I have setup a pension via our company. They match up to 3% but I am contributing 5%

I was very surprised when I read my Statement last week and I could not believe the fees that they are charging to maintain my pension.

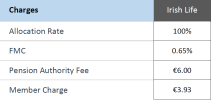

Here are some interesting figures:

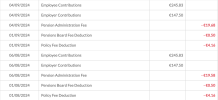

- My monthly contribution is 245 euros and the company is paying 147.5

About the monthly charges:

It is the pension administration fee that completely blew my mind as yearly it is adding to 236 euros which is almost equal to my monthly contribution. When including the policy fee it is costing me almost 300 euros per year to look after my pension.

Are these fees the norm? Where should I complain if the fees are deemed too high?

I was very surprised when I read my Statement last week and I could not believe the fees that they are charging to maintain my pension.

Here are some interesting figures:

- My monthly contribution is 245 euros and the company is paying 147.5

About the monthly charges:

- Policy fee deduction : 4.16 euro

- Pensions Board Fee Deduction: 0.50 euro

- Pension Administration Fee: 19.68

It is the pension administration fee that completely blew my mind as yearly it is adding to 236 euros which is almost equal to my monthly contribution. When including the policy fee it is costing me almost 300 euros per year to look after my pension.

Are these fees the norm? Where should I complain if the fees are deemed too high?