theObserver

Registered User

- Messages

- 103

(Background: https://www.askaboutmoney.com/threads/thought-experiment-55-retired-and-managing-assets.236124/)

I want to type out my thoughts on the three bucket withdrawal strategy to help think it through and to give people an opportunity to correct me.

The bucket strategy was created by legendary financial planner Harold Evensky to solve the problem of retirees panic selling during market downturns.

The original strategy was just two buckets and simply increased the amount of cash holding to 2-5 years and refilling each quarter by re-balancing (selling stocks when the market is up to buy bonds or selling bonds to buy shares with market is down).

Eventually people went from 2-5 years of cash holdings down to 1-2 years better balance returns and peace-of-mind-cash.

If two buckets are good, then three must be better, right? So over time people started adding additional buckets to the plan.

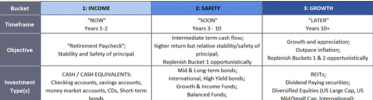

It’s important realize there is a huge difference between the two and the three (or more) buckets strategy. The two buckets strategy simply increased the cash holdings while the various three or more buckets strategy moved away from percentages (60% shares , 40% bonds etc) towards years and the allocation of certain asset types into each bucket:

Let’s ask again: what problem is this intended to solve?

Well, the cynic in me thinks the primary goal is for financial advisers to sell an overly complex retirement plan.

But, ignoring the cynic, I notice the additional bucket can provide additional peace of mind while offering some growth. The switch from percentages to years also helps reassure: “I know I am funded for the next five to ten years whatever happens.” etc

At this point we should bring in the Mental Accounting bias which I believe is important to understanding the appeal of the three bucket strategy:

The three plus buckets strategy plays off the Mental Accounting bias by encouraging us to create additional categories of funds for additional peace of mind.

Returning to the original question, what problem does the three bucket strategy solve as those with lower risk tolerance should hold more cash either in a current/saving account or/and hold more bonds?

The introduction of a third or more buckets, and switching from percentages to years, does superfluously offer peace of mind but its hard to see the real advantages over the original two bucket system created by Harold Evensky. Perhaps the mental accounting image of buckets filling with money and flowing periodically into a current account resembles a pay cheque or a pipeline but this is mostly smoke and mirrors.

I do however see a use for three buckets in determining your risk tolerance:

What is the minimum amount of cash do you need to feel secure during market downturns and economic trouble? (this is bucket 1)

How much cash beyond bucket 1 do you need to have peace of mind ? (Bucket 2 split 50/50 bonds and equities).

Everything else in bucket 3 (stocks).

But this is really just deciding on the initial allocation of cash/bonds/stocks with yearly or quarterly re-balancing afterwards,

I was initially very excited by the Three Bucket strategy, believing it offered a reliable pipeline of money flowing from the market into my account each year. Having dug into it more however I have come to believe it merely offers an illusion of peace of mind at the cost of lower returns from investments.

Conclusion: Keep it simple. A two buckets conceptual strategy is enough.

I want to type out my thoughts on the three bucket withdrawal strategy to help think it through and to give people an opportunity to correct me.

The bucket strategy was created by legendary financial planner Harold Evensky to solve the problem of retirees panic selling during market downturns.

The original strategy was just two buckets and simply increased the amount of cash holding to 2-5 years and refilling each quarter by re-balancing (selling stocks when the market is up to buy bonds or selling bonds to buy shares with market is down).

Eventually people went from 2-5 years of cash holdings down to 1-2 years better balance returns and peace-of-mind-cash.

If two buckets are good, then three must be better, right? So over time people started adding additional buckets to the plan.

It’s important realize there is a huge difference between the two and the three (or more) buckets strategy. The two buckets strategy simply increased the cash holdings while the various three or more buckets strategy moved away from percentages (60% shares , 40% bonds etc) towards years and the allocation of certain asset types into each bucket:

Let’s ask again: what problem is this intended to solve?

Well, the cynic in me thinks the primary goal is for financial advisers to sell an overly complex retirement plan.

But, ignoring the cynic, I notice the additional bucket can provide additional peace of mind while offering some growth. The switch from percentages to years also helps reassure: “I know I am funded for the next five to ten years whatever happens.” etc

At this point we should bring in the Mental Accounting bias which I believe is important to understanding the appeal of the three bucket strategy:

"Mental accounting is our tendency to mentally sort our funds into separate “accounts,” which affects the way we think about our spending. Mental accounting leads us to see money as less fungible than it is and makes us susceptible to biases such as the sunk cost fallacy.

The two bucket strategy involves taking money out the market for instantly available cash; in effect sacrificing returns for peace of mind. "

The three plus buckets strategy plays off the Mental Accounting bias by encouraging us to create additional categories of funds for additional peace of mind.

Returning to the original question, what problem does the three bucket strategy solve as those with lower risk tolerance should hold more cash either in a current/saving account or/and hold more bonds?

The introduction of a third or more buckets, and switching from percentages to years, does superfluously offer peace of mind but its hard to see the real advantages over the original two bucket system created by Harold Evensky. Perhaps the mental accounting image of buckets filling with money and flowing periodically into a current account resembles a pay cheque or a pipeline but this is mostly smoke and mirrors.

I do however see a use for three buckets in determining your risk tolerance:

What is the minimum amount of cash do you need to feel secure during market downturns and economic trouble? (this is bucket 1)

How much cash beyond bucket 1 do you need to have peace of mind ? (Bucket 2 split 50/50 bonds and equities).

Everything else in bucket 3 (stocks).

But this is really just deciding on the initial allocation of cash/bonds/stocks with yearly or quarterly re-balancing afterwards,

I was initially very excited by the Three Bucket strategy, believing it offered a reliable pipeline of money flowing from the market into my account each year. Having dug into it more however I have come to believe it merely offers an illusion of peace of mind at the cost of lower returns from investments.

Conclusion: Keep it simple. A two buckets conceptual strategy is enough.