Brendan Burgess

Founder

- Messages

- 55,272

To apply for a UK State Pension, all you need to do is fill in the form and send it off.

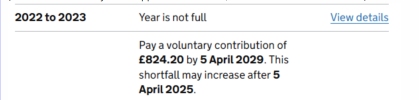

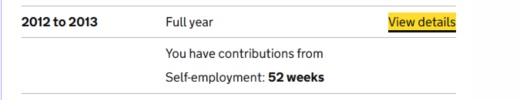

There is no need to register at this stage. But registering will tell you what the gaps are in your contribution record and which ones you can buy.

But they default to Class 3 whereas if you submit the form, they will tell you

1) You don't qualify at all so there is no point in registering

2) You qualify for Class 2 in which case you pay a lot less

3) You are Class 3 so you pay a lot more.

No need to register, just print off the form and send it off - UK Pension

an overview of the process Keep it simple. Print off CF83, fill it in & post by recorded delivery - 20 mins work. You can faff about with the online registration after you've done that.

www.askaboutmoney.com

There is no need to register at this stage. But registering will tell you what the gaps are in your contribution record and which ones you can buy.

But they default to Class 3 whereas if you submit the form, they will tell you

1) You don't qualify at all so there is no point in registering

2) You qualify for Class 2 in which case you pay a lot less

3) You are Class 3 so you pay a lot more.

Attachments

Last edited: