are very expensive

Mortgage Rates | Fixed, Variable, Buy-To-Let | Ulster Bank

Ulster Bank Ireland DAC is no longer accepting any new application requests from personal customers. There are some exceptions to this for existing customers, visit our website for further information.

At least, they are tied to their SVR, so that is some protection from arbitrary increases.

Bank of Ireland does not seem to quote the rates on their website.

Worse, it appears to me that if you follow the links on their https://personalbanking.bankofireland.com/borrow/mortgages/investor/why-boi/

investor page, they bring you to the home loan rates.

AIB is very clear and simple, if expensive.

It's bizarre in my opinion that they complain about the difficulty in repossessing properties and yet they don't appear to have different rates for different LTVs. Maybe if the top LTV is 70%, there isn't much difference between 70% and 50%?

Attachments

Last edited: