PLEASE NOTE I AM MIDWAY THROUGH EDITING THIS AND THE CALCS NEED TO BE UPDATED (THIS IS INSANELY COMPLICATED)

Analysis of the interaction between Investment Portfolios and State Pensions[1]

This article considers a potential tax/benefits trap that Irish Financial Planners should consider when recommending a personal investment portfolio (as distinct from a pension or ARF)

I don't profess to be an expert in Social Welfare benefits and the following is based on my interpretation of the current rules as set out here (please feel free to add any constructive criticism)

It should also be noted that Revenue practice in this area is constantly changing and it would be reasonable to assume that nobody knows for certain what the rules will be in the future (including the Department of Employment Affairs and Social Protection)

The purpose of this analysis is to highlight an arbitrage opportunity/planning trap that currently exists.

PRSI

Generally, persons over 16 years and under 66 years are liable to PRSI on all of their different forms of income.

In Budget 2013 it was announced that from 1st January 2014, the exemption from PRSI applying to employed contributors and occupational pensioners aged under 66 years whose only additional income is unearned income, will be abolished. This means that unearned income such as rental income, investment income, dividends and interest on deposits and savings will be liable to PRSI.

This income will now become liable to PRSI at 4% (Tax year 2018) for the above persons provided the person is a chargeable person in accordance with the Revenue definition as detailed below.

Revenue Definition of a chargeable person:

Persons who are "chargeable persons” for income tax purposes under the Taxes Consolidation Act 1997 will be liable. A chargeable person does not include a PAYE taxpayer who

(i) does not have other income or;

(ii) has an element of other insignificant income that is fully taxed through the Revenue Commissioners PAYE system (Revenue regard amounts not exceeding €5,000[2] as insignificant.

Individuals with income exceeding €5000 must pay and file under Revenue's self-assessing system).

“Exclusions from reckonable income

27A. For the purposes of the definition of ‘reckonable income’ in section 2(1), the following items shall not be included in reckonable income in respect of any contribution year commencing on or after 1 January 2004:

(a) any payment in respect of a foreign life policy referred to in section 730J of the Act of 1997,

(b) the amount of any gain arising on a disposal of a foreign life policy referred to in section 730K of the Act of 1997,

(c) any payment received in respect of a material interest in an offshore fund referred to in section 747D of the Act of 1997, and

(d) the amount of any gain arising in respect of a disposal of a material interest in an offshore fund referred to in section 747E of the Act of 1997.”.[3]

PRSI Classes

If you are an employee, your employer deducts your PRSI contribution from your wages. Your employer then submits your contribution and their employer's contribution to the Revenue Commissioners. Your employer must also pay social insurance on your behalf.

If you are self-employed, you pay Class S social insurance. In this case, you pay your social insurance contributions directly to the Revenue Commissioners.

If you are a PAYE worker and have unearned income of over €5,000 you are a chargeable person and you must pay 4% PRSI under Revenue's self-assessment system (Pay and File). Revenue pay the money into the Social Insurance Fund. A record of the contributions you have paid is then sent to the DEASP.

However, if your only source of income is unearned, for example, you have rental income and dividends from shares but no earned income then you will be liable to pay PRSI at Class S

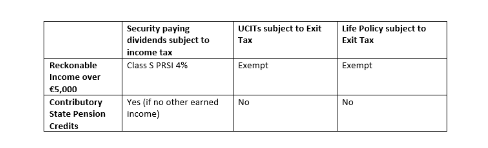

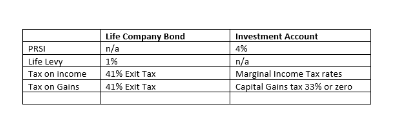

Note that gains on contracts for Life Assurance subject to Exit Tax are exempt from PRSI.

Implications for Financial Advisers

From the table above, we can see that for some investors, paying PRSI can increase their entitlement to the contributory State Pension. Since this does not apply with investments subject to Exit Tax, it follows that an adviser needs to consider the implications of the client’s tax status today as well as their State Pension record when considering the suitability of an investment contract.

The State Pension (Contributory) is paid to people from the age of 66 who have enough Irish social insurance contributions. It is not means-tested. You can have other income and still get a State Pension (Contributory). This pension is taxable but you are unlikely to pay tax if it is your only income.

As the social insurance conditions are very complex you should apply for a State Pension (Contributory) if you have ever worked and have any contributions (stamps) paid at any time. There are a number of pro-rata pensions available to people who paid different types of social insurance contributions or who did not pay contributions because of various reasons (see below).

If you retire early, you should ensure that you continue to pay PRSI contributions or get credited contributions (if eligible) to maintain your entitlement to a pension. If you are getting Jobseeker's Benefit (JB) and are aged between 65 and 66 when your JB would normally end, you may continue to receive it until the age of 66, provided you meet the PRSI requirements.

The Department of Employment Affairs and Social Protection (DEASP) has published FAQs on Qualifying for the State Pension (Contributory) which can help you to work out whether you qualify for a State Pension (Contributory).

Rules

To qualify for a State Pension (Contributory) you must be aged 66 or over and have enough Class A, E, F,G, H, N or S social insurance contributions.

You need to:

1. Have paid social insurance contributions before a certain age

2. Have a certain number of social insurance contributions paid and

3. Have a certain average number over the years since you first started to pay

1. Paid insurance before a certain age

You must have started to pay social insurance before the age of 56.

2. Number of paid contributions

If you reach pension age on or after 6 April 2012, you need to have 520 full-rate contributions (10 years contributions). In this case, only 260 of the 520 contributions may be voluntary contributions.

3. Average number of contributions per year

You must meet the average condition. This is probably the most complex aspect of qualifying for a State Pension (Contributory).

Normal average rule

The normal average rule states that you must have a yearly average of at least 10 appropriate contributions paid or credited from the year you first entered insurance or from 1953, whichever is later to the end of the tax year before you reach pension age (66). An average of 10 entitles you to a minimum pension; you need an average of 48 to get the maximum pension.

Claiming on behalf of an Adult dependent - Income limits

For most social welfare payments your adult dependant cannot have gross weekly earnings or income (before tax and PRSI deductions) of more than €310 (€16,120). If your adult dependant earns less than €100 you will get a full Increase for a Qualified Adult (IQA). If your adult dependant earns between €100 and €310 you will get a reduced rate of IQA (sometimes called a tapered rate of IQA). If your adult dependant is earning more than €310 you will not get an IQA. You can find out what the tapered rate of IQA for your payment is in the Department of Employment Affairs and Social Protection's SW19 (Rates of Payment) booklet.

Credits and homemakers

The Homemaker's Scheme can make it easier for homemakers to qualify for a State Pension (Contributory). If you give up work to look after a child under 12 years of age, or a disabled child, or adult, you can get credits from the date you give up work to the end of that contribution year.

Note

From 6th April 1994, any period spent as a homemaker caring for either a child under 12 or an ill person may be disregarded when calculating your ‘yearly average’. A maximum of 20 years can be disregarded.

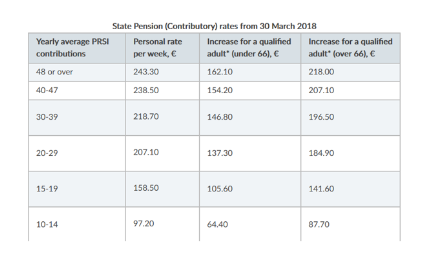

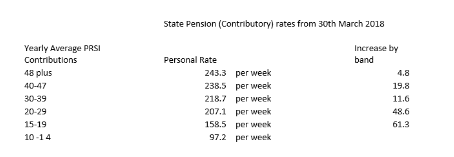

Rates

*Increases for qualified adults are means-tested payments

Example

Jayne is 50 years old and has taken a career break to look after her children.

At this time, she has 17 years Contributory State Pension credits and 18 years to go until the State Pension age. Her children are over the age of 12.

An important element to the calculation for her entitlement to Contributory State Pension is when she FIRST PAID PRSI as the "band" for her State Pension is determined by taking her total contributions between the first date and her reaching 66 and averaging this over the total period.

Let's assume that she made her first contribution in 1992 and it is now 2019 and she will reach age 66 in 2035. So, Jayne has a maximum of 43 years available to her out of a maximum of 48, but 15 of these are disregarded.

Let’s also assume that she had 15 years that will be disregarded as this period was spent caring for a child under 12.

Her denominator for averaging her state pension entitlement is therefore 28 (43-15 disregarded)

She has a joint investment with her husband of €500,000

Analysis

Jayne isn’t working and so isn’t paying PRSI directly via her salary. Her children are over 12 so she is not earning credits from caring for them.

Her adviser is considering a Single Premium Investment Bond from a well-known life insurance company.

Unless she goes to work, Jayne will not earn additional State Pension entitlement. Her investment income is greater than €16,000pa and so she is not entitled to a means tested Increase for a Qualifying Adult.

How might we model the cost of arranging a life assurance contract compared to a more tax efficient solution?

We need to consider Jayne’s marginal rate of income tax and establish if there are any CGT losses which can be carried forward.

Model the effect of the State Pension

Assuming everything else equal, the impact of missing out on additional State Pension credits is more significant for those with under 30 years of PRSI contributions at age 66.

For example, the State Pension entitlement leaps up from €0 to €97.20 per week by increasing average PRSI contributions from 9 to 10 years.

From this we can conclude that as Jayne only has 17 years credits to the Contributory State Pension currently, that each additional year will add either 1/158.5 for the next 2 years or 1/207.10 for the following 10 years and finally 1/218.70 for the final 4 years to age 66.

Her maximum entitlement would be potentially 33 qualifying years averaged over her 28 year PRSI record (see above)

The yearly average is calculated as follows:

Full rate paid contributions and credits

_______________________________

Total contribution years (from 1st PRSI payment to age 66)

In Jayne's example she will potentially have 1,716 weeks contributions over 28 years giving an average of 61 entitled to a full state pension.

Looking at the table this could potentially increase her pension to €238.50per week compared to her current entitlement of 17 years over 28 . (***)

What is the net effect?

We assume a dividend yield of 2%pa on an equity portfolio of €500,000 generating a total gross annual dividend income of €10,000.

So, Jayne’s income is €5,000pa so she is liable to class S PRSI at a rate of 4% on her income.

However, she has to pay 4% of her income subject to a minimum €500pa in tax that would not be payable under the Life Assurance contact (all else equal)

Note that the minimum PRSA payment of €500 is another tax trap.

In Jayne's case, the minimum PRSA payment is an effective rate of tax of 10% rather than the headline PRSI rate of 4%.

However, she potentially improves her State Pension by an average of (€238.50 - €207.10 = €31.40pw) assuming she pays the additional PRSI for the next 16 years.

PRSI Paid = 16 x €500 = €8,000

Breakeven for pension €8000/(€31.40 x 52) = €1,632.8

4.9 years

Jayne only needs to receive payments from her State Pension for 4.9 years to breakeven and recoup the PRSI via the enhanced State Pension payments!

Conclusion

In addition to considering their client’s marginal rate of income tax and any capital gains tax losses carried forward, Financial Advisers need to consider the impact on the client’s State Pension of their recommendation to purchase a Life Assurance Single Premium Bond compared to an Investment Portfolio.

Important

This document has been prepared for information and educational purposes only and should not be relied upon by any individual without seeking specific guidance on the suitability of any course of action for their unique circumstances.

[1] [broken link removed]

[2] Previously €3,174

[3] http://www.irishstatutebook.ie/2004/en/si/0428.html

Analysis of the interaction between Investment Portfolios and State Pensions[1]

This article considers a potential tax/benefits trap that Irish Financial Planners should consider when recommending a personal investment portfolio (as distinct from a pension or ARF)

I don't profess to be an expert in Social Welfare benefits and the following is based on my interpretation of the current rules as set out here (please feel free to add any constructive criticism)

It should also be noted that Revenue practice in this area is constantly changing and it would be reasonable to assume that nobody knows for certain what the rules will be in the future (including the Department of Employment Affairs and Social Protection)

The purpose of this analysis is to highlight an arbitrage opportunity/planning trap that currently exists.

PRSI

Generally, persons over 16 years and under 66 years are liable to PRSI on all of their different forms of income.

In Budget 2013 it was announced that from 1st January 2014, the exemption from PRSI applying to employed contributors and occupational pensioners aged under 66 years whose only additional income is unearned income, will be abolished. This means that unearned income such as rental income, investment income, dividends and interest on deposits and savings will be liable to PRSI.

This income will now become liable to PRSI at 4% (Tax year 2018) for the above persons provided the person is a chargeable person in accordance with the Revenue definition as detailed below.

Revenue Definition of a chargeable person:

Persons who are "chargeable persons” for income tax purposes under the Taxes Consolidation Act 1997 will be liable. A chargeable person does not include a PAYE taxpayer who

(i) does not have other income or;

(ii) has an element of other insignificant income that is fully taxed through the Revenue Commissioners PAYE system (Revenue regard amounts not exceeding €5,000[2] as insignificant.

Individuals with income exceeding €5000 must pay and file under Revenue's self-assessing system).

“Exclusions from reckonable income

27A. For the purposes of the definition of ‘reckonable income’ in section 2(1), the following items shall not be included in reckonable income in respect of any contribution year commencing on or after 1 January 2004:

(a) any payment in respect of a foreign life policy referred to in section 730J of the Act of 1997,

(b) the amount of any gain arising on a disposal of a foreign life policy referred to in section 730K of the Act of 1997,

(c) any payment received in respect of a material interest in an offshore fund referred to in section 747D of the Act of 1997, and

(d) the amount of any gain arising in respect of a disposal of a material interest in an offshore fund referred to in section 747E of the Act of 1997.”.[3]

PRSI Classes

If you are an employee, your employer deducts your PRSI contribution from your wages. Your employer then submits your contribution and their employer's contribution to the Revenue Commissioners. Your employer must also pay social insurance on your behalf.

If you are self-employed, you pay Class S social insurance. In this case, you pay your social insurance contributions directly to the Revenue Commissioners.

If you are a PAYE worker and have unearned income of over €5,000 you are a chargeable person and you must pay 4% PRSI under Revenue's self-assessment system (Pay and File). Revenue pay the money into the Social Insurance Fund. A record of the contributions you have paid is then sent to the DEASP.

However, if your only source of income is unearned, for example, you have rental income and dividends from shares but no earned income then you will be liable to pay PRSI at Class S

Note that gains on contracts for Life Assurance subject to Exit Tax are exempt from PRSI.

Implications for Financial Advisers

From the table above, we can see that for some investors, paying PRSI can increase their entitlement to the contributory State Pension. Since this does not apply with investments subject to Exit Tax, it follows that an adviser needs to consider the implications of the client’s tax status today as well as their State Pension record when considering the suitability of an investment contract.

The State Pension (Contributory) is paid to people from the age of 66 who have enough Irish social insurance contributions. It is not means-tested. You can have other income and still get a State Pension (Contributory). This pension is taxable but you are unlikely to pay tax if it is your only income.

As the social insurance conditions are very complex you should apply for a State Pension (Contributory) if you have ever worked and have any contributions (stamps) paid at any time. There are a number of pro-rata pensions available to people who paid different types of social insurance contributions or who did not pay contributions because of various reasons (see below).

If you retire early, you should ensure that you continue to pay PRSI contributions or get credited contributions (if eligible) to maintain your entitlement to a pension. If you are getting Jobseeker's Benefit (JB) and are aged between 65 and 66 when your JB would normally end, you may continue to receive it until the age of 66, provided you meet the PRSI requirements.

The Department of Employment Affairs and Social Protection (DEASP) has published FAQs on Qualifying for the State Pension (Contributory) which can help you to work out whether you qualify for a State Pension (Contributory).

Rules

To qualify for a State Pension (Contributory) you must be aged 66 or over and have enough Class A, E, F,G, H, N or S social insurance contributions.

You need to:

1. Have paid social insurance contributions before a certain age

2. Have a certain number of social insurance contributions paid and

3. Have a certain average number over the years since you first started to pay

1. Paid insurance before a certain age

You must have started to pay social insurance before the age of 56.

2. Number of paid contributions

If you reach pension age on or after 6 April 2012, you need to have 520 full-rate contributions (10 years contributions). In this case, only 260 of the 520 contributions may be voluntary contributions.

3. Average number of contributions per year

You must meet the average condition. This is probably the most complex aspect of qualifying for a State Pension (Contributory).

Normal average rule

The normal average rule states that you must have a yearly average of at least 10 appropriate contributions paid or credited from the year you first entered insurance or from 1953, whichever is later to the end of the tax year before you reach pension age (66). An average of 10 entitles you to a minimum pension; you need an average of 48 to get the maximum pension.

Claiming on behalf of an Adult dependent - Income limits

For most social welfare payments your adult dependant cannot have gross weekly earnings or income (before tax and PRSI deductions) of more than €310 (€16,120). If your adult dependant earns less than €100 you will get a full Increase for a Qualified Adult (IQA). If your adult dependant earns between €100 and €310 you will get a reduced rate of IQA (sometimes called a tapered rate of IQA). If your adult dependant is earning more than €310 you will not get an IQA. You can find out what the tapered rate of IQA for your payment is in the Department of Employment Affairs and Social Protection's SW19 (Rates of Payment) booklet.

Credits and homemakers

The Homemaker's Scheme can make it easier for homemakers to qualify for a State Pension (Contributory). If you give up work to look after a child under 12 years of age, or a disabled child, or adult, you can get credits from the date you give up work to the end of that contribution year.

Note

From 6th April 1994, any period spent as a homemaker caring for either a child under 12 or an ill person may be disregarded when calculating your ‘yearly average’. A maximum of 20 years can be disregarded.

Rates

*Increases for qualified adults are means-tested payments

Example

Jayne is 50 years old and has taken a career break to look after her children.

At this time, she has 17 years Contributory State Pension credits and 18 years to go until the State Pension age. Her children are over the age of 12.

An important element to the calculation for her entitlement to Contributory State Pension is when she FIRST PAID PRSI as the "band" for her State Pension is determined by taking her total contributions between the first date and her reaching 66 and averaging this over the total period.

Let's assume that she made her first contribution in 1992 and it is now 2019 and she will reach age 66 in 2035. So, Jayne has a maximum of 43 years available to her out of a maximum of 48, but 15 of these are disregarded.

Let’s also assume that she had 15 years that will be disregarded as this period was spent caring for a child under 12.

Her denominator for averaging her state pension entitlement is therefore 28 (43-15 disregarded)

She has a joint investment with her husband of €500,000

Analysis

Jayne isn’t working and so isn’t paying PRSI directly via her salary. Her children are over 12 so she is not earning credits from caring for them.

Her adviser is considering a Single Premium Investment Bond from a well-known life insurance company.

Unless she goes to work, Jayne will not earn additional State Pension entitlement. Her investment income is greater than €16,000pa and so she is not entitled to a means tested Increase for a Qualifying Adult.

How might we model the cost of arranging a life assurance contract compared to a more tax efficient solution?

We need to consider Jayne’s marginal rate of income tax and establish if there are any CGT losses which can be carried forward.

Model the effect of the State Pension

Assuming everything else equal, the impact of missing out on additional State Pension credits is more significant for those with under 30 years of PRSI contributions at age 66.

For example, the State Pension entitlement leaps up from €0 to €97.20 per week by increasing average PRSI contributions from 9 to 10 years.

From this we can conclude that as Jayne only has 17 years credits to the Contributory State Pension currently, that each additional year will add either 1/158.5 for the next 2 years or 1/207.10 for the following 10 years and finally 1/218.70 for the final 4 years to age 66.

Her maximum entitlement would be potentially 33 qualifying years averaged over her 28 year PRSI record (see above)

The yearly average is calculated as follows:

Full rate paid contributions and credits

_______________________________

Total contribution years (from 1st PRSI payment to age 66)

In Jayne's example she will potentially have 1,716 weeks contributions over 28 years giving an average of 61 entitled to a full state pension.

Looking at the table this could potentially increase her pension to €238.50per week compared to her current entitlement of 17 years over 28 . (***)

What is the net effect?

We assume a dividend yield of 2%pa on an equity portfolio of €500,000 generating a total gross annual dividend income of €10,000.

So, Jayne’s income is €5,000pa so she is liable to class S PRSI at a rate of 4% on her income.

However, she has to pay 4% of her income subject to a minimum €500pa in tax that would not be payable under the Life Assurance contact (all else equal)

Note that the minimum PRSA payment of €500 is another tax trap.

In Jayne's case, the minimum PRSA payment is an effective rate of tax of 10% rather than the headline PRSI rate of 4%.

However, she potentially improves her State Pension by an average of (€238.50 - €207.10 = €31.40pw) assuming she pays the additional PRSI for the next 16 years.

PRSI Paid = 16 x €500 = €8,000

Breakeven for pension €8000/(€31.40 x 52) = €1,632.8

4.9 years

Jayne only needs to receive payments from her State Pension for 4.9 years to breakeven and recoup the PRSI via the enhanced State Pension payments!

Conclusion

In addition to considering their client’s marginal rate of income tax and any capital gains tax losses carried forward, Financial Advisers need to consider the impact on the client’s State Pension of their recommendation to purchase a Life Assurance Single Premium Bond compared to an Investment Portfolio.

Important

This document has been prepared for information and educational purposes only and should not be relied upon by any individual without seeking specific guidance on the suitability of any course of action for their unique circumstances.

[1] [broken link removed]

[2] Previously €3,174

[3] http://www.irishstatutebook.ie/2004/en/si/0428.html

Last edited: