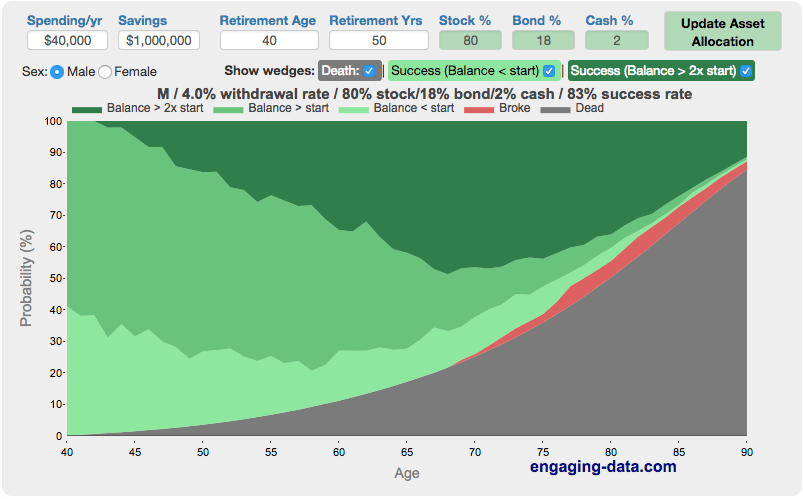

https://www.financialmentor.com/calculator/best-retirement-calculator

I am just wondering if anyone has used this Retirement Calculator & if so do people rate it well, as a tool? It seems to offer a lot of flexibility is terms of inputs.

Obviously it is in US$ but I assume the logic holds for Euro?

I am just wondering if anyone has used this Retirement Calculator & if so do people rate it well, as a tool? It seems to offer a lot of flexibility is terms of inputs.

Obviously it is in US$ but I assume the logic holds for Euro?