You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

House in my ex's name; mortgage in joint names. I can't get another mortgage.

- Thread starter rt1123

- Start date

Brendan Burgess

Founder

- Messages

- 52,091

Are you still living in the house?

How much was the site worth?

Brendan

How much was the site worth?

Brendan

You're investment in the house was 10k. You paid the mortgage (or half) when living there. You now have the option of walking away and possibly getting a windfall in 20 years. I know you won't like this and I'm not having a go but it seems like a result to me. You're kids get to live in the house which is great also.

Mortgage outstanding: €130000

House value: €280000

I pay €600 maintenance per month.

Maintenance not relevant to this discussion.

You 10K

She 10K plus 80K = 90 K

280 - 130 = 150K. Less her 90K, = 60K of which 10K is yours, then split the 50K remaining leaves your share at about 25K. But from that out comes how much she's paid from 2014 to 2020. Then there's the matter that your children are being housed etc.

How much were you hopeing to get. Many people look starigt at the 280K - 130K = 150K and think that's serious money. Then there's little problems like who is housin gthe kids, and paying for that housing. Then there's the matter of how is the wife supposed to get her hands on half the 150K. Not realistic for a parent with no permanent employment and having to mind children too.

So what to do. Walk away. Forget about it. Or try and come to an amicable arrangement whereby she does her best to get your name off the mortgage. And then there's Elcato's option.

My advice. Do the best that will keep as much of the family talking as possible and avoid overthinking the money. But your alternative is a lon drawn out fruitless legal route to get probably hardly anything except large legal bills for the pair of you and two warring parents. .

dereko1969

Registered User

- Messages

- 3,046

It seems your desired outcome is to have your name taken off the mortgage.

The amount outstanding is 130k, any idea what her annual income is and what the maximum mortgage she could get in her own name?

Are you in a position to pay a lump sum off the mortgage to assist in her getting a mortgage in her own name, whilst still retaining some money to assist you in getting your own mortgage?

Are you currently renting or living with a new partner?

Do try and suggest solutions on these lines to her to try and avoid court.

How many children and how old are they currently?

The amount outstanding is 130k, any idea what her annual income is and what the maximum mortgage she could get in her own name?

Are you in a position to pay a lump sum off the mortgage to assist in her getting a mortgage in her own name, whilst still retaining some money to assist you in getting your own mortgage?

Are you currently renting or living with a new partner?

Do try and suggest solutions on these lines to her to try and avoid court.

How many children and how old are they currently?

Brendan Burgess

Founder

- Messages

- 52,091

This is very complicated.

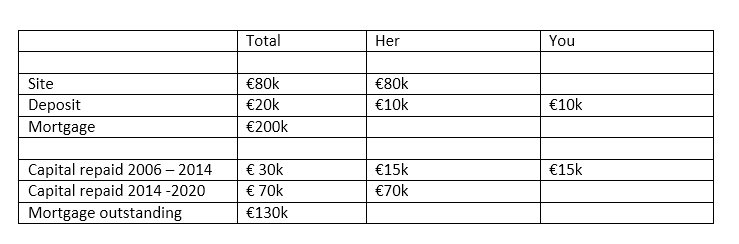

This is my summary of the figures

So you bought a house between you for €300k. She provided €90k of it and you provided €10k of it.

The house is worth less than you paid for it. So there is no increase in value due to you.

You both benefited from the repayments while you were living there. The repayments would have been a lot less than renting an equivalent house.

If she were to sell the house today, I would say that you are not entitled to anything.

Likewise, if she sells the house in 11 years, I don't think you would be entitled to anything either.

Another way of looking at it

You stopped paying the mortgage in 2014. At the time, the house was worth about €150k and the mortgage was €160k, so you were in negative equity.

How the judge might look at it

And I understand that there are no guidelines so the judge could order anything.

"Sell the house in 2031 and give your ex half the proceeds after the mortgage is paid off."

The judge could even order that your name be taken off the mortgage. Such an order would be invalid, as the bank would have no obligation to do so.

It's likely that the judge will take the overall picture into account. How much maintenance you are paying. How much your rent is. etc.

How the bank will look at it

They won't care as long as your ex continues to pay the mortgage

They won't take your name off the mortgage unless she has the income and she cooperates.

What does your solicitor say?

You do not want her to sell the house. But you might have to issue proceedings to seek a sale of the house. Her solicitor will advise her that there is a risk that the judge might agree. Then she might talk to you via her solicitor.

Brendan

This is my summary of the figures

So you bought a house between you for €300k. She provided €90k of it and you provided €10k of it.

The house is worth less than you paid for it. So there is no increase in value due to you.

You both benefited from the repayments while you were living there. The repayments would have been a lot less than renting an equivalent house.

If she were to sell the house today, I would say that you are not entitled to anything.

Likewise, if she sells the house in 11 years, I don't think you would be entitled to anything either.

Another way of looking at it

You stopped paying the mortgage in 2014. At the time, the house was worth about €150k and the mortgage was €160k, so you were in negative equity.

How the judge might look at it

And I understand that there are no guidelines so the judge could order anything.

"Sell the house in 2031 and give your ex half the proceeds after the mortgage is paid off."

The judge could even order that your name be taken off the mortgage. Such an order would be invalid, as the bank would have no obligation to do so.

It's likely that the judge will take the overall picture into account. How much maintenance you are paying. How much your rent is. etc.

How the bank will look at it

They won't care as long as your ex continues to pay the mortgage

They won't take your name off the mortgage unless she has the income and she cooperates.

What does your solicitor say?

You do not want her to sell the house. But you might have to issue proceedings to seek a sale of the house. Her solicitor will advise her that there is a risk that the judge might agree. Then she might talk to you via her solicitor.

Brendan