imalwayshappy

Registered User

- Messages

- 248

Hi,

I have contacted both the revenue (advised to contact the IRS in Portugal) and raisin for advice but neither were of any assistance.

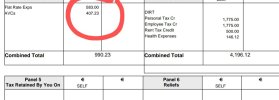

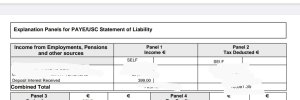

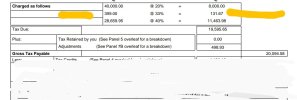

A deposit on raisin matured and a withholding tax of c. 38% has been applied to the interest. Raisin in fairness provided me with the relevant forms to fill out (RFI 21) and post back to the portugese tax authorities which i received the day before i went on holiday last and subsequently forgot to deal with.

Can anyone offer any advice on where to go from here? Googling the IRS is Portugal has been to no avail as I cant find an email to send the query to. Is it too late to fill out the RFI21 form and post off?

Thanks

I have contacted both the revenue (advised to contact the IRS in Portugal) and raisin for advice but neither were of any assistance.

A deposit on raisin matured and a withholding tax of c. 38% has been applied to the interest. Raisin in fairness provided me with the relevant forms to fill out (RFI 21) and post back to the portugese tax authorities which i received the day before i went on holiday last and subsequently forgot to deal with.

Can anyone offer any advice on where to go from here? Googling the IRS is Portugal has been to no avail as I cant find an email to send the query to. Is it too late to fill out the RFI21 form and post off?

Thanks