My friend's situation for 2024:

Has a part-time PAYE job with low income

Started a sports coaching business in September 2024

Registered for income tax as projected profits will be just over €5,000

Currently a full-time college student who has received SUSI grants for two years

The issue for 2025 SUSI application:

SUSI requires a full 12-month set of accounts ending in 2024 for susi applications made in 2025

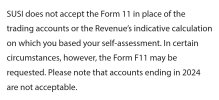

They don't accept Form 11 tax returns

He will only have 4 months of business accounts (September-December 2024

Question: Given these circumstances, would it be better to only declare his PAYE employment on the SUSI application?

The situation is complicated because SUSI's website states they won't accept Form 11

and require 12 months of accounts from the previous year, but he won't have this due to only starting his business in September 2024.

I'm seeking advice on how to proceed with the SUSI application given these constraints

Has a part-time PAYE job with low income

Started a sports coaching business in September 2024

Registered for income tax as projected profits will be just over €5,000

Currently a full-time college student who has received SUSI grants for two years

The issue for 2025 SUSI application:

SUSI requires a full 12-month set of accounts ending in 2024 for susi applications made in 2025

They don't accept Form 11 tax returns

He will only have 4 months of business accounts (September-December 2024

Question: Given these circumstances, would it be better to only declare his PAYE employment on the SUSI application?

The situation is complicated because SUSI's website states they won't accept Form 11

and require 12 months of accounts from the previous year, but he won't have this due to only starting his business in September 2024.

I'm seeking advice on how to proceed with the SUSI application given these constraints