Brendan Burgess

Founder

- Messages

- 55,395

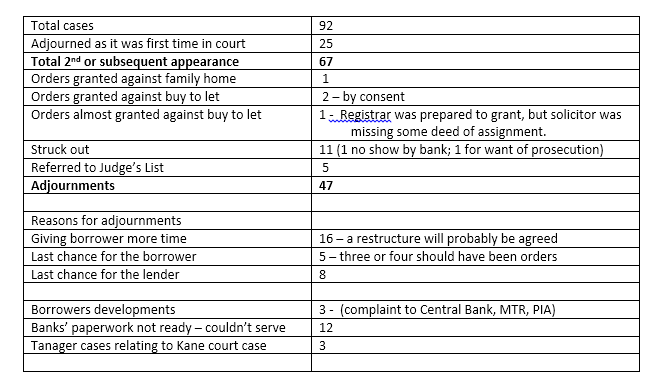

It's a couple of years since Séamus Coffey, Karl Deeter and I reported on our visits to the Registrars' Courts around the country. I was in the Dublin Court on Thursday 8th and Friday 9th, to see if much has changed.

Of course, this is the Dublin court only. Practices vary around the country.

36% of borrowers attended court or were represented - that is up from 24% two years ago.

Profiles of the one order granted against family home

Lender KBC

Borrower attended court with solicitor and barrister

6 months stay

€50k arrears on a mortgage of €222k

Paid €30k in November 17 as promised last time in court.

Previous payment was €200 in May 2014

"Paid" €1,500 in December and January but into wrong account in KBC

Comment: It doesn't seem very clever to pay a €30k lump sum. If he had that money, he should have been paying €3k a month regularly. If he continues paying his mortgage, KBC will probably not enforce the order. They will just hold it over him to get him to keep paying.

Lessons for borrowers facing repossession proceedings

Of course, this is the Dublin court only. Practices vary around the country.

36% of borrowers attended court or were represented - that is up from 24% two years ago.

Profiles of the one order granted against family home

Lender KBC

Borrower attended court with solicitor and barrister

6 months stay

€50k arrears on a mortgage of €222k

Paid €30k in November 17 as promised last time in court.

Previous payment was €200 in May 2014

"Paid" €1,500 in December and January but into wrong account in KBC

Comment: It doesn't seem very clever to pay a €30k lump sum. If he had that money, he should have been paying €3k a month regularly. If he continues paying his mortgage, KBC will probably not enforce the order. They will just hold it over him to get him to keep paying.

Lessons for borrowers facing repossession proceedings

- Pay as much as you can

- Engage with the lender - in particular send in an SFS with all the supporting documentation

- Ask the lender for a meeting well in advance of the court date. If they refuse, it will look good for you.

- Show up in court - even if the bank tells you that they will be applying for an adjournment

- Bring all your paperwork to court with you - you might be asked for it

- If an employee of the bank told you something, make sure you know the name of the employee and the date of the call - Don't say "one of their staff told me over the phone that they would do a deal with me."

- Don't rely on legal arguments - if you are paying your mortgage, you won't need them

- There is no need for a solicitor or barrister - they often just get in the way

- The Registrar will listen to your story carefully and give you plenty of time. She will be polite as long as you don't mislead the court or play games

- Don't leave things to the day before the court case - that annoys the Registrar. Submit your SFS in good time. If you are making a payment, make it in good time.

Attachments

Last edited: