You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Where should I invest €70k for three years?

- Thread starter deco87

- Start date

State savings are tax free.presume DIRT will be due

Inflation outstripping deposit or state savings returns.is there anything negative I should be concerned about here ?

podgerodge

Registered User

- Messages

- 1,062

Making up for no Dirt, the 3 year is still less than 2% per year. The first interest rates shown are the total of ALL the years.LAST QUERY - I wonder about this ? Sounds very good - feels very safe - presume DIRT will be due - is there anything negative I should be concerned about here ? Thank you , all.View attachment 8070

Not much you can do about that I suppose ? Would it still be better than leaving it in credit unions with very minimal dividend return ?Inflation outstripping deposit or state savings returns.

Well fair play , I had no idea about that - best to stick with the bank then , I reckon even with dirt ?Making up for no Dirt, the 3 year is still less than 2% per year. The first interest rates shown are the total of ALL the years.

The thread title is about "investing".Not much you can do about that I suppose ? Would it still be better than leaving it in credit unions with very minimal dividend return ?

Putting money on deposit isn't really investing.

The returns in real terms are almost guaranteed to be marginal if not negative once inflation is factored in.

Hi clubman , thanks for your reply indeed with inflation - I wouldn’t expect much return. The reason I put it in the - deposit - thread was , that I want to make a deposit to a financial institution in order to achieve a return. As I say the return is almost negative now. I would like to put a deposit in a place where it will be safe and perhaps provide some return - it’s a lot is money to me and it would be nice to get some return. This post has been brilliant as I now know about DIRT - what I could expect to receive depending on where I put the money - the best return that my investment / deposit , may make for me -The thread title is about "investing".

Putting money on deposit isn't really investing.

The returns in real terms are almost guaranteed to be marginal if not negative once inflation is factored in.

Based on the advice I have received here I feel ready to make the change with the knowledge my retirement money may make some return in the next couple years rather than near enough nil over the last couple- in the knowledge I won’t lose it -

Thank you to the contributors and any further / advice /guidance, is most appreciated - thanks

Afraid !!!!!What about sticking it in one of the online brokers like Trade Republic or Lifeyear?

Afraid !!!!!

Of what if I may ask? Of them going busted?Afraid !!!!!

Dunno - no idea of guarantees etc - I’m happy enough with the banks here and the 100k gaurantee- just a bit of return with no risk is what I’m after , thanks thoughOf what if I may ask? Of them going busted?

Attachments

So, to summarise you want a deposit, and you want to stick to Ireland. I hope this helps:Well fair play , I had no idea about that - best to stick with the bank then , I reckon even with dirt ?

The State Savings are DIRT free, but as mentioned some of the Irish Banks are paying more, even after DIRT. BUT - if you've an unexpected need for the money during the term, you can get your money back from State Savings in about 7 days, so you can access the money if you need it.

Of the Irish Banks fixed rates:

- BOI allow you to access 10% of your money without penalty, on 6month, 1 year & 2 year term accounts. But they have the lowest rates.

- PTSB allow access, but have a formula to calculate a break fee.

- AIB do not allow access during the fixed term.

The Credit Unions pay dividends out of their annual 'profit'. Each CU sets it's own dividend rate at the end of each year. They will start paying more than 0.01% dividends, but it will take a while before they get close to the rates offered by the banks.

Remember, you don't have to put it all in 1 account. If you're not sure if you can put it all away for the full 3 years, you can split the money between 1, 2 & 3 years accounts for example.

You'll find the full list of rates updated in the Best Buys, just scroll down to the Irish banks. https://www.askaboutmoney.com/threads/term-deposits-fixed-lump-sum-savings.101813/

That’s a fair summary and very informative Red Onion , thanks - I will follow this advice - 70 c dividend paid on 65k in year 2021 - just rang credit union - that’s very poor thksSo, to summarise you want a deposit, and you want to stick to Ireland. I hope this helps:

The State Savings are DIRT free, but as mentioned some of the Irish Banks are paying more, even after DIRT. BUT - if you've an unexpected need for the money during the term, you can get your money back from State Savings in about 7 days, so you can access the money if you need it.

Of the Irish Banks fixed rates:

For 'demand' money, the An Post book based deposit pays 0.75%, or BOI pay 1% on 30 day notice accounts.

- BOI allow you to access 10% of your money without penalty, on 6month, 1 year & 2 year term accounts. But they have the lowest rates.

- PTSB allow access, but have a formula to calculate a break fee.

- AIB do not allow access during the fixed term.

The Credit Unions pay dividends out of their annual 'profit'. Each CU sets it's own dividend rate at the end of each year. They will start paying more than 0.01% dividends, but it will take a while before they get close to the rates offered by the banks.

Remember, you don't have to put it all in 1 account. If you're not sure if you can put it all away for the full 3 years, you can split the money between 1, 2 & 3 years accounts for example.

You'll find the full list of rates updated in the Best Buys, just scroll down to the Irish banks. https://www.askaboutmoney.com/threads/term-deposits-fixed-lump-sum-savings.101813/

Attachments

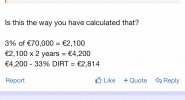

It's close enough for what you're doing.Is this the correct formula to work out interest ?

Thank youIt's close enough for what you're doing.

Ceist Beag

Registered User

- Messages

- 1,462

Click on Savings Calculator at https://www.statesavings.ie/our-products