Brendan Burgess

Founder

- Messages

- 55,283

Raging Bull attached this to another post in the middle of a long thread. I thought it worth highlighting.

The Mortgage Store’s ‘Fresh Start’ outlines the criteria for lending to customers who have experienced financial difficulty in the past (both BOI and non BOI customers) provided they engaged / co-operated with their lender during their financially difficult period and the circumstances that gave rise to the arrears have been resolved / improved. We are obliged (under Regulation) to ensure a customer can afford their mortgage debt and therefore all new lending is subject to standard affordability assessment, including Switchers. These customer must demonstrate a satisfactory track record of repaying their existing mortgage repayments. For customers with previous financial difficulty and now meeting the payments and terms of their restructure loan, seeking to switch;

1. The new mortgage must be affordable on a fully amortising basis and be fully repaid by borrowers’ retirement age (typically 65 years ) – noting that some restructures include split mortgages whereby a tranche of the mortgage is at zero interest rate/ no repayments OR maybe the maturity term extended materially beyond retirement. These restructures are for customers that do not have affordability to repay their mortgage in full.

2. Satisfactory track record of meeting full capital and interest repayments that would fully repay the mortgage for a min period (typically 2 -3 years) to ensure sustainability of ability to manage debt level “

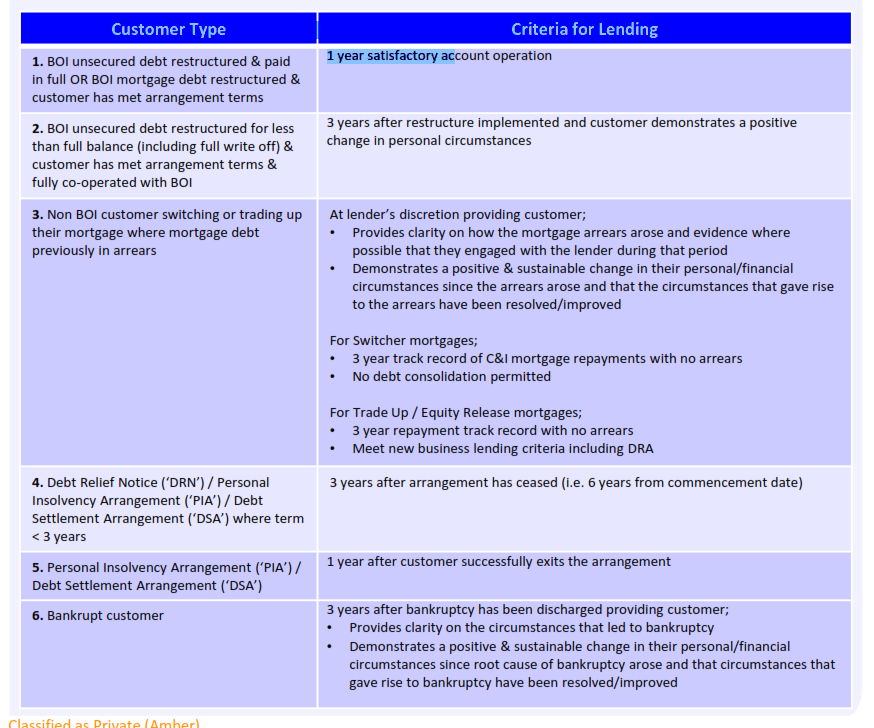

The granular details of our policy are set out below:

The Mortgage Store’s ‘Fresh Start’ outlines the criteria for lending to customers who have experienced financial difficulty in the past (both BOI and non BOI customers) provided they engaged / co-operated with their lender during their financially difficult period and the circumstances that gave rise to the arrears have been resolved / improved. We are obliged (under Regulation) to ensure a customer can afford their mortgage debt and therefore all new lending is subject to standard affordability assessment, including Switchers. These customer must demonstrate a satisfactory track record of repaying their existing mortgage repayments. For customers with previous financial difficulty and now meeting the payments and terms of their restructure loan, seeking to switch;

1. The new mortgage must be affordable on a fully amortising basis and be fully repaid by borrowers’ retirement age (typically 65 years ) – noting that some restructures include split mortgages whereby a tranche of the mortgage is at zero interest rate/ no repayments OR maybe the maturity term extended materially beyond retirement. These restructures are for customers that do not have affordability to repay their mortgage in full.

2. Satisfactory track record of meeting full capital and interest repayments that would fully repay the mortgage for a min period (typically 2 -3 years) to ensure sustainability of ability to manage debt level “

The granular details of our policy are set out below: