I'd really appreciate some advice on my situation, outlined briefly below. I realise that I probably need to seek out broader advice specific to my situation. I've been in the fortunate position of not giving much consideration to my pension and now finding myself feeling very naive of what my options will be in retirement.

I have left one employer and anticipate joining a new employer and am wondering if in negotiating my contract I should ask the new employer to increase my salary in lieu of pension contributions. I am not sure if they would even contemplate this, but first need to ascertain if it would be in my interests to ask.

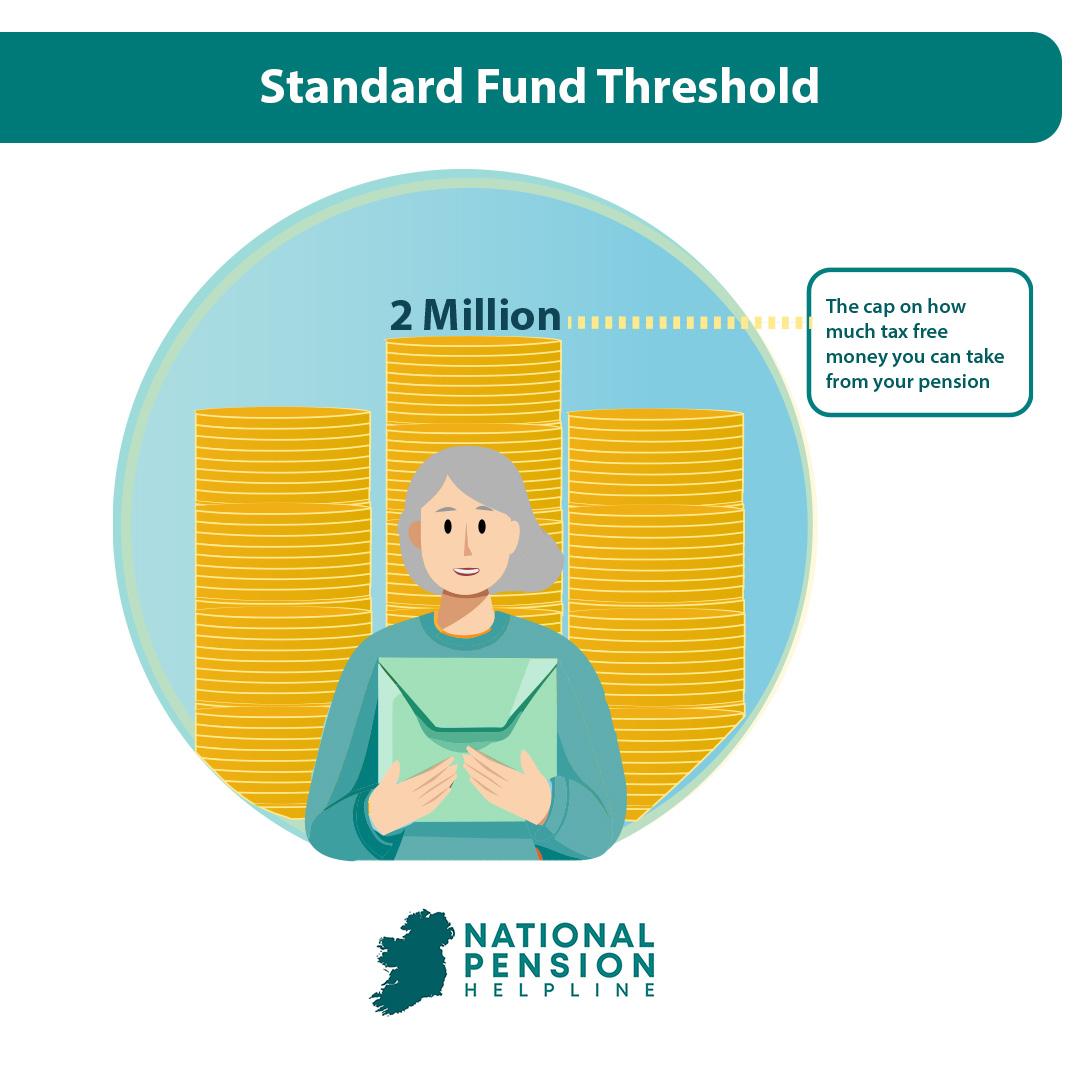

My DC fund from the employment I'm leaving is €760k (after recent sell off). I'm 43 and would target retiring in about 20 years. My fund is fairly aggressively invested in all equity (on the basis that my spouse has a generous public sector DB pension and I have income from an investment property). I also anticipate switching to a plural career in 10-15 years and tapering into retirement so would expect to have some flexibilty about when I retire. With 7% returns I see myself hitting a €3m fund value in 20 years without ever paying another penny in. If I start contributing to a new scheme the combined contributions would be of the order of 30k p.a. sending me towards the threshold on an even faster trajectory. I suppose I'm trying to balance the possibility that the SFT threshold increases against the possibility of paying the circa 70% tax. I know I'll have line of sight on the funds and could shift to cash, but if I end up doing that in 10 years time then there's the opportunity cost of having that cash in my hand and invested in higher-returning assets or paying off my mortgage more quickly

If it makes any difference my main concerns are obviously having a comfortable (though not excessively lavish) retirement with plenty of travel, which clearly we will be able to achieve, but also ideally in around 20 years i.e. at the point of retirement being in a position to help my children with a house purchase. I would far rather provide help at that juncture than as an inheritance.

Could anyone give me some broad strokes thoughts on this situation as it may be fairly time sensitive?

I have left one employer and anticipate joining a new employer and am wondering if in negotiating my contract I should ask the new employer to increase my salary in lieu of pension contributions. I am not sure if they would even contemplate this, but first need to ascertain if it would be in my interests to ask.

My DC fund from the employment I'm leaving is €760k (after recent sell off). I'm 43 and would target retiring in about 20 years. My fund is fairly aggressively invested in all equity (on the basis that my spouse has a generous public sector DB pension and I have income from an investment property). I also anticipate switching to a plural career in 10-15 years and tapering into retirement so would expect to have some flexibilty about when I retire. With 7% returns I see myself hitting a €3m fund value in 20 years without ever paying another penny in. If I start contributing to a new scheme the combined contributions would be of the order of 30k p.a. sending me towards the threshold on an even faster trajectory. I suppose I'm trying to balance the possibility that the SFT threshold increases against the possibility of paying the circa 70% tax. I know I'll have line of sight on the funds and could shift to cash, but if I end up doing that in 10 years time then there's the opportunity cost of having that cash in my hand and invested in higher-returning assets or paying off my mortgage more quickly

If it makes any difference my main concerns are obviously having a comfortable (though not excessively lavish) retirement with plenty of travel, which clearly we will be able to achieve, but also ideally in around 20 years i.e. at the point of retirement being in a position to help my children with a house purchase. I would far rather provide help at that juncture than as an inheritance.

Could anyone give me some broad strokes thoughts on this situation as it may be fairly time sensitive?