Duke of Marmalade

Registered User

- Messages

- 4,429

David McWilliams in today's IT.

He has promoted the situation to the Great Pandession. Not much economic content. Riffing on about the Black Plague/the Renaissance; the Spanish Flu'/the Roaring Twenties; the 1958 Flu/the Swinging Sixties. Somewhat tenuous connections but a reasonably entertaining bit of spoof nonetheless.

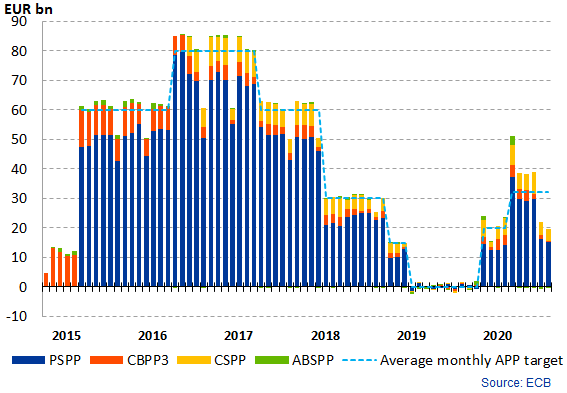

The economic content? We should ignore the "austerity jihadis" (add that to breakfast roll man) and let the ECB print the money. It's almost inside the box these days, is he losing his grip?

There was a time of course when McWilliams castigated Quantitative Easing. I remember an episode of his Punk Economics cartoons which was notable for producing an enormous amount of zeros, representing the quantity of money the ECB were printing. Heck, we are all allowed to change our minds.

He has promoted the situation to the Great Pandession. Not much economic content. Riffing on about the Black Plague/the Renaissance; the Spanish Flu'/the Roaring Twenties; the 1958 Flu/the Swinging Sixties. Somewhat tenuous connections but a reasonably entertaining bit of spoof nonetheless.

The economic content? We should ignore the "austerity jihadis" (add that to breakfast roll man) and let the ECB print the money. It's almost inside the box these days, is he losing his grip?

There was a time of course when McWilliams castigated Quantitative Easing. I remember an episode of his Punk Economics cartoons which was notable for producing an enormous amount of zeros, representing the quantity of money the ECB were printing. Heck, we are all allowed to change our minds.