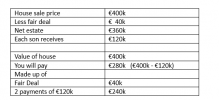

Hi, my father is currently in a nursing home and my mother has already passed, with the family home lying empty. My two brothers have agreed that myself and my family could move into the home as caretakers and sell my own property with a view to purchasing the family home from them once my father has passed. The house has been valued at €400k to be split equally three ways once our father passes. The nursing home bill (under the fair deal scheme) will also need to be paid from the sale of the house.

I am looking for advice on the future purchase of the house and how it will work in relation to monies to be paid to both brothers. If the house is worth €400k, am I to borrow a mortgage only to cover payment for buyout of my two brothers i.e. 2/3 of price - or how does it work?

I would also welcome any further advice on any taxes that my be incurred during the purchase.

thanks,

I am looking for advice on the future purchase of the house and how it will work in relation to monies to be paid to both brothers. If the house is worth €400k, am I to borrow a mortgage only to cover payment for buyout of my two brothers i.e. 2/3 of price - or how does it work?

I would also welcome any further advice on any taxes that my be incurred during the purchase.

thanks,

Last edited: