Brendan Burgess

Founder

- Messages

- 52,099

A business owner has told me that these are not "taxable" but that wage subsidies are.

I had assumed that they were income just like any other income in the company

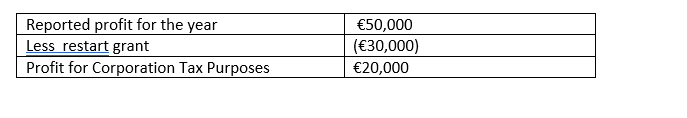

In simple terms, forgetting about capital allowances and depreciation, he says it should be like this:

Brendan

I had assumed that they were income just like any other income in the company

In simple terms, forgetting about capital allowances and depreciation, he says it should be like this:

Brendan

Last edited: