Brendan Burgess

Founder

- Messages

- 53,720

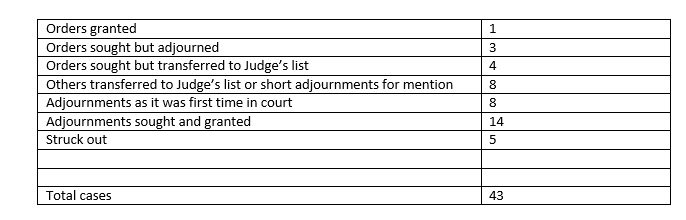

I hadn't been to the Repossession Courts for around a year, so I went down last Thursday to see whether things had changed much.

So, it's still very difficult for the lenders to get an order for possession. However, one significant change is that around 12 cases were sent to Court 22 for the judge to deal with.

In the past, the Registrar only rarely sent cases to the Judge's List, so I don't know how many of these 12 cases will result in an order.

Some will definitely result in an order. The borrower had raised some legal issue, although in most cases, it seemed to be a bogus legal argument and I doubt if the Judge will have any time for them.

Others were cases where the Registrar was tired of the bank's failure to deal with the issue and she was not prepared to adjourn it any further. I got the impression that she was suggesting to the Judge that he might strike it out. The Judge can strike out a case against the wishes of the bank,but the Registrar can't.

Profile of the order which was granted

Lender: Pepper

Mortgage amount: €1,062,000

Arrears: €317k

Currently paying €300 per month where the repayment should be €3,600

Stay of 6 months.

The barrister for the bank was excellent. Outlined that in December, the Registrar had refused an extension of time to lodge an affidavit. This is the 7th time in court since 2014

1) PDA on first appearance

2) Affidavit from bank

3) Bank changed name to Pepper

4) Not reached

5) A solicitor came on record

6) The last occasion, adjourned so that he could consult a PIP.

The first default happened in 2009.

The borrower was present and represented by a barrister. They had apparently lodged an affidavit the day before outlining how the borrower's financial position had improved and his income was likely to increase to €175k a year. If an order was granted they would be homeless. It was terribly stressful for the wife. The 4th child was doing the Leaving this year and it was stressful for her. The legal proceedings were based on the house being worth €650k but it was actually worth €850k.

The Registrar was having none of it. The barrister for the borrower argued vehemently. They wanted to consult a PIP. But apparently it was adjourned 6 months ago so that they could consult a PIP.

The barrister then asked for a two year stay. But the Registrar granted only 6 months.

While one has a natural sympathy for anyone who loses their family home, I doubt if anyone would disagree with the Registrar's decision in this case.

Example of a case where an order was refused and it was sent to the Judge's List - probably taking advice from one of the anti-eviction groups.

The borrower was present and it appeared to be a rented house as they read a notice asking if there were any residents of the specific address in the court.

The borrower had lodged an affidavit the day before. The Registrar asked why she had not lodged it in time, as she had 6 months since the last adjournment. The borrower replied that she did not want to perjure herself and told the Registrar that under 5(b) she had the authority to extend the time to file an affidavit.

The barrister for the bank was excellent and sought an order. He had just received the affidavit and summarised it as follows:

1) She quotes the comments of the Master of the High Court. They have no precedent value or other value in this court

2) She quotes the EU Directive on Cancellation of Contracts – These have no relevance. They refer to the cold calling.

3) She quotes the Unfair Terms in Consumer Contracts Regulations – these do not apply to the main subject terms of the mortgage so no issue arises

4) She wants to cross-examine the deponent – it is moot because she is outside the time limit

5) She says she got advice on her mortgage from the disgraced solicitor Michael Lynn. Although that has no relevance, while he may well have witnessed the first offer, two other solicitors who are beyond reproach, were involved later.

“While her affidavit might be admirable in the extent of its research, it is lacking any substance”.

The Registrar granted her an extension of time to file the affidavit but sent the whole lot to the Judge's List to be dealt with.

Example of an adjournment

Adjourned to 22 June

This is the 10th time in court. (The case began in 2014)

Borrower: They are a vulture fund. I have offered them what they paid for the mortgage so that they can break even. Registrar: I can’t intervene in your negotiations.

Affidavit filed – plaintiffs not ready.

Registrar ordered that no costs on any proceedings to date were to be charged to the borrower.

100k arrears

Borrower is arguing that it was not a change of name, that it was a sale of their mortgage.

The barrister for the lender said that there was no basis for this argument.

Borrower paying €1,400 a month when should be paying €1,546

The EBS wanted an order in this case, but the Registrar was very annoyed with the EBS.

She had instructed the last time that EBS meet with the borrower, but they had not done so.

Case adjourned for mention to 16th Feb when it will be sent to the Judge's List "for her to do as she pleases with it.". If a meeting has not been arranged by the 16th Feb, the Registrar ordered that the Manager of the Arrears Support Unit attend court to explain why.

Borrowers paying more than the scheduled payment but not engaging

4th time on the list. Arrears of €30k. Borrowers paying €1,600 although the repayment is only €1,492. The borrower refuses to engage and told the solicitor for the bank to stop writing to them.

ptsb can't do anything if they don't get an SFS, although they felt that the loan could be restructured. The Registrar sent it to the Judge's List and ordered the two borrowers to attend.

These guys might well lose their home, but are too stubborn to engage with the lender.

So, it's still very difficult for the lenders to get an order for possession. However, one significant change is that around 12 cases were sent to Court 22 for the judge to deal with.

In the past, the Registrar only rarely sent cases to the Judge's List, so I don't know how many of these 12 cases will result in an order.

Some will definitely result in an order. The borrower had raised some legal issue, although in most cases, it seemed to be a bogus legal argument and I doubt if the Judge will have any time for them.

Others were cases where the Registrar was tired of the bank's failure to deal with the issue and she was not prepared to adjourn it any further. I got the impression that she was suggesting to the Judge that he might strike it out. The Judge can strike out a case against the wishes of the bank,but the Registrar can't.

Profile of the order which was granted

Lender: Pepper

Mortgage amount: €1,062,000

Arrears: €317k

Currently paying €300 per month where the repayment should be €3,600

Stay of 6 months.

The barrister for the bank was excellent. Outlined that in December, the Registrar had refused an extension of time to lodge an affidavit. This is the 7th time in court since 2014

1) PDA on first appearance

2) Affidavit from bank

3) Bank changed name to Pepper

4) Not reached

5) A solicitor came on record

6) The last occasion, adjourned so that he could consult a PIP.

The first default happened in 2009.

The borrower was present and represented by a barrister. They had apparently lodged an affidavit the day before outlining how the borrower's financial position had improved and his income was likely to increase to €175k a year. If an order was granted they would be homeless. It was terribly stressful for the wife. The 4th child was doing the Leaving this year and it was stressful for her. The legal proceedings were based on the house being worth €650k but it was actually worth €850k.

The Registrar was having none of it. The barrister for the borrower argued vehemently. They wanted to consult a PIP. But apparently it was adjourned 6 months ago so that they could consult a PIP.

The barrister then asked for a two year stay. But the Registrar granted only 6 months.

While one has a natural sympathy for anyone who loses their family home, I doubt if anyone would disagree with the Registrar's decision in this case.

Example of a case where an order was refused and it was sent to the Judge's List - probably taking advice from one of the anti-eviction groups.

The borrower was present and it appeared to be a rented house as they read a notice asking if there were any residents of the specific address in the court.

The borrower had lodged an affidavit the day before. The Registrar asked why she had not lodged it in time, as she had 6 months since the last adjournment. The borrower replied that she did not want to perjure herself and told the Registrar that under 5(b) she had the authority to extend the time to file an affidavit.

The barrister for the bank was excellent and sought an order. He had just received the affidavit and summarised it as follows:

1) She quotes the comments of the Master of the High Court. They have no precedent value or other value in this court

2) She quotes the EU Directive on Cancellation of Contracts – These have no relevance. They refer to the cold calling.

3) She quotes the Unfair Terms in Consumer Contracts Regulations – these do not apply to the main subject terms of the mortgage so no issue arises

4) She wants to cross-examine the deponent – it is moot because she is outside the time limit

5) She says she got advice on her mortgage from the disgraced solicitor Michael Lynn. Although that has no relevance, while he may well have witnessed the first offer, two other solicitors who are beyond reproach, were involved later.

“While her affidavit might be admirable in the extent of its research, it is lacking any substance”.

The Registrar granted her an extension of time to file the affidavit but sent the whole lot to the Judge's List to be dealt with.

Example of an adjournment

Adjourned to 22 June

This is the 10th time in court. (The case began in 2014)

Borrower: They are a vulture fund. I have offered them what they paid for the mortgage so that they can break even. Registrar: I can’t intervene in your negotiations.

Affidavit filed – plaintiffs not ready.

Registrar ordered that no costs on any proceedings to date were to be charged to the borrower.

100k arrears

Borrower is arguing that it was not a change of name, that it was a sale of their mortgage.

The barrister for the lender said that there was no basis for this argument.

Borrower paying €1,400 a month when should be paying €1,546

The EBS wanted an order in this case, but the Registrar was very annoyed with the EBS.

She had instructed the last time that EBS meet with the borrower, but they had not done so.

Case adjourned for mention to 16th Feb when it will be sent to the Judge's List "for her to do as she pleases with it.". If a meeting has not been arranged by the 16th Feb, the Registrar ordered that the Manager of the Arrears Support Unit attend court to explain why.

Borrowers paying more than the scheduled payment but not engaging

4th time on the list. Arrears of €30k. Borrowers paying €1,600 although the repayment is only €1,492. The borrower refuses to engage and told the solicitor for the bank to stop writing to them.

ptsb can't do anything if they don't get an SFS, although they felt that the loan could be restructured. The Registrar sent it to the Judge's List and ordered the two borrowers to attend.

These guys might well lose their home, but are too stubborn to engage with the lender.