Brendan Burgess

Founder

- Messages

- 53,691

Mortgage interest relief

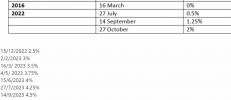

I have decided to introduce a one-year Mortgage Interest Tax Relief for home owners with an outstanding mortgage balance on their primary dwelling house of between €80,000 and €500,000 as of 31 December 2022.

Relief will be available in respect of the increased interest paid on the mortgage in the calendar year 2023 as compared with the amount paid in 2022, at the standard rate of 20% income tax. The relief will be capped at €1,250 per property.

Approximately 165,000 mortgage holders will benefit from this measure with an estimated cost of €125 million.

Last edited: